Double Down or Walk Away?

Tuesday, January 23, 2007

Yesterday's Bloomberg story Goldman, Deutsche Bank Say Double Down on Commodities makes you wonder whether commodity markets in 2007 are going to be even wilder than in 2006.

(Hey, if the mainstream media can use this gambling analogy for troop levels in Iraq, why not with commodities too - actually, the "All In" Saturday Night Live skit was probably closer to the mark for Iraq.)

From the looks of precious metal prices this morning, 2007 may indeed be far more exciting than last year (and unfortunately, the same is probably true for the Middle East.) Saijel Kishan and Tan Hwee Ann of Bloomberg write:

Saijel Kishan and Tan Hwee Ann of Bloomberg write:Anyone who followed the advice of Goldman Sachs Group Inc. last year and invested $10 million in the Goldman Sachs Commodity Index would have lost 15 percent, or $1.5 million.

The story goes on to present a fairly balanced view of what to expect in the new year. The short answer? Who the heck knows? You'll get as many predictions for $40 oil as you will for $65 oil, though the calls for $500 gold are few and far between - given the continuing problems with the U.S. dollar, higher precious metal prices seem certain.

Like so many of Wall Street's best and brightest, Goldman, the biggest securities firm by market value, says it wasn't wrong, just early, and to expect an 8.1 percent return in 2007.

"The long-term secular story is very much intact,'' Jeff Currie, global head of commodities research at New York-based Goldman, told customers in London earlier this month. That's the same outlook provided 13 months ago by Arun Assumall, the firm's London-based head of commodities sales.

Like Goldman, Deutsche Bank AG isn't discouraging anyone from doubling down in what increasingly looks like a bear market. Germany's largest bank in September said oil will trade between $60 and $70 a barrel this year, well above the $49.90 fetched last week. Barclays Capital, the securities unit of the U.K.'s No. 3 bank, said four months ago crude won't drop below $60.

The year 2007 is still so young - still feeling its way along.

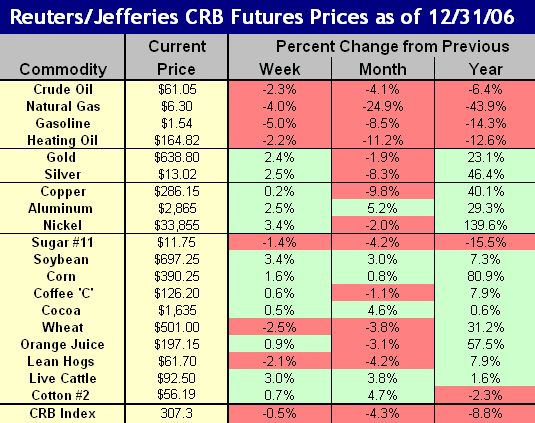

As for 2006, depending on which measure you look at, it was either horrible or not so bad - here's a look at what the major commodity indexes did:

[Note that these are approximations based on currently available data - a more definitive performance comparison will be published here sometime in the near future.]

Naturally, the two indexes at the top of the list that have higher energy weights fared the worst - that should be clear by looking at the table below. It was a very bad year for energy prices, unless of course your primary interest in the cost of energy is the price at the pump and your monthly heating bill - then it was a good year. You don't hear too much about all the items that show green in the right-most column above. A portfolio of metals and agricultural commodities would have done quite well last year - just stashing a few gold and silver coins would have put you way ahead of the crowd.

You don't hear too much about all the items that show green in the right-most column above. A portfolio of metals and agricultural commodities would have done quite well last year - just stashing a few gold and silver coins would have put you way ahead of the crowd.

Though the price increase was impressive, hoarding five-cent slugs for their melt value is still impractical for the ordinary investor. Despite the 38% gain that would result in recapturing the 25 percent nickel content, at 5 grams apiece, the volume and weight add up much too quickly.

Corn, OJ, and wheat saw hefty increases. The desire for alternative energy and undue congressional influence have turned Midwest corn farming into a high-stakes, high-yield business. They're talking about housing booms in the Great Plains as a result of an expected mass migration to deal with the continuing surge in demand.

It's too bad that corn is a horrible source for ethanol - that's what passes for forward looking energy policy in this country today.

Overall, 2006 continues to be portrayed as a very bad year for commodity investors, but when you look at all that green in the table, maybe it wasn't so bad after all.

So, double down or walk away?

Maybe just make sure those gold and silver coins are well hidden and add a few to the pile while you're at it (on second thought, maybe add a few handfuls to the pile).

6 comments:

Unless there's a big reversal, this breaks your 2006 streak of writing about PMs on a down day.

Could be a good sign for '07.

Gold and HUI just finished an ABCDE correction. Should be a good move up from here.

Long-term, it's a no-brainer. Short-term, the Administration is desperately looking for excuse to justify an escalation and counter the anti-war sentiment. The downside is quite limited , imo.

Oh MAN! They're filling the strategic petroleum reserve... I should have doubled down.

Investors keep looking for somewhere to put their money. Eventually they are going to run out of options and that is when the dollar will fall.

Inflation hasn't started yet.

Oh, inflation has started for sure. But just wait until it really gets going.

Post a Comment