Friends in High Places?

Monday, October 02, 2006

Life is always much more fun when there's a good conspiracy theory to kick around. When the New York Times starts kicking it around too, then it can really be enjoyable.

Such is the case with the recent plunge in the price paid for gasoline by formerly dour consumers leading up to an election where the party in power is clearly having difficulty wooing the electorate. It just so happens that the newly appointed Treasury Secretary used to run the investment bank that controls the world's most important commodity index, which seven weeks ago cut the weighting of unleaded gasoline by nearly 75 percent, causing all commodity investments based on this index to sell their unleaded gasoline futures.

For the same number of buyers, a glut of sellers means lower prices, and voila! Prices at the pump drop precipitously, consumer confidence rebounds, and the electorate develops a new spring in their step.

Or at least, that's what some would have you believe.

A recent poll revealed that 42 percent of the respondents thought the White House had somehow manipulated the price of gasoline so that it would decrease before this fall's elections. They were only slightly outnumbered by the 53 percent who believed there to be no trickery involved.

Still, there are a few too many events that have lined up so precisely over the last few months that it's hard not to take notice. A recent New York Times story observed the changes made to the Goldman Sachs Commodity Index back on August 9th, particularly its fortuitous timing. Heather Timmons writes:Wholesale prices for New York Harbor unleaded gasoline, the major gasoline contract traded on the New York Mercantile Exchange, dropped 18 cents a gallon on Aug. 10, to $1.9889 a gallon, a decline of more than 8 percent, and they have dropped further since then. In New York on Friday, gasoline futures for October delivery rose 4.81 cents, or 3.2 percent, to $1.5492 a gallon. Prices have fallen 9.4 percent this year.

Not surprisingly, Goldman Sachs had no comment on the recent change.

The August announcement by Goldman Sachs caught some traders by surprise. The firm said in early June that it planned to roll its positions in the harbor contract into another futures contract, the reformulated gasoline blendstock, which is replacing the harbor contract at the end of the year because of changes to laws about gasoline additives.

Later in June, Goldman said it had rolled a third of its gasoline holdings into the reformulated contracts but would make further announcements as to whether the remainder would be rolled over. Then in August, the bank said it would not roll over any more positions into gasoline and would redistribute the weighting into other petroleum products.

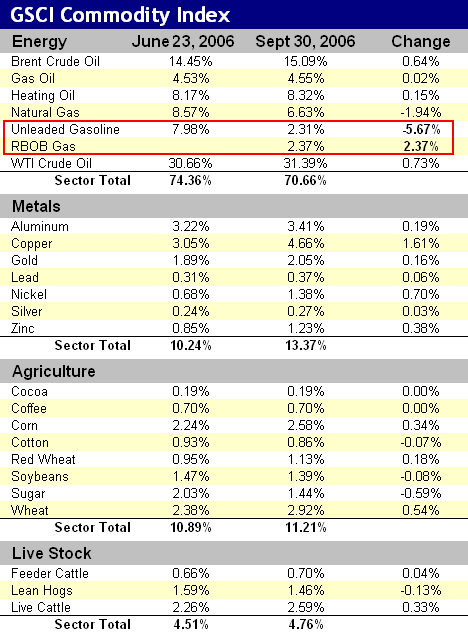

Having looked at this commodity index some time ago as part of the work done for the Iacono Research website, the weightings from late June were already available in spreadsheet form. A comparison between the composition from a few months ago to the most recent data available at the GSCI page of Goldman's website shows the following changes. The Times article states that the adjustment prompted the sell-off of some $6 billion in unleaded gasoline futures contracts, some of these being replaced by Reformulated Gasoline Blendstock for Oxygen Blending ("RBOB") futures and, as shown in the chart above, the rest being distributed to other commodities. Note that there was a hefty decline in the natural gas weighting as well.

The Times article states that the adjustment prompted the sell-off of some $6 billion in unleaded gasoline futures contracts, some of these being replaced by Reformulated Gasoline Blendstock for Oxygen Blending ("RBOB") futures and, as shown in the chart above, the rest being distributed to other commodities. Note that there was a hefty decline in the natural gas weighting as well.

