After surgery of some sort, Alan Abelson returns to his post at Barron' s offering this commentary($) about crashing markets, rising prices, settlements in space, monetary policy, and Ben Bernanke's gastrointestinal goings on.

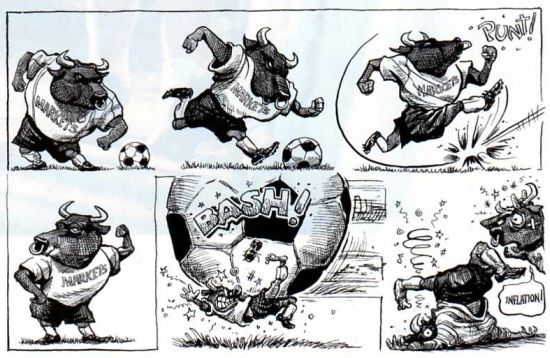

The most popular notion as to what touched off the wave of selling that swept markets the globe over was that Ben Bernanke, who succeeded Alan Greenspan as chairman of the Federal Reserve, had discovered inflation. And since Mr. Bernanke never went to obfuscation school (from which Mr. Greenspan graduated, summa cum laude) -- or cut classes if he did -- he failed to mumble "inflation" with sufficient inaudibility or at the very least find an ambiguous euphemism for the repulsive noun. Instead, he said it out loud and in a public place yet. Imagine!

Even so, we think the rush to put the blame on Ben, boys, is silly, and all wet, to boot. Wall Street's corps of professional kibitzers (aka "strategists") -- who are the last to know just about anything -- for months before Mr. Bernanke took over at the Fed had been making a hullabaloo about new Fed chairmen inevitably demonstrating their machismo by taking a poke at inflation.

So how could anyone possibly be surprised when Ben decided to show a little muscle in that time-honored fashion? Ben may yet drop money from a helicopter to get the economy going if -- or, rather, when -- it stalls, and he does favor face hair, but that's the extent of his unorthodoxy. More to the point, he wears a nondescript suit, an unthreatening tie and a benign expression -- in other words, he's the epitome of tradition.

No, Ben knows all about inflation and how he's supposed to harrumph at it. What we're not entirely clear on is why, having done time at the Fed -- and surely aware that Mr. G. was leaving one heck of a mess stuffed as much as possible under the rug -- he was so blamed eager to take the job. Maybe hubris -- he thought that tidying up would be a cinch for someone with his smarts. Maybe -- and this is worse -- he didn't realize just how big a mess he was inheriting.

The long and short of it is that we don't credit the idea that the world turned upside down, that spectacularly emerging markets became spectacularly submerging markets faster than anyone could say "Sell!" and that bourses from one end of the planet to the other all suffered severe indigestion because Ben burped. Any more than we believe that his subsequent comments that inflation may not be rampant now, but just you wait, sent the markets scooting back up the latter part of last week.

Indeed, Mr. G. did leave one heck of a mess and it is perplexing that anyone would willingly accept the task of taking over where he left off as Ben Bernanke did. As commented on in this space before, it seems anyone accepting the position as successor to Alan Greenspan as Chairman of the Federal Reserve should have been immediately disqualified for the post for either of the reasons cited by Mr. Abelson, or some combination of the two:

- He thought he could actually fix the mess

- He didn't understand how bad the mess was

As more and more news stories contain the words "inflation" and "rising prices", some reporters favoring more alliterative phrases such as "pain at the pump", whatever the thought process was that compelled him to yearn for and ultimately secure this top spot at the top central bank in the world, it's hard not to feel sorry for Ben Bernanke.

Rising prices, it seems, are now showing up in all kinds of places that no one thought to look when Mr. G. was sitting in the big chair mumbling about one thing or another while energy and imports were cheap and many asset classes stood at the ready, waiting to be inflated.

Nor is the insidious rise in inflation, it might be noted, restricted to licit activities. Comes word from the AP that smugglers of undocumented Mexicans into this promised land have raised their asking price to $3,000 for every person carried across the border; that's up from $2,000 a fortnight ago and $300 back in 1994. Like all of us working stiffs, smugglers have to make a living, and gasoline is a major expense item. And just like us, they worry about the future, too: The more circuitous routes they'd be compelled to travel if an extended wall is constructed along our southern border would significantly hike their cost of doing business. Although, as one Mexican-American comedian wonders, if some of the more severe deportation measures that have been proposed are adopted, who'd be left to build that wall?

The principal engine of the global inflationary surge is, it's no secret, China. And the latest data from that monstrously growing economic dragon shows it's still breathing fire at a fantastic rate. Last month, the country's industrial production rose an astonishing 17.9% and in the first quarter of this year, GDP sprinted ahead a blazing 10.3%. Besides an unshakeable thirst for oil, China has been bolting down industrial commodities at a truly awesome pace. According to Morgan Stanley's Steve Roach, in '05, it accounted for 50% of the growth in aluminum consumption, 84% of the rise in demand for iron ore, 108% of the increase in consumption of steel, and 115%, 120% and 307% in the growth of worldwide demand for cement, zinc and copper, respectively. How do you say "wow!" in Chinese?

And despite Beijing's solemn vow to cool it, the 19% jump in the money supply in May suggests otherwise. We remain skeptical that the folks in charge of China's so-called command economy have all that much interest in cooling it and all that might portend for a huge restive and grossly underemployed population. The only thing that will truly cool the red-hot Sino economy, we fear, is implosion. That'll happen, but not tomorrow or the day after. Which means the odds strongly favor a fresh lease on life for the boom in commodities...and their prices.

So ask not why Ben's antsy about inflation. He should be.

Read more...