Like Phil Conners encountering Ned Ryerson on consecutive mornings in the 1993 classic Groundhog Day, incoming mail with links to stories on one particular subject have become a recurring event around here.

The frequency is not yet daily, the calendar does continue to advance, and looking at the inbox does not elicit anything like the final response by Phil (Bill Murray) to Ned (Stephen Tobolowsky) after being queried repeatedly on the same subject - but there are some similarities.

As you'll recall, the arrogant, egocentric, and frustrated weatherman from a Pittsburgh, Pennsylvania TV station was assigned to the annual Groundhog Day festivities in Punxsutawney, only to find himself experiencing the same day, February 2nd, over and over.

As you'll recall, the arrogant, egocentric, and frustrated weatherman from a Pittsburgh, Pennsylvania TV station was assigned to the annual Groundhog Day festivities in Punxsutawney, only to find himself experiencing the same day, February 2nd, over and over.

His interaction with a high school classmate on consecutive days went like this:

-- Day 1 --

Ned: Phil? Phil Connors? Phil Connors, I thought that was you! Hey now, don't you tell me you don't remember me 'cause I sure as heckfire remember you.

Phil: Not a chance.

Ned: Ned... Ryerson. "Needlenose Ned"? "Ned the Head"? C'mon, buddy. Case Western High. I did the whistling belly-button trick at the high school talent show? Bing. Ned Ryerson, got the shingles real bad senior year, almost didn't graduate? Bing, again. I dated your sister Mary Pat a couple of times until you told me not to anymore? Well?

Phil: Did you turn pro with that belly button thing or what?

Ned: I sell insurance.

Phil: What a shock.

Ned: Do you have life insurance, Phil? Because if you do, you could always use a little more. I mean who couldn't? Am I right or am I right?

Phil: I would love to stand here and talk with you, but I'm not going to.

[Phil walks away, Ned follows]

Ned: I'll walk with you. Whenever I see an opportunity now, I charge it like a bull. Ned the Bull, that's me now. I have friends who live and die by the actuarial tables. It's all one big crap shoot. Have you ever heard of single premium life? I think that really could be the ticket for you.

[Phil turns to cross the street]

God! It is so good to see you! What are you doing for dinner?

Phil: Something else.

Ned: Watch out for that first step. It's a doozy!

[Phil steps into a pothole full of icy water]

-- Day 2 --

Ned: Phil? Phil Connors? Phil Connors, I thought that was you! Hey now, don't you tell me you don't remember me 'cause I sure as heckfire remember you.

Phil: Ned Ryerson?

Ned: Bing! First shot right out of the box! How's it going, old buddy?

Phil: Actually, I'm not feeling well. Would you excuse me?

Ned: It's funny you should mention your health. You will never guess what I do now.

Phil: Do you sell insurance?

Ned: Bing again! You are sharp as a tack today. Do you have life insurance? If you do, you could always use more. Right? Who couldn't? You know something? I got a feeling you ain't got any. Am I right or am I right?

Phil: I gotta go.

Ned: Watch out for that first step. It's a doozy.

[Phil avoids the pothole]

-- Day 3 --

Ned: Phil?

Phil: Ned.

[Phil punches Ned in the face]

-- Later that day --

Phil: I was in the Virgin Islands once. I met a girl. We ate lobster and drank pina coladas. At sunset we made love like sea otters. That was a pretty good day. Why couldn't I get that day over and over and over...

There were other memorable scenes - one with a train and an automobile, another with a dive from an open second story barn door. Whatever the case, again today, a long row has been hoed, with an as-yet-uncertain payoff.

So what is it around here that feels something like Groundhog Day?

What steady stream of correspondence has prompted such a comparison?

Well, with all the talking that Alan Greenspan has been doing lately, much of it aimed at defending his actions while Federal Reserve chairman and the rest thinly disguised cheerleading for the housing bubble he left behind, many writers have taken him to task.

And links to those stories are being forwarded here with increasing frequency.

It has been a regular occurrence in the last month or so - since he called the bottom of the housing market (kind of), then went on to explain why one percent interest rates weren't necessarily a bad thing.

New this week is this story from Caroline Baum (the "Baumer", as she is sometimes referred to here) where she claims "first reviewer" status of the Maestro's handiwork.

Greenspan Legacy Submits to Its First Review

Alan Greenspan didn't go quietly from the global stage when he retired as chairman of the Federal Reserve in January. His speeches are still widely reported, his economic views and forecasts instantly disseminated.

It would probably be better if they weren't.

His latest "forecast" -- that the worst of the housing slump is over -- was rudely challenged Friday when the Commerce Department said October housing starts plunged 14.6 percent from the prior month to a six-year low. Starts were down 27.4 percent in October from a year earlier; single-family starts have fallen by more than a third since the start of the year. Housing permits declined for the ninth consecutive month, a record.

Having presided over the late 1990s stock-market bubble, and having cut interest rates aggressively to clean up the mess when it burst, Greenspan has a vested interest in the health of the housing market. If the residential real-estate boom ends badly, as all bubbles do, he could go down in history as a "DBCB", or double-bubble central banker.

No wonder Greenspan is laying out a new framework for analyzing the once-soaring property market. In a speech to a private group in Canada last month, Greenspan said the housing boom wasn't a response to the "1 percent fed funds rate or from the Fed's easing. It came from the collapse of the Berlin Wall."

Yes, the Berlin Wall theory of self propagating asset bubbles, or, as the Baumer puts it, the "Fallen Walls Doctrine" - a perfectly rationale explanation.

