Friday Lite

Friday, November 10, 2006

Mercifully, another election season has come to an end. What looked like it might drag on for a while has come to a speedy conclusion in both Montana and Virginia, and both bodies of Congress will have a new look when they start banging gavels in January.

Now for the bad news...

The countdown for the 2008 Presidential Election has officially begun.

Oh well, it's Friday.

Madam Speaker Made for Caricature

If this Lexington column from last week is any indication, writers at The Economist are going to have a good time with the new Speaker of the House.

It's probably a good thing that this magazine wasn't being read here back when Tip O'Neil was the subject of the artist's brush (by the way, check out the new speakers finances(.pdf) - very impressive). NANCY PELOSI is one of those politicians who seems made for caricature. She is the very embodiment of privileged liberalism—the wife of a rich-as-Croesus property investor and the representative of a city, San Francisco, that, as far as most Americans are concerned, is synonymous with ageing hippies, lay-about trustfunders, aggressive beggars and gay parades.

NANCY PELOSI is one of those politicians who seems made for caricature. She is the very embodiment of privileged liberalism—the wife of a rich-as-Croesus property investor and the representative of a city, San Francisco, that, as far as most Americans are concerned, is synonymous with ageing hippies, lay-about trustfunders, aggressive beggars and gay parades.

Ms Pelosi's public appearances do her no favours. Often she talks drivel.

...

It's like listening to a cross between a Stepford wife and Jesse Jackson. Yet Ms Pelosi has been at the top of the Democratic Party's greasy pole for almost four years. And, if the polls are right, she is poised to become the first Democratic speaker of the House in twelve years. This will not only make her the first female speaker; it will make her second in line for the presidency after Dick Cheney.

Is it Democratic or Democratic?

As another election wraps up and confetti is mopped and balloons are popped, many Americans find themselves confused about the proper usage of the words "Democrat" and "Democratic". While not claiming to know which form is best at which time, something has indeed changed.

The "ic" seems to have been dropped from the back end of the word when used in the same context as has been heard year after year. Instead of "vote Democratic", you now hear "vote Democrat". There are more instances of this minor deletion, many of them coming from the Republican Campaigner in Chief, but others in his party have taken to doing the same thing.

Some have been asking the same question at Democratic Underground (or is it Democrat Underground).

Democrats and Commodities

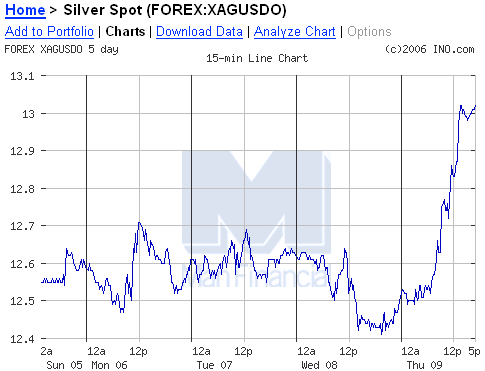

Nearly all commodities are liking the new look of Congress. The CRB Index took the firming up of results on Wednesday as a cue to break out of its recent funk. Gold, and particularly silver, seem to be taking the news well too. Of course silver goes up and down so quickly and so often that it's hard to think that there's really a connection (speculation that China will soon be selling U.S. dollars and buying gold has surely nudged silver along).

Gold, and particularly silver, seem to be taking the news well too. Of course silver goes up and down so quickly and so often that it's hard to think that there's really a connection (speculation that China will soon be selling U.S. dollars and buying gold has surely nudged silver along). Oil prices will be the ones to watch in the coming months. After languishing under $60 a barrel since the end of the brutal late-summer sell off, the price of oil has demonstrated a desire to move back up in recent days.

Oil prices will be the ones to watch in the coming months. After languishing under $60 a barrel since the end of the brutal late-summer sell off, the price of oil has demonstrated a desire to move back up in recent days.

Bloggers' Take

The most recent edition of Bloggers' Take over at Barry's Big Picture asked what the impact of the election might be on the stocks, bonds, housing, etc. This is the comment that was offered here:If the Democrats are smart, they'll spend a fair amount of time in the next two years making it clear that:

John Colbert said something the other day in a similar vein - Tuesday's big win was just a ploy by Karl Rove to ensure that the Republicans win both houses of Congress along with the White House in 2008.

a) they didn't cause the housing bubble

b) they can't stop it from bursting

It will likely take another year or so, just when things are starting to heat up for the next general election, for most homeowners to realize that much of their wealth has again evaporated.

Look for the Dems to try to fix the housing problem over the next two years.

Bob Casagrand: Lightening Up on the Commentary

Realtor Bob Casagrand of San Diego is unusually chipper this month. This update about real estate conditions just north of the Mexican border has none of the foreboding of previous commentary where he said things like, "I debated about putting this in writing because the numbers are scary".

No mention of falling prices - he's starting to sound like a Realtor. Many people ask me about the future but my crystal ball is as foggy as anyone's. I can say that to change our current market condition will require buyers coming back to the market. Until that happens there will be continuous downward pressure on prices. There are a few things to watch to see if the market is beginning to transition into a market change. By the way this change can be either downward or upward. You need to watch the change in sales from period to period, any changes in inventory supply - are the days increasing or decreasing - and what is happening to the low end of the market. If the low end is showing sales increases year over year then you are about 6 to 9 months away from seeing increasing sales up the price ladder.

