How Not to Fight "Inflation"

Thursday, June 15, 2006

The ongoing debate about the significance of owner's equivalent rent within the consumer price index is yet another example of how hapless the nation's dismal scientists are as they continue to formulate monetary policy based on fundamentally flawed measures of "inflation".

As you'll recall, most economists restrict the usage of the word "inflation" to mean "core inflation", which excludes things like energy and food, and since 1983 has utilized Owner's Equivalent Rent (OER) in lieu of actual costs of home ownership.

To determine OER, instead of measuring what homeowner's costs actually are - items such as principle, interest, taxes, insurance, upkeep, etc. - the Bureau of Labor Statistics asks homeowners, "If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?"

So, "core inflation" today is made up of about 38 percent housing rental costs - 30 percent OER and another 8 percent reflecting the prices paid by people who actually rent.

If you're a central banker in an Anglo Saxon country this is a great deal because you can have home prices skyrocket and these costs don't show up in the consumer price indices. High home prices boost the economy in many ways - many new mortgage lending and construction jobs are created and consumption increases dramatically through easy home equity withdrawal - but they don't hurt the banker's bottom line of price stability.

In a strange twist of fate however, as short-term interest rates continue to be pushed up, what has in recent years suppressed "core inflation" - declining demand for rental units while nearly everyone was out buying up real estate - is now working against central bankers for a number of reasons:

All this tilts the supply-demand equation in favor of the landlord, at least for the time being, and now rents are rising.

Housing rental costs that have behaved so well in recent years, checking in with benign price increases month after month, year after year, are now turning against their master. The single statistic on which central bankers are judged when they show up for their annual performance reviews is now out of control due to rent.

But is this fair to the central bankers? Maybe not.

Is basing monetary policy on this rent-bloated "core inflation" prudent? Well, that depends.

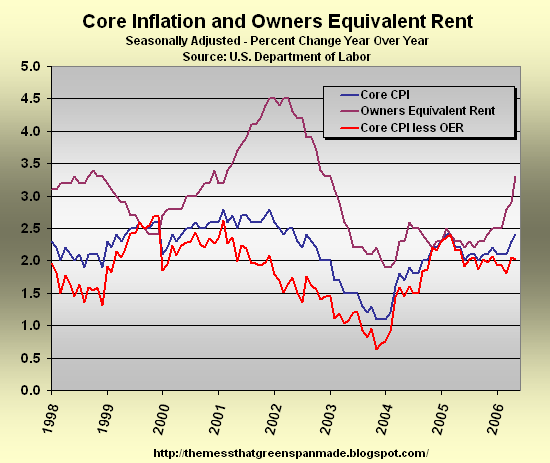

Taking a look at year-over-year core inflation with and without OER in the chart below, it is clear that without OER, core inflation has been essentially flat for some time now. In fact, core CPI less OER has been trending downward since it reached a peak in early 2005.

The same trend can be seen when six months of data is annualized as shown in the chart below. While OER is rising dramatically, without it, "core inflation" is essentially flat and within a range that appears normal. In fact, when including yesterday's data, the most recent measure shows a decline.

The six-month annualized figure was cited in last week's speech by Ben Bernanke. That is, the speech on June 5th to which most market participants had a violent reaction, after hearing words like "unwelcome" and "vigilant".While monthly inflation data are volatile, core inflation measured over the past three to six months has reached a level that, if sustained, would be at or above the upper end of the range that many economists, including myself, would consider consistent with price stability and the promotion of maximum long-run growth. For example, at annual rates, core inflation as measured by the consumer price index excluding food and energy prices was 3.2 percent over the past three months and 2.8 percent over the past six months. For core inflation based on the price index for personal consumption expenditures, the corresponding three-month and six-month figures are 3.0 percent and 2.3 percent. These are unwelcome developments.

The 2.8 percent rate cited above is the end point of the blue line below - unchanged from last month.

So, seeing the heavy influence of OER, the largest, worst behaving component within "core inflation", a reasonable question to ponder is the likely impact of higher interest rates on owner's equivalent rent. After all, if pain is going to be inflicted on the populace in the form of higher rates, there should be a reasonable expectation of a reduction in "core inflation". Shouldn't there?

But, think about it.

In the near term at least, housing is only going to get less affordable with more interest rate hikes since house prices are "sticky down" (or at least that's what they say - we'll see just how sticky "sticky down" really is if rates continue rising).

And, if rates are at current levels or higher next March, when more than a trillion dollars of adjustable rate mortgages adjust upward, then there will likely be even more homeowners who revert to writing a check to a landlord, rather than to a mortgage company.

So what's the rationale for continuing to raise rates to fight this kind of "inflation"?

Wouldn't it make more sense to lower rates, so more renters can become homeowners and existing homeowners can refinance at lower interest rates, removing all the recent excess demand for rental housing, thus forcing OER back to a benign state?

Isn't raising rates now a perfect example of how not to fight "inflation"?

