Fun With the Public Debt

Wednesday, November 02, 2005

Having developed a sense for which statistical data represented in tables would make interesting charts, when happening across this particular table, it was immediately clear that attention was needed. This data has surely appeared elsewhere in a chart such as this, but it was deemed worth the small effort to present it in a familiar format.

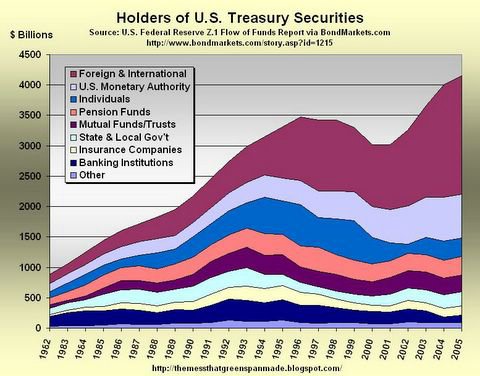

With short term interest rates rising another quarter point yesterday, and recently announced plans to borrow hundreds of billions more in the coming months, let's take a look at U.S. debt and to whom the money is owed, from a historical perspective.

Click to enlarge

It's a good thing no one overseas seems to be bothered with the major trend here - it might be difficult paying the bills next year if our generous overseas trading partners and offshore hedge funds were to dial back a little and force us to make ends meet on our own. That would result in either a lot of pain in the form of tax hikes and spending cuts, or more likely, just a huge expansion of the violet area of the chart. That would be the U.S. Monetary Authority as Treasury purchaser, as in, "Fire up the printing press Ben, and make some coffee - we're going to be here a while."

[Monetary Authority is described in Federal Reserve documentation as "Assets and liabilities of Federal Reserve Banks and Treasury monetary accounts that supply or absorb bank reserves." It is presumed that this is where monetizing the debt would appear on this chart.]

Debt Data

Now, keep in mind that U.S. Treasuries account for only about half the national debt, which is currently in the $8 trillion dollar range. For anyone who is interested, you can get the exact amount, The Debt to the Penny, compliments of some idle hands at the Treasury Department website support staff. As of yesterday it was:

When you think about it, with all the government accounting deficiencies in the Defense Department and elsewhere, it's probably misleading to report the debt to the penny every day - increasing, on average, at over $2 billion daily, getting it to the closest billion once a week would probably suffice. Although, surprisingly, the submitter of this question to the Public Debt Online FAQ seems to feel differently:Why does the debt only change once a day? Why doesn't Treasury keep a rolling tab?

Oh.

Our current accounting system produces the Total Public Debt Outstanding amount each morning around 11:30 A.M. EST. Our system relies on approximately 50 different reporting entities (e.g. Federal Reserve Banks) to report a variety of Treasury security information to us. Furthermore, the bulk of information that these reporting entities report to us is sent all at once at the end of the day. On the following business day, our accounting system processes this information and generates the Total Public Debt Outstanding for the previous day. Although we continually look for methods to improve our process, daily accounting is still the most effective, efficient, and accurate manner to account for the debt.

So, the other half of the national debt is referred to as Intragovernmental Holdings, and consists primarily of the Social Security Trust Fund, although again, just like debt monetization, it would be nice if they would mark these things clearly - money created out of thin air & social security trust fund - simple, why make people guess?

Here's the trust fund - Intragovernmental Holdings - the money's right there next to the debt held by the public, seemingly equal.

You can get all kinds of information about the public debt on government websites - The Public Debt Online has a vibrant color scheme, cartoonish fonts, and plentiful, well-organized data to make the experience an enjoyable one. Of course they do have a perpetual need to borrow money, so that may factor into making the website experience as pleasant as possible - just click on "Treasury Direct" on the left side-bar to start investing in U.S. Treasuries.

It really is quite easy - and fast. One of the relatively few processes that the U.S. government seems to have really perfected - borrowing money.

