A Very Mixed Farewell

Monday, January 30, 2006

In recent days there has been a very mixed and unexpectedly sparse group of farewell stories about departing Federal Reserve Chairman Alan Greenspan, who will retire tomorrow after eighteen years. Still, his legacy will be judged not just by his record at the Fed, but also by the economy he bequeaths. And when he leaves office Jan. 31, Greenspan leaves a nation awash in debt -- record household debt and a record trade gap. Many analysts say his low interest rate policies contributed to these huge imbalances, which threaten the economy he nurtured. "The jury is out on his legacy in large part because of the debt" and the trade deficit, said Stephen S. Roach, chief economist at Morgan Stanley. "You will not be able to truly judge his accomplishments until we see how this plays out in the post-Greenspan era." So many Democrats were outraged in January 2001, when Greenspan urged Congress to cut taxes, lending a key political boost to President George W. Bush's tax cut proposal. Critics charged that Greenspan had become too partisan for a Fed chief; others saw him simply reverting to his anti-government ideology. But Greenspan believed the surpluses would continue and suggested that policymakers design "triggers" to scale back the tax cuts if deficits reemerged. Congress later passed a reduced form of Bush's tax cut without such provisions. Disappointing fourth quarter U.S. gross domestic product numbers on Friday should not shake Federal Reserve confidence the economy is on a reasonably solid footing, analysts said. But higher core inflation shown in the data ought to ensure that it retains a slight tightening bias, which markets bet means one more rise before ending the current rate-hike cycle. Mr Greenspan has served his country and the world with distinction as Chairman of the Fed for nearly 19 years. He is the first central banker in history to become a household name across the globe and his achievement is not just the most successful tenure in history but one truly admirable for its vision, wisdom and strength in both the best and the most testing of times.

Back in August, during his Jackson Hole send-off there were many more legacy stories and a decidedly more upbeat tone about them. Perhaps a trip to the trendy Wyoming vacation spot allowed kinder words to flow more easily than in recent days.

Or, maybe with housing markets looking more vulnerable, energy prices still rising, and instability around the globe, writers are following that motherly advice about not saying anything if they can't say something nice.

Some reporters have recorded their thoughts. Here's a look at a few of them.

Washington Post

Nell Henderson penned two stories last week that were not so complimentary to the outgoing chairman - one story about the debt that has been created and another about politics. Asking Stephen Roach to comment speaks volumes.

As Economy Thrived Under Greenspan, So Did Debt

Chairman Moved a Nation

Los Angeles Times

Tom Petruno wonders about inflation and of the legacy of managing inflation "expectations". It's always interesting to see a business writer for a mainstream publication tip-toe around the suspect nature of inflation reporting.

Greenspan Legacy: A Dragon ThrottledWas your inflation rate 2% last year?

MSN Money

Tallying up your gasoline and grocery bills, you may feel like 2% is a low-ball figure for inflation.

...

The whole core-inflation thing, admittedly, is an irritant to many people. The core rate excludes food and energy costs, which economists generally believe are too volatile to include if you're trying to gauge the long-term trend in inflation.

While Roger Ibottson sounds somewhere between luke-warm and mildly laudatory, Bill Fleckenstein gets right to the point.

How Greenspan got it rightAlan Greenspan will be remembered most for his laissez-faire approach to the management of the economy and his obscure manner of speaking. He believed that too much intervention in the economy could do more harm than good. So he practiced restraint and pragmatism. He allowed a combination of academic theory and intuition to guide his decisions, and he always stayed flexible. By not laying down concrete plans of action or committing to targets, Greenspan could wield his power with greater precision.

Greenspan: The worst Fed chief everAlan Greenspan gave a speech last year titled "Economic Flexibility." It should have been called "Damn, I'm Good," because the world's biggest serial bubble blower -- and most incompetent, irresponsible Fed chairman of all time -- tried to rewrite history. This column will endeavor to set the record straight.

CNN/Money

Now, there it is - an unabashedly positive story about the wonders that Mr. Greenspan has wrought.

Happy Trails, AlanWhat do Alan Greenspan and Muhammad Ali have in common?

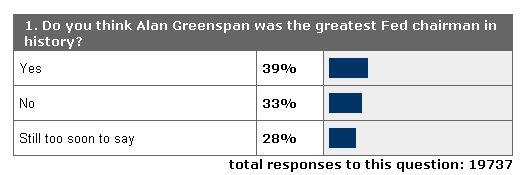

A poll on the same page provided the following results:

Many observers say the two men are the greatest of all time in their respective professions.

Greenspan's tenure as chairman of the Federal Reserve comes to a close at the end of this month and economists looking back at his 18-plus years as the head of the central bank almost uniformly say Greenspan did a more than admirable job. It would seem that the smart money is on "Still too soon to say".

It would seem that the smart money is on "Still too soon to say".

Reuters

It sure seems that either the retrospectives are coming late this time around or everyone has just lost interest. Of course there is fierce competition for newspaper ink from the Alito vote, the State of the Union Address, the Middle East, energy concerns, and many more issues which now, somehow, appear much more important.

