Commodities for Dummies

Sunday, January 08, 2006

Daniel Roling of Merrill Lynch writes a short and sweet summary of why increasing commodity prices are a no-brainer for 2006. Reading this should in no way be construed to mean that you can skip reading Jim Rogers' book, Hot Commodities, which is required reading for anyone wanting to participate in what is now a six year old bull market, and what will likely be the next bubble in our "bubble economy". Demand should continue to exceed supply for most commodities during 2006. Capacity is being added, but the lead time to bring new supply online is measured in years.

A doubter of the magical qualities of gold, if Jim Rogers has been reading the papers over the last couple months, he's probably warming up to the yellow metal right about now, and perhaps rethinking his oft-quoted advice that you'll make more money in lead than in gold. Maybe not - does anyone know what the price of lead is?

...

Why are we so positive on commodities?

1. We do not look for a recession in the near term, so demand should remain strong.

2. We look for the U.S. dollar to remain stable to being weaker, which should dampen the demand for imported steel and keep the price of commodities attractively priced in foreign currencies.

3. Demand for copper remains very strong, especially from China. In addition, we look for copper demand in the U.S. to be above trend as the massive rebuilding program along the Gulf of Mexico gets under way this year.

4. It is our view that unlike prior cycles, there is just not a lot of idle capacity waiting to be brought back online. The underinvestment in basic industry during the last decade is truly having an impact as the supply side of the equation is constrained.

One thing is certain, most — if not all — commodities are setting new highs in prices this cycle. The reason is simple: Demand is exceeding supply, and supply cannot catch up without a recession. Thus, we look for prices to be strong in 2006 because we do not see a supply response strong enough to offset expected demand growth.

UPDATE:

If you go back to July 1999, when gold bottomed out, the price of lead was $495 a ton and the price of gold was $252 an ounce. Having only been able to find November 2005 pricing for lead at $1017, that would be a 105 percent increase for lead and a 89 percent increase for gold using a November gold price of $476.

Using today's gold price of $539, gold has risen 114 percent since 1999.

UPDATE BONUS:

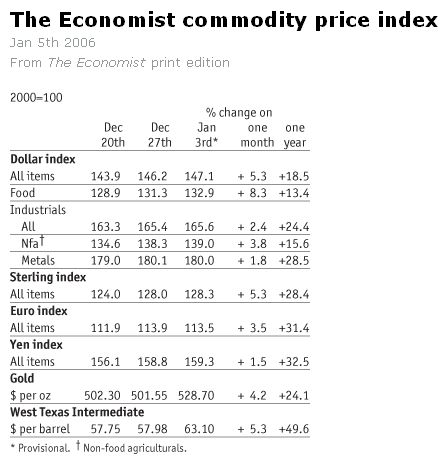

The always hilarious commodity price index in the back of The Economist magazine. It's just a good thing there's no inflation or these commodity prices would be killing us.

UPDATE SUPER BONUS:

On lead and gold ...

Surprisingly, gold is denser than lead. According to this chart, about 70 percent more dense. This is one of the reasons why you'll find us yammering on in these pages about holding a couple of gold coins in your hand - it's not just the color or the shine, it's the weight and the sound made when such dense metals contact each other that impresses.

4 comments:

It's just a good thing there's no inflation or these commodity prices would be killing us.

Nice work Tim! When I looked at that Economist commodity price index table last week, I thought exactly the same thing!

There's something I'm not clear on. You've repeatedly pointed out that we're heading for a mess. But this analysis basically says that the lack of a recession in '06 points towards higher commodity prices.

So are we looking at strong growth in 2006, or a downturn as the various stimulative forces run out? I'm not trying to be argumentative; it just seems like a continued bull market in gold or problems with inflation aren't consistent with the prospect of a downturn.

Like many others, absent any natural or geopolitical disasters, I dont' think 2006 will be too bad a year by normal measures - no recession, U.S. GDP growth in the 2-3 percent range. Also, like many others, I think 2007 will bring a recession.

The point of the Merrill Lynch article was that even with just 2 percent growth, commodity prices will rise due to restricted supply.

A recession/depression fixes all the things that should not have been. This is necessary and not a bad thing in the long run. If life is a marathon, we won't reach the finish at a 4 minute pace. This is what happened throughout the 90's and it accelerated in Y2K. Thereafter, we blew up and had to walk for a whole mile. Now, we've tried to push 4 minutes again only to find we're losing strength after another mile. Mr. Bernanke is readying plans to administer an adrenaline boost if we cannot hold onto 4 minutes. Guess what happens next?

Post a Comment