Barry Ritholtz doesn't seem to appreciate the true value of rebates offered by many computer equipment manufacturers via their retailers. In a nutshell, buyers who purchase products with mail in rebates can get a discount roughly twice what would be available had a rebate not been offered, all other things being equal.

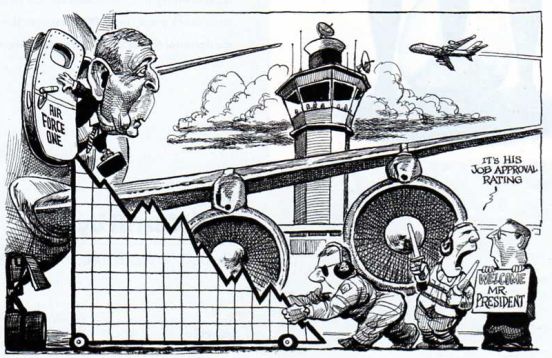

We'll explain in a minute, but first, have a look at the first scan to come out of a new Epson CX4200 printer/scanner/copier/back massager that was recently purchased for $30 (after rebates).

Not too bad.

The backside of the page shows through, and with the photo editing software provided with the printer along with all the gizmos and gadgets in the various control panels, this week's Economist cartoon might be made a little more presentable. But, there is little time to fiddle with these extra goodies when there is the larger issue of rebates on which to opine.

Yes, rebates are a pain - sometimes a big pain.

This particular printer cost $130 plus about another ten dollars in sales tax and the combined value of the three rebates (yes, there was one for $50, one for $30, and one for $20) was $100. It seems the most grating thing about the whole rebate process is that you have to pay sales tax on the rebate amount, which in this case is about $8.

So, it's really a $40 printer (after rebates).

Anyway, once the equipment was found to be in working order, all the rebate instructions were studied and the required material was assembled, filled-out, punched, stapled, folded, and then inserted into envelopes and sent on their way.

Please allow 8 to 10 weeks for processing and delivery of your rebates.

The nice thing about mailing in a rebate for a piece of equipment such as this is that it is very easy to make copies of all the completed paperwork. The copies of the paperwork can then be assembled, punched, stapled, and affixed via a push-pin to some bulletin board - somewhere out of the way but in plain sight, so that it can be retrieved, dusted off, and scoured for a phone number to call if the checks fail to arrive after three months.

So, how do you get double the discount when you buy something with a rebate? The explanation begins with this comment left by yours truly over at The Big Picture:

Statistics are hard to come by, but I believe the real reason why rebates exist is that many people never send in the rebate material to claim the rebate. I've heard numbers as high as 50 percent, but, this data is hard to come by.

The psychological effect is that if the buyer paid $1100 for the computer and had a $200 rebate, in his mind he has only paid $900. End of story - regardless of what happens next.

Many people are unorganized enough to throw away the box before they cut out the UPC label or fail to fulfill some other term of the agreement, so they just abort the process and go on thinking that they only paid $900.

So, others who have purchased the same $130 printer may have come home, unpacked the equipment, set aside the rebate forms to be filled out later, set the boxes out by the trash, and began fiddling with their new toy.

They probably think of it as a $30 printer, even though there is work yet to be done...

A couple days go by, and it's still a $30 printer, but the rebate work is beginning to fade from memory, and the rebate forms have worked their way down into a pile of other paperwork...

A week later, it's still a $30 printer and the boxes went out with last week's trash and the rebate forms are nowhere to be found - but that's OK, because all thoughts about doing rebate work have exited the owner's consciousness days ago.

This particular rebate is only available when you purchase a notebook computer, so some smarty at Epson probably figured out that the rebate submittal rate becomes exceptionally low when the new printer owner is distracted from his printer rebate forms by a new notebook computer.

So, if you figure that half the people never send in these three rebate forms to claim the hundred dollars, as Epson probably did when deciding to offer the rebates, then the real retail cost of this peripheral, all other things being equal, is about $80 - the average of the final cost paid by those who submitted the rebate and those who did not.

Both purchasers continue to think of it as a $30 printer.

Read more...