There have been many other factors at work contributing to plunging energy prices over the last two months - the calming of tensions in the Middle East, a mild hurricane season, and improving energy production around the world - but the August 9th date serves as the peak for nearly all energy products.

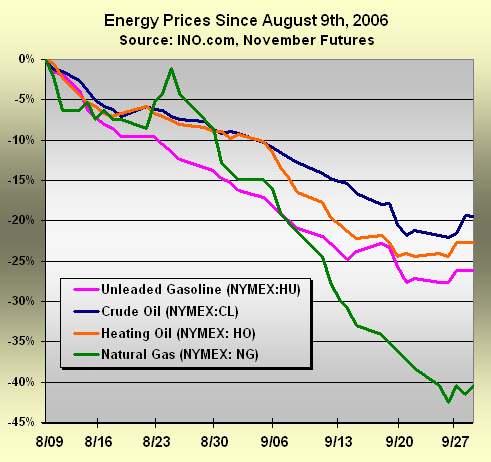

The plunge of unleaded gasoline prices around this time is clear in the chart below. So, indulging some conspiratorial inklings just a bit further, a reasonable question to ask is whether there might be a relationship between falling gasoline prices and other energy prices. Were plunging gasoline prices just part of a broad energy price deline or did it serve as a catalyst?

So, indulging some conspiratorial inklings just a bit further, a reasonable question to ask is whether there might be a relationship between falling gasoline prices and other energy prices. Were plunging gasoline prices just part of a broad energy price deline or did it serve as a catalyst?

The price of heating oil, for example is often affected by the price of crude oil, and gasoline prices can impact how much traders will pay for other commodities.

As it turns out, the end of the first week in August marks a peak for almost all energy commodities - crude oil, heating oil, gasoline, and more. But one look at the chart below and it becomes clear which energy commodity led the others down.  With the exception of a brief exchange with always-volatile natural gas shortly after August 9th, other energy prices appear to have been led down by the falling price of unleaded gasoline. It looks like a contagion in the graphic above, spread by unleaded gasoline and picked up by other energy commodities that were unable to fight off its effects.

With the exception of a brief exchange with always-volatile natural gas shortly after August 9th, other energy prices appear to have been led down by the falling price of unleaded gasoline. It looks like a contagion in the graphic above, spread by unleaded gasoline and picked up by other energy commodities that were unable to fight off its effects.

Not until ten days before Amaranth Advisors fessed up to their bad energy bets on the weekend of September 17th and 18th did the plunge in natural gas prices surpass that of unleaded gas. Of course, owning near ten percent of all natural gas contracts just prior to that fateful weekend, the actions of Amaranth traders leading up to their confessional likely exacerbated this decline.

So, as far as conspiracy theories go, this is quite a good one. The motivation for the commodity index change and the impact on other energy prices will likely never be confirmed or corroborated, but it makes for an interesting story.

Make a little change that causes $6 billion in unleaded gasoline futures to be dumped onto the NYMEX, then watch prices tumble. Stand clear, watching for traders like Amaranth to implode, and get ready to mop up any other messes that arise during the process - all to relieve a little pain at the pump, prior to the polls opening.

Some at the White House may be patting themselves on the back figuring that the best thing they've done in years was to get Hank Paulson to take the job at Treasury.

It's good to have friends in high places.

20 comments:

Another discussion on this topic took place yesterday on James Hamilton's Econbrowser:

The great gasoline price conspiracy

Lots of good links there as well.

What are the odds that the natural gas de-weighting had something to do with Amaranth?

Thanks Tim for doing the analysis I wanted to do =)

Anonymous:

It looks a lot from this data like the gas de-weighting could have been a factor in dragging Amaranth down. Not surprisingly, Goldman and its brethren (especially Lehman) are huge winners in the Amaranth implosion.

Further, the implosion lead to many energy contracts being picked up far below market price (how far below can only be estimated). Some have commented that this would lead to weakness in the energy market for weeks or months after the initial event.