Many people ask me about the future but my crystal ball is as foggy as anyone's. I can say that to change our current market condition will require buyers coming back to the market. Until that happens there will be continuous downward pressure on prices. There are a few things to watch to see if the market is beginning to transition into a market change. By the way this change can be either downward or upward. You need to watch the change in sales from period to period, any changes in inventory supply - are the days increasing or decreasing - and what is happening to the low end of the market. If the low end is showing sales increases year over year then you are about 6 to 9 months away from seeing increasing sales up the price ladder.

Housing Deflation

The homebuilders' crystal ball is not so foggy and prices are front and center when they talk to analysts. They don't relish the thought of slashing prices further, but are painfully aware that they'll have to do so to move the inventory. In this report from Toll Brothers, the current market conditions are explained."We think it's a loss of confidence in the buyers," Toll Brothers Chief Executive Robert Toll said during a conference call with analysts Tuesday. "Nobody wants to buy something that they think will cost less two weeks later."

Or two months later ... or two years later, which brings us to a curious comment by Barry Ritholtz, appearing in Money Magazine last month, referencing a much longer holding period."If your grandfather picked up a vacation home and overpaid by 40 percent, held it for two decades and gave it to his grandkids, how do you think he did?"

Hmmm...

Father Calls About Fisher

This story from the Philadelphia Inquirer prompted a call from my father in Pennsylvania. He wondered if this had anything to do with "that Greenspan blog you write".We're all human. Everybody makes mistakes.

"Yeah", came the reply, "It's taken awhile, but people are starting to catch on. You know it's not really a matter of the inflation data being off by half a percent - the inflation figures the BLS reports are off by much more than that. The whole monetary policy during that period was attempting to combat the evil of deflation that wouldn't be necessary without the Fed's inflationary bent that causes ..."

It's just that some people's mistakes are, well, more consequential than others'.

Exhibit A for that point surfaced last week, when the president of the Federal Reserve Bank of Dallas gave a speech containing what has to rank as one of the biggest "oops"es of the decade.

Speaking to a group of New York economists last Thursday, Richard W. Fisher acknowledged that some bad data on inflation caused the Fed to hold interest rates too low for too long, fueling the house-price bubble of the last few years.

As a consequence, Fisher said, "today... the housing market is undergoing a substantial correction and inflicting real costs to millions of homeowners across the country."

Oops.

He interrupted, "I've got to go rake some leaves - I'll call this weekend".

Lacker and Fisher Looking to Rumble Likely upset at the recent ink spilled on the behalf of Dallas Fed President Richard Fisher and his comments about 2003-2004 monetary policy, Richmond Fed President Jeffrey Lacker has been talking again too. Mr. Lacker and Mr. Fisher should really square off in some sort of cage match or something and settle this thing.

Likely upset at the recent ink spilled on the behalf of Dallas Fed President Richard Fisher and his comments about 2003-2004 monetary policy, Richmond Fed President Jeffrey Lacker has been talking again too. Mr. Lacker and Mr. Fisher should really square off in some sort of cage match or something and settle this thing.The Federal Reserve has failed to communicate its determination to bring down inflation in a forceful enough fashion, raising the risk that price increases will become entrenched, according to Jeff Lacker, president of the Richmond Fed.

Breaking ranks, speaking out. It's time for Ben Bernanke to have a talk with these boys.

In an interview with the Financial Times, Mr Lacker, who broke ranks to vote for interest rate increases at each of the last three Fed policy meetings, said the central bank had been "unclear" as to how it would respond to the pass-through of energy cost increases to consumers in the shape of higher prices.

The Politicians Win Again

And finally, from The Onion, come this astute observation on Tuesday's election results.After months of aggressive campaigning and with nearly 99 percent of ballots counted, politicians were the big winners in Tuesday's midterm election, taking all 435 seats in the House of Representatives, retaining a majority with 100 out of 100 seats in the Senate, and pushing political candidates to victory in each of the 36 gubernatorial races up for grabs.

Get ready for 2008. Prominent politicians from across the country celebrate the election results. While analysts had been predicting a possible sweep for months, and early exit-poll numbers seemed favorable, politicians reportedly exceeded even their own expectations, gaining an impressive 100 percent of the overall national vote.

Prominent politicians from across the country celebrate the election results. While analysts had been predicting a possible sweep for months, and early exit-poll numbers seemed favorable, politicians reportedly exceeded even their own expectations, gaining an impressive 100 percent of the overall national vote.

"It's a good night to be a politician," said Todd Akin, an officeholder from Missouri. "The American people have spoken, and they have unanimously declared: 'We want elected officials to lead this nation.'"

6 comments:

methinks you secretly like Nancy...

blah-blah-blah. When will they realize the Fed has no intention to manage money, nor the economy. The Fed is all about managing YOU.

Tim just wants her for her money.

Nancy boy

A more interesting question to ask yourself about the words democrat/democratic is:

Why do we call ourselves a democracy and our rallying cries are always about "DEMOCRACY" when the US is a republic?

Then do some reading on why the founding fathers despised democracies and why they purposely chose a republic.

Tim,

EYE OPENER video on INTEREST ONLY loans ..

http://www.youtube.com/watch?v=7RTqk1NbKJU

Post a Comment