At Reuters, it's interest rates, a consulting firm, and just a little doom and gloom for Ben Bernanke.

Fed to raise US rates again as Greenspan era ends

Greenspan to set up consulting firm: reportFederal Reserve Chairman Alan Greenspan plans to establish a consulting firm called Greenspan Associates in Washington after he leaves the central bank at the end of the month, the Wall Street Journal reported on January 26, quoting people familiar with the matter.

Bernanke to take over Fed with uncertain road aheadBernanke will also be facing what some economists see as economically destabilizing imbalances.

Associated Press

In addition to a potential bubble in the housing market, some economists believe burgeoning U.S. budget and trade deficits have led to a dangerous reliance on foreign capital.

The proximity of the first two items on the Associated Press timeline must be weighing on Ben Bernanke's mind, while sycophants Blinder and Reiss are recalled for their Jackson Hole homage, and Vice President Dick Cheney offers a ham-handed vote of confidence for the incoming Fed Chairman.

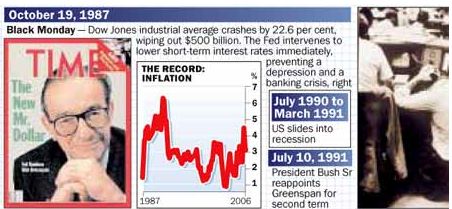

Timeline for Greenspan's Fed TenureKey dates during Alan Greenspan's 18 1/2-year tenure as chairman of the Federal Reserve:

Iconic Fed Chief Prepares His Departure

Aug. 11, 1987: Greenspan takes over at the Fed after being picked by President Ronald Reagan to succeed Paul Volcker. Greenspan will be renominated by both Presidents Bush and President Clinton.

Oct. 19, 1987: "Black Monday." The Dow Jones industrial average suffers a record one-day plunge of 23 percent. Greenspan spurs a rally the next day when the Fed issues a brief statement promising to lend to any financial institutions in distress.In a 93-page analysis of the "Greenspan Standard" that was released last summer, Princeton University economists Alan Blinder and Ricardo Reis concluded, "We think he has a legitimate claim to being the greatest central banker who ever lived."

Times Online

Saying goodbye to Greenspan will not be easy.

Vice President Dick Cheney, trying to offer reassurance about the days ahead, spoke well of Bernanke in a Fox News interview, then added: "Besides, Chairman Greenspan is only a phone call away."

Across the pond, the mood is more dour. The British Chancellor of the Exchequer, the Right Honourable James Gordon Brown, had a few good words to share, but others weren't so positive.

Merryn on Money: America is not invincibleI am still hanging on to one opinion that puts me in something of a minority — the view that Alan Greenspan’s legacy to America, as he prepares to retire on Tuesday, is a truly horrible one. Greenspan’s many fans say that in his 18 years at the helm of the Federal Reserve he has presided over a low-inflation era of astonishing prosperity and stability. But is this true? The answer is that it depends how you look at it. Greenspan has prevented any huge crises actually taking place on his watch, so for that you could applaud him. However, what his preventative actions have also done is pretty much guarantee that a serious crisis will take place on his successor’s watch, something I’d say isn’t quite so praiseworthy.

Focus: United States

Leader of vision, wisdom and strength by Gordon BrownWHEN Alan Greenspan stands down, the world will pay tribute to not only its most outstanding economic policymaker but the greatest economist of his generation.

But critics also say the US is still suffering from the Greenspan errors. The collapse of the equity market helped to produce the recession of 2001. As the economy faltered, the Fed was forced to cut rates more aggressively than it had ever done before.

Fed maestro sleeps easy

...

Greenspan-backers say this again showed the Fed Chairman’s extraordinary flexibility when the economy needed it. But the critics contend that, in acting to offset the results of the collapsing equity bubble, Mr Greenspan inflated another bubble — this time in housing.

...

But this critique doesn’t stand up to much scrutiny either. As one senior Fed official puts it: “What were we supposed to do? Just sit back and leave rates alone and let the economy go into a deep hole?” At midnight on January 31 Alan Greenspan will hop into bed for his first worry-free sleep in eighteen-and-a-half years.

So he told me during a recent visit to London at the invitation of Gordon Brown, a Greenspan admirer despite the Fed chairman’s support for tax cuts. Here to deliver a lecture and be made a Freeman of the City of London (which entitles him to herd sheep across London Bridge, be drunk and disorderly without being arrested, and, if it comes to it, be hanged with a silken rope), the soon-to-be private citizen said: “I have only just realised that I have been on 24-hour call for 18 years.”

...

It is too early to determine whether Greenspan has left a mess for his successor to clean up, or a golden inheritance on which he can build. Bernanke is calmly confident that, come what may, he can handle the job. Good thing, if Bank of England Governor Mervyn King is right that “it is rather unlikely ... the next ten years (will) be as nice as the past ten.”

17 comments:

thanks alot a-hole. under your watch every investment i have made turned to crap. now upon your departure you have devalued my cash to keep me in the welfare state.