Debt and Deficits

For even more fun, go to the Office of Management and Budget, where you'll find a link to historical tables (warning - PDF) containing the Federal Budget of the United States. Now, compare the yearly budget deficits against the change in the public debt - that's an interesting exercise.

In the last few years, budget deficits have been in the $300 billion range while total government debt increases by close to $600 billion per year. And that off-budget category - that must be the government's version of "pro-forma" accounting.

Exclude all the bad stuff - if it works for business, why not government?

This data too is crying out for attention - if we had more time we'd whip up a chart or two to illustrate what most people already know about our government's finances, but something which can be brought to life through some colorful chart work and wry commentary.

That will have to wait for another day.

13 comments:

tim, do you plan on making a post about what the underinflated CPI numbers do for GDP figures? that would be an interesting follow-up.

I'm planning to - just haven't gotten around to it yet.

awesome. what is your feeling about how much GDP is overstated? my instincts tell me GDP is probably 1-2% higher than it should be.

I've heard people say we're already in a recession because the combined understatement of inflation and overstatement of growth exceeds the reported real GDP of 3 or 4 percent.

I haven't looked into enough to have an opinion other than that real GDP is higher than it should be simply because inflation is understated.

If we are already in an unreported recession, wouldn't we see corporate profits tanking, retail sales dropping fast at places like Wal-Mart, Costco, etc.?

Tim,

Heard of "Peak Oil"? How about "Peak Credit"??? Perhaps that would be the point where the Japanese and Chinese are no longer willing to buy ever increasing amounts of Treasuries.

I want to thank you so much for this blog. This is great stuff.

Sean Love

I like your warning about pdfs. I hate them too.

Tim you have small(HUGE) loophole in your anaylsis on international holdings of US assests. What else are the Japenese and Chinese gonna buy besides US securities? Euro growth rates in the basement, a staggering Asian market, or the credit/political risk filled prospect of Latin America? Sad as it may seem the US can fire up the press all they want until a better investment comes along. Now when that happens its a different story, but in the short to mid-term sorry but I see little worry about.

Re: loophole

Better investments have existed for a while. The Chinese are aggressively pursuing energy and commodities WW. Tipping point will come when that is widely perceived as the place to park money. Can't buy earthquake insurance during the earthquake.

What else are they going to do with the money? Lots of things - buying commodities and investing in natural resource companies are at the top of the list.

The question of when will Asia stop taking those dollars and lending them back to us is really the question of the decade.

It should really be viewed not as "investing" the money, but as "what can they do with the dollars that would serve their interests best?" Right now, their interests are best served by keeping the U.S. budget deficit funded and continuing to loan money for U.S. housing in order to keep our economy going and their exports going.

The problem for the U.S. is that what is in one's best interest changes over time - the U.S. has become overly dependent on borrowing money from abroad..

Re: What else.....

I figure China see their hoardings of dollars as a sort of weapon in reserve, which they can drop on the market when and if the US should ever seriously annoy them. The financial loss they would thus inflict upon themselves has surely already been written off.

Great blog! Your flood of depressing facts does not surprise me, though. What can you expect from a government run by criminals? This is what you get when two totally corrupt and rotten to the core political parties have a stranglehold on power in this country.

Good research.

I've done some, too.

Did you know that much of the government's Intragovernmental holdings are termed Treasury Government Account Series (GAS) securities.

They created these when they "paid down the debt" in the late 90s.

The politicians could proclaim they were paying down the debt when they were just creating GAS securities to fund the buying back of bonds from those on the outside while increasing debt inside.

Unfortunately, the debt did not go down, but actually increased as transaction costs

Whoever dreamed up that acronym, GAS, had a sense of humor, since the securities are nothing but air.

Recently, I read that they are now simply writing off these GAS securites since they owe it to themselves anyway. Some trick, huh?

So the GAS securities go back from whence they came. Hot air.

The result is further debasement of the currency.

Post a Comment