Wither the Oil Price

Wednesday, January 10, 2007

Crude oil prices continue to fall amid cuts in Russian oil supplies, talk of cuts from OPEC, revolt in Nigeria, more nationalization in Venezuela, and a tinderbox in the Middle East.

What's driving the price of oil down? It must be the weather.

Well, that and an apparent exodus of investors and speculators.

In this story from CBS MarketWatch, at least one analyst doubts that warm weather is involved."I can find very little reason for a big movement in oil prices," said Charles Perry, chairman of energy-consulting firm Perry Management.

Hmmm...

"Weather is really not that big of an influence on oil prices, when most crude is converted to gasoline -- plus the natural-gas prices have not moved," he said. Since the start of the year, natural-gas futures have moved less than 1%.

Most crude oil is converted to gasoline.

The $6 billion of gasoline futures that are no longer needed for commodity funds based on the Goldman Sachs Index are surely involved somehow.

No one seems to believe that OPEC is going to cut production, no one but Royal Dutch Shell seems to care what's going on in Nigeria, and news of a million barrel a day interruption in Russian oil supplies doesn't seem to matter either.

Hugo Chavez? Mahmoud Ahmadinejad? Irrelevant.

Like stock markets, fear seems to have been completely removed from the oil market.

Worse for Investors

What's worse is that if you're invested in oil through a fund that tracks futures prices, purchasing near month oil futures contracts and then rolling them over every month, you're losing money with each new month due to what is now an extreme form of "contango".

This story($) from the Wall Street Journal explains.Oil-futures contracts expire every month. Investors holding the most current contracts have to buy new ones to replace them if they want to maintain their positions. In the past couple of years -- in part, because of the influx of financial investors making long-range bets -- these contracts have gotten pricier the further into the future they are scheduled to be delivered, something known as contango. That raises the cost of keeping a position in the market. It's almost like the difference between walking a mile, and walking a mile uphill.

This condition was particularly noticeable a couple months ago when a futures contract plunged about two dollars just before it expired while prices for all other delivery dates held steady. Anyone selling an expiring contract would have had an immediate loss of two dollars when moving to the next month's contract.

About two years ago, spot prices of crude were higher than future months, something known as backwardation, which boosted investors' returns every month.

In practical terms, for most investors with oil in their portfolio, the cost of rolling over the expiring near-month futures contract into the one for the next month's delivery is now more than $1.25 a barrel. The price of oil could be unchanged at $50 per barrel, and an investor would still lose 2.5% because of these costs.

...

This is affecting large institutional investors, such as pension funds, which have been pouring into commodities in recent years, seeking to diversify their portfolios. A few years ago, they were happy to pay the "roll cost" to hold oil, because its price was rising and canceled out carrying costs in the futures markets.

...

Nobody is predicting an end to investors' interest in commodities as a way to diversify their portfolios. The California Public Employees' Retirement System, or Calpers, approved a pilot program this past fall to invest directly in commodities-futures markets, and it is one of a growing number of pension funds planning to devote a much larger allocation to the sector.

But these investors also may seek to adjust their allocations to indexes that are less energy-focused than, say, the Goldman index. Because roughly $60 billion is invested in funds linked to the Goldman index, pulling out or switching allocations rapidly could cause further downward pressure on the oil markets, some traders and economists say.

Different funds investing in oil futures have novel approaches to counter this condition - selling the near month contract at opportune times each month or using a mix of contracts with later delivery months are two approaches - but investing in oil futures seems to be fraught with difficulty if the intent is simply to track the price of crude oil.

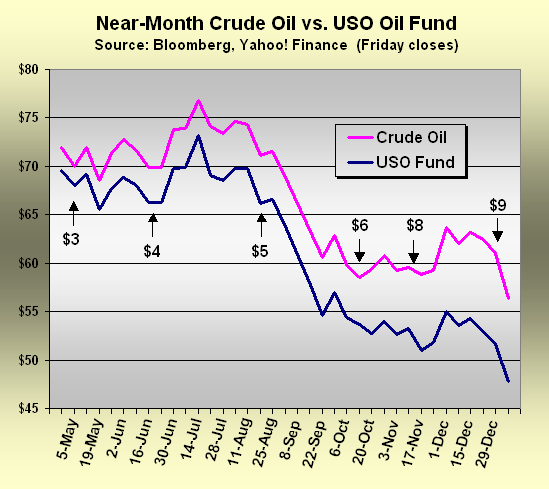

For anyone owning the United States Oil Fund (AMEX:USO) since its inception last spring, your buy-and-hold experience looks a lot like the chart below - the gap between the near month futures contract and the share price of the fund has widened from $3 last March to as much as $9 in recent weeks. There has got to be a better way for the ordinary investor to obtain exposure to the most important of all commodities.