Roach has it pegged. It's just too soon to tell. People were saying nice things about the captain of the Titanic right up until near the end of the voyage when the iceberg popped up. Until then, it was all, "Have you ever seen a ship this big move this fast? It's amazing what we can do with ships these days...."

I see that Easy Al turned 18 in Mar

1944... well thank God he didn't end up on Omaha or Normandy Beach.

Where would we be today if he hadn't been around to double the Payroll Tax and steal (I mean borrow, of course) $2 Tril from the working class (who did end up on Omaha) in the mid 80's.

Does this mean he's not part of "The Greatest Generation"?

I think we should set a term limit for fed chairmen. Volcker did a better job and was there for 8 years, but if he had stayed for 18 1/2 we might think less of him today. We should have a 10 year limit for Fed chariman, because the 18 1/2 years that GSpan has been with us is too long. His policies will affect the US economy for at least the next 50 years (probably my entire lifetime) because we have such imbalances anything less than a great depression combined with a major war or massive productivity spurt will not clean them up.

He should have left in 2000 and let someone else clean up the stock bubble. If he had, we might not be dealing with the housing bubble at this point.

We need fresh thinking in the Fed chair position; term limits is a good start.

You may be interested in knowing that Santa Barbara realtors have STOPPED GIVING OUT SALES STATISTICS. IF you can't sell a house in Santa Barbara you cannot sell a house anywhere. I see a depression coming, unless Bernanke takes the dollar down to about 10 cents.

not sure but I think 10 cents would be UP from here...

... and speaking of nickles and dimes and other mass delusions that Fed miesters love to foist upon us;

nickle - 75% copper 25%zinc 5 g

Dime - 75% copper 25%zinc 2.25 g

why do we pretend that a dime is worth twice as much as a nickle...

Matrix perhaps?

Because coins are symbols. Why is a check for $100 worth more than a penny, when it's written on paper that costs less than 5g of copper and zinc?

As one senior Fed official puts it: “What were we supposed to do? Just sit back and leave rates alone and let the economy go into a deep hole?”

That's reassuring.

Exactly...

We've transformed from an age when the country was founded where money was real, to an age where money is unreal. From an age where great presidents like Andrew Jackson actually revoked the charter of the Federal Reserve(2nd Nat Bank in 1836) and returned us to a real money system. Didn't have any decade long depressions back in the 19th century.

Greenspan was a political hack. I'm not holding my breath and hoping for any better from his sucessor ("Helicopter Ben").

The Fed is running our currency into the ground. It is best we have this institution abolished. Why is Government meddling with money, anyway? Let the people decide what the medium of exchange shall be. Given the choice, people will gravitate to honest money - i.e. gold and silver. That's the way it was for over 5000 years, and that's the way it shall be.

What we're going through now is just another prolonged experiment with Government-issued, unbacked toilet-paper money. The experiment will end when the next serious crisis hits, and the entire financial system implodes.

I'm with you f_i_f... an abolistionist. It took only 20 short years for the 1913 experiment in toilet paper, that promised to stabilize the currency, to prove to be a total and abject failure.

Why does it still exist?

anonymous @ January 30, 2006 3:09 PM:

"Total & abject failure", judged from the 30's until today (admittedly not what you claim), strikes me as a gross overstatement. It's not the fiat currency as such, but its abuse to cover debt with more fiat money (and thus given the financial traction mechanisms, more debt). E.g. compare the core EU (before the Euro, and to some extent now) -- they have fiat currencies, but not even close to the inflation of the US -- in my judgement, that's more because their currencies can't (directly) buy oil, not because of any greater virtue on their part.

OTOH consider that real (as in fundamentally real, not in the inflation adjusted sense) economic growth after WW2 was at such rates that you could not have possibly "covered" it with precious metal. You simply cannot excavate that much precious metal, or even so you wouldn't want the people who own the ground that carries metal to dictate your economic growth patterns. It's not much different from having to spend your wages in the company store. Metal-based currency would have been a bottleneck and straitjacket to growth, and hard currency regimes would merely have led to different mis- or underallocations. (For the post-Y2K period I wouldn't be so sure anymore.)

Obivously my above post is quite ambivalent. As are my leanings on the topic.

Yes, metal based currency does produce a bottleneck and straight jacket; but not to economic growth and prosperity, to govt's ability to wage war. Woodrow Wilson I broke out less than 9 months after the creation of the Financing Mechanism, even though tensions had been smoldering for years. World wide economic misery of the 1930's led to HItler, Holocost and Woodrow Wilson II. Yes I'd call that an Abject failure.

With a look on the bright side, permit me to paraphrase Marc Faber: the beauty of the bubble is that there exist undervalued assets elsewhere. We have been given the investment opportunity of a lifetime. Unfortunately, it will be at the expense of those who believe in the bubble.

i'd like to understand why gold is a straight jacket on a growing economy. wouldn't the constant money supply simply revalue itself?

it's a false argument pushed on us by those who don't want the constraint of gold on their ambitions.

It hosts a numbers of home for sale by owner, Canadian vacation rentals,

rent and agents listing Vancouver, BC Canada. www.realsale.ca

Post a Comment