Previous articles on inflation:

10/17/2005 - Home Ownership Costs and Core Inflation

10/30/2005 - Housing Costs - Core CPI Recap

11/11/2005 - Open Enrollment and the CPI - Part One

11/14/2005 - Open Enrollment and the CPI - Part Two

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

13 comments:

I always wondered about the effect of raising rates has on prices as well, due to the higher interest rates. Also peoples payments on loans and credit cards.

That said, IMHO, I believe this rate hike regimine is the medicine for the economy to wring out the excesses of the housing bubble. It is time for some reality to return.

None other than Dean Baker, co-director of CEPR agrees with you:

http://beatthepress.blogspot.com/2006/06/is-bernanke-promoting-inflation.html

but of course his analysis is not dripping with sarcasm.

So, am I to interpret the last paragraph as sarcasm about lowering rates? I sure hope so...

Even better, we could quit trying to guess which components are going to be most "stable" and just define "core inflation" as the average increase in components that didn't go up each month.

They should just define core inflation as two percent and be done with it.

Let's not define inflation and let the market determine the interest rate.

Well what's the problem?

Rate's reduced, more people buy houses, inflation falls, rates reduced again - all good.

Rate's raised, more people rent, inflation rises, rates raised again - all bad now?

As chechetti states, at [http://people.brandeis.edu/~cecchett/pdf/inf_current.htm]

"I firmly believe that some measure of the cost of owner-occupied housing belongs in the price index used for monetary policy purposes. We should not just get rid of it. Furthermore, looking at these data, there are two choices: Either the OER distorts the CPI, or it doesn't. If it does, then along with claiming that measured inflation is currently too high, you have to accept that measured inflation from 2001 to 2004 was too low. That is, there was never a deflation scare. Instead, policy was much too loose following the end of the 2001 recession. That's what I think, but I doubt that Chairman Bernanke does."

The same argument could be made for oil: why raise interest rates to lower inflation caused by rising oil prices, when those high prices are already acting to curtail consumption?

I'll tell you why: the Fed must manage NOT inflation itself, but EXPECTATIONS of inflation. Further, they cannot risk letting inflation get a start.

If they lower interest rates to make housing affordable, not only will the housing bubble continue off the charts once more, but inflation will keep rising as consumption increases. These 14 interest rate increases still have NOT dampened consumer spending. You cannot lower rates to save homeowners or to make the CPI look lower, because it won't work. If it were that easy, they would have done it already. The Fed has briliant economists, hundreds of them, mulling this all day long.

Believe me, if lowering interest rates would bail out housing and the economy while reducing inflation, IT WOULD HAVE BEEN DONE. Because it is painless. But they haven't done it BECAUSE IT CANNOT WORK.

Some of you are missing the point of this story, which is to demonstrate how ridiculous monetary policy has become as a result of attempting to manage only certain prices and substituting one thing for another in an era of wild asset price inflation

In this case, Tim correctly states that all else equal, if interest rates were lowered, core CPI would likely go down because rental costs would go down due to decreased demand for rental housing as more people would be buying homes again.

Back in the 70s and 80s when we didn't import so many inexpensive foreign goods, rising wages would result in rising consumer prices, which then resulted in rising wages, and the cycle fed on itself. Today the system is completely different as a result of how the CPI is constructed, how productivity has changed, and how inexpensive imported goods put downward price pressure on both consumer price and wages.

The result is what the Europeans view as a fundamentally flawed approach to monetary policy where too much emphasis is placed on narrow price indexes, and not enough emphasis is placed on monetary aggregrates and other factors.

Great post, Tim. Its a ruse and Bernanke knows it. The goal here is to save the dollar. Incidentally doing this would have effects similar to fighting inflation--for example, keeping imports from becoming excessively expensive (yes, pushed far enough, the Chinese will float against us).

Yes it's a ruse and they know it. However it's more than saving the dollar.

Why does everyone assume the Fed's stated goals are the same as their real goals?

If the Fed is the source of all inflation, then how can they claim to "fight inflation"? To "fight inflation" they'd simply stop creating money. Therefore, it's obvious the only thing they are really fighting is the *perception* of inflation.

But isn't that deception with the intent to profit? Print money and inflate, but look over here... nothing to see folks.

Isn't that fraud?

Here's the definition of "fraud":

1. A deception deliberately practiced in order to secure unfair or unlawful gain.

2. A piece of trickery; a trick.

http://dictionary.reference.com/browse/fraud

So we have a central bank who states that there is no inflation and that they are actively fighting inflation.

But they are simultaneously expanding the money supply for their own gain. The more they lend, the more interest they collect.

deliberate deception... secure an unfair gain... trickery through CPI distortions...

YES, that is the EXACT definition of fraud. I don't think you could come up with a more clear-cut case of fraud than the Fed.

So our central bank the one controlling key parts of our economy... just proven to be fraudulent.

Fed officials now seem worried that we may be seeing the start of another round of self-sustaining inflation. But is that a realistic fear? Only if you think we can have a wage-price spiral without, you know, the wages part.

Post a Comment