At the Cato Institute's Monetary Conference last week, apparently the 2002-2004 pedal-to-the-metal approach to interest rate policy, believed in many circles to be largely responsible for what is now a quickly deflating housing bubble - this policy was roundly criticized.

"Did the Greenspan Fed err by providing too much liquidity in 2001-2004?'' Frankel said. "My answer is 'probably yes.' I await Woodward's customary follow-up book.'' (Perhaps "Plan of Attack'' is to "State of Denial'' as "Maestro'' is to "Rookie?'')

Cato Chairman William Niskanen was no more complimentary of Greenspan's crisis management (no mention of risk management).

"Ben Bernanke's next major challenge will be to avoid the recession that may be a consequence of deflating the demand bubble that he inherited from Alan Greenspan,'' Niskanen said. The record of the past 20 years suggests the Fed's overreaction to financial crises raises the probability of recession, imposing a "long-term cost'' on the economy.

Gee. A new Woodward book? Nice angle. Where has that been heard before?

Oh yeah - A New Woodward Book? - that was here, about a week ago (someone will have to explain the Baumer's proposed title - "Rookie?" - not gettin' it here).

Are people really surprised that things might get a little rocky now that the latest asset bubble is losing air rapidly? Could others not see the folly at the time and calculate the odds of an undesirable outcome?

Maybe a lot of people have been living in a sort of Groundhog day where, like Phil Conners' experience in Punxsutawney, asset bubbles keep occurring over and over - each time pretty much the same thing, only slightly different.

[Note: Please continue to send links to Greenspan stories this way - today's post was just in fun, and none of you should fear being punched, as poor Ned was.]

Read more...

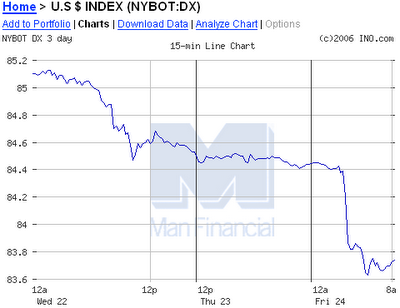

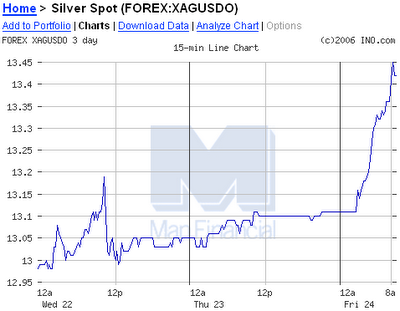

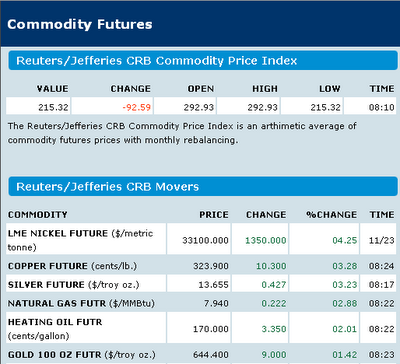

All this activity seems to have made the Bloomberg Commodity Futures page go bonkers.

All this activity seems to have made the Bloomberg Commodity Futures page go bonkers.

The centenary game is making news beyond the Lehigh Valley: It airs on ESPN2 at 9 a.m. ET Thursday, one of hundreds of traditional high school games played across the USA on Thanksgiving, mainly in the Northeast. There are fewer of these turkey bowls played than years ago. Many rivalries have been moved off the day so as not to interfere with state playoffs, according to Bob Kanaby, executive director of the National Association of State High School Associations.

The centenary game is making news beyond the Lehigh Valley: It airs on ESPN2 at 9 a.m. ET Thursday, one of hundreds of traditional high school games played across the USA on Thanksgiving, mainly in the Northeast. There are fewer of these turkey bowls played than years ago. Many rivalries have been moved off the day so as not to interfere with state playoffs, according to Bob Kanaby, executive director of the National Association of State High School Associations.

As you'll recall, the arrogant, egocentric, and frustrated weatherman from a Pittsburgh, Pennsylvania TV station was assigned to the annual Groundhog Day festivities in Punxsutawney, only to find himself experiencing the same day, February 2nd, over and over.

As you'll recall, the arrogant, egocentric, and frustrated weatherman from a Pittsburgh, Pennsylvania TV station was assigned to the annual Groundhog Day festivities in Punxsutawney, only to find himself experiencing the same day, February 2nd, over and over. As you'll recall, after abandoning his car, William 'D-Fens' Foster takes a baseball bat to the candy aisle of a convenience store after an uncooperative clerk rubs him the wrong way. He then interacts with gang members, guns, and finally Robert Duvall as a retiring police officer who just wants to get to his daughter's birthday party.

As you'll recall, after abandoning his car, William 'D-Fens' Foster takes a baseball bat to the candy aisle of a convenience store after an uncooperative clerk rubs him the wrong way. He then interacts with gang members, guns, and finally Robert Duvall as a retiring police officer who just wants to get to his daughter's birthday party. We shall have much more to say about CERA's forecast later. For now, it is sufficient to note that CERA's analysis is lacking. The world's oil supply will not continue to grow to meet ever-rising global demand, and worse, the consequences could irrevocably damage global economies. Such an outcome would have harmful effects on people's lives. So, this debate is not "academic" — much depends on a correct analysis of the future oil supply.

We shall have much more to say about CERA's forecast later. For now, it is sufficient to note that CERA's analysis is lacking. The world's oil supply will not continue to grow to meet ever-rising global demand, and worse, the consequences could irrevocably damage global economies. Such an outcome would have harmful effects on people's lives. So, this debate is not "academic" — much depends on a correct analysis of the future oil supply.