There has got to be a better way for the ordinary investor to obtain exposure to the most important of all commodities.

Hedge funds are now reportedly buying and storing the stuff themselves - similar to the gold and silver ETFs that buy and store the physical commodity, then offer shares to others. Paying a couple percent a year in storage costs would seem to be an attractive alternative to the chart above.

Losing $6 a barrel on top of a 20 percent decline since the highs last summer doesn't seem like a very good long-term approach.

Naturally, if oil heads back toward $100 a barrel, few will care how well an oil fund tracks the price of oil.

5 comments:

From a CNN story yesterday:

Kevin Norrish, a commodities analyst at Barclays in London, has a price target for U.S. crude of $80 a barrel by the third quarter of 2007.

Norrish believes that rise will be fueled mostly by fundamentals. He pointed out that the U.S. Northeast, where warm weather has dominated for the last several weeks and has been cited as the main driver behind the recent selloff, only accounts for 6 percent of all U.S. oil use.

"People sold on the back of this warm weather and we think they are incorrect," he said.

The other guy they interviewed said the fall to $40 later this year would be based on fundamentals too.

Some fundamentals.

Tim,

Your own report yesterday of the production stats is a great bullish argument for oil. Production increases have been pretty pathetic. Yet the developing world just keeps on with 20-30% demand increases each year, and the developed world is solid at growth of at least 2%.

You have contango and backwardation backwards, by the way. We are in backwardation now, meaning futures prices are lower than spot. You profit from this situation by not holding commodity in stock, to the maximum extent possible. Last spring and summer we were in contango, when future prices are higher than the present, so there's an incentive to buy and store, selling in the future.

Both are self-fulfilling prophecies, which we're seeing all the more distinctly due to all the leveraged trading.

Hedge funds storing on contango until late last summer is likely a major reason US-based storage swelled (at the expense of the rest of the world) at the time. This caused illusorily high storage stats, which gave the market a false signal to sell, once the seasonal peak ended and selling began in earnest (then there was the GSCI factor).

We've been in an overcorrection every since, in my opinion, likely due to self-perpetuating backwardation.

At some point soon there will likely be a shock that reminds energy traders the margin of supply over demand is still razor thin with no hopes of expanding significantly.

We talk about it all the time to reduce our usage of oil and find alternative fuels. The problem is so much of our economy is reliant on oil production and price per barrel. We are being controlled by this liquid black stuff, my job, my quality of life, everything. There are so many other fuels to use in so many cases, so that the price of fuel is not such an important part of life.

Mark

Dialaphone | Green Flag

Some clarification from Wikipedia:

"Contango is a futures market term. It is the situation where, and the amount by which, the price of a commodity for future delivery is higher than the Spot price. Or a far future delivery price higher than a nearer future delivery. A contango is normal for a non-perishable commodity which has a cost of carry. Such costs include warehousing fees and interest forgone on money tied up, less income from leasing out the commodity if possible (eg. gold).

Backwardation, sometimes incorrectly referred to as "backwardization," is the situation where futures contracts closer to expiration trade at higher prices than those that are far from expiration."

According to INO.com we are now in contango - the further out the delivery, the higher the price, all the way into 2009 and then it levels out and declines a little bit.

As I recall, a while back, when first moving up through $40, $50, and $60 crude oil was in backwardation because far month prices were lower, partly because everyone thought spot prices were way too high. As spot prices kept going up you'd make money each time the higher-priced near-month was sold and the lower-price contract for the next month was purchased.

I'm not sure what the normal condition is for crude oil - I remember reading that it was in backwardation for a few years before switching to contango last spring.

Hmm... I suspect it is possible to be in short-term contango and long-term backwardation and vice versa.

My recollection is that "contango" is the situation that predominated until the pullback late last year.

In other news, another mortgage lender (Origen) has been shut down. My count is up to 9!

Post a Comment