Rationalizing Bubbles, Shaping a Legacy

Wednesday, September 28, 2005

Two speeches in two days. One on mortgage banking, the other on economic flexibility. It looks like Alan Greenspan has shifted into full-time legacy-shaping, arse-covering mode.

Four more months of this, and then it's over.

Largely responsible for the mess that will be left behind upon his departure in January (we call it a mess, but then of course we have to - others think of it as a two-decade long party that never has to stop), Mr. Greenspan seems to be calming nerves, defending his policies, and sounding warnings - all with increasing frequency in recent months.

The speeches of the last two days are fine examples of efforts to allay the fears of a rattled citizenry, demonstrate how he is still on top of things, and to let everyone know what they need to do in order to assure their continued economic well-being after he departs.

Monday is for Mortgages

In Monday's speech on mortgage banking, we learn that he is so on top of things that he just co-authored a new report! His first report in nearly ten years, we are told. Titled "Estimates of Home Mortgage Originations, Repayments, and Debt on One-to-Four-Family Residences", this is a largely impenetrable work that does however