Please,

Put your tinfoil hat back on. You've really outdone yourself this time.

George Dubya, stop posting your misleading comments on these boards. Cheney, stop spellchecking his postings, too. :)

>>monetizin' the debt said...

Please,

Put your tinfoil hat back on. You've really outdone yourself this time<<

ad hominem arguements come easy to commenters with tiny brains

I (facetiously) agree with the anomyous gentleman about putting your tinfoil hats back on, especially you, Tim. I mean, really, there are no conspiracies in freedom's land, are there? We're all free here. Enron? Operation Northwoods? Foleygate? Abramoff? No conspiracies here, except the official conspiracies like Bin Laden. Outside of those, just coincidences. Like everyone in the administration having a connection to big oil. Like Cheney giving the finger to the Soviets over the pipeline he's building in the 'Stans. Like Condalezza Rice having an oil tanker embossed with her name. Just a coincidence. Sure there's lot's of 'em. But nothing to worry you sorry, precious little tinfoil hat over, my pet. Run along now, Tiny Tim, and you conspiracy crazies and buy something from China to keep our "economy" going....

Uneducated sheeple are easily manipulated by those with sinister agendas. Who cares. The sheeple don't vote.

Gambling money in the energy markets ran out, and the bubbly positions were deflated, and the crash in the price of oil was the result. The fundamental supply and demand for oil will reset the correct value.

Goldman Sachs .. hmm.. where have I heard that name before?

Oh yeah, the big gold short on the Tocom in Japan. The big shorter on the Crimex .. I mean the Comex.

How convenient GS shorts commodities like crazy with their henchmen pals like JPM just in time to cause a perceived crash just before an election.

WOULD NEVER HAVE SEEN THAT COMING !

I'm shocked , shocked I tell you.

Ex-Goldies in the US govt , Can. govt , Italian, hell they're everywhere.

And they make record profits. They hardly ever lose on the futures markets.. not that I would ever ever suggest they're front running the markets .. because , you know, they're as-pure-as-the-driven-snow. Just cause they have connections at the highest positions in the treasury and govt's .. nah, couldn't be.

You all know darn well that there is never any corruption, conspiracy, or wrong doing by the big banksters.

I know .. cause the regulatory agencies say so .. and they would never ever come under the influence eg. captured interests .. on these guys.

Nope. Don't see any conspiracies anywhere!

"Conspiracy Theory" is usually a misnomer -- typically one is simply reading a blunt description of how our political system actually works.

Hey look , GS hard at work : ( based on the Tues. Oct. 3 chart ) : right on schedule, right at the Crimex :

http://kitco.com/charts/livegold.html

The markets are in "lockdown" mode until after the election.

He's a big fish. Now, he's either very smart or very dumb.

He's gone under the boat! Hooper!! He's gone under the boat!

monetizin' the debt:

Ahmadinejad says the holocaust was "just a conspiracy theory."

Careful whose argumentation techniques you emulate.

Dear Friends,

We may not need pensions anymore. According to the New York Times webpage, the Dow has just closed at 17,727.26. I kid you not. This is their LEAD story:

http://www.nytimes.com/

Check it out before the dreary fact checkers get there!

Shoot, the fact checkers have gotten there already. Never mind, I have captured the PDF of the story for posterity. It was like the 90's all over again. How I miss those times!

The best one I've heard is that money will now be rotating out of housing back into stocks. What a hoot!

Show me an event today that isn't a conspiracy.

Do you see the price of oil? Just a little oversold... All time DOW closing high today! Best economy and future prospects in the US ever!

No conspiracy here... you're paranoid. But you're not paranoid if you believe your shampoo poses a threat while flying.

Conspiracies are for Ahmadinejad , Hitler , or worse yet , Barry Ritholtz

look, you're in slate

http://www.slate.com/id/2150903/

Tim,

Definition of Paranoid: one who is in possession of the truth or facts.....

You might as well give Goldman Sachs an assist on the latest stock market pullback as well....

hit the URL link for an explanation: Goldman Sucks?

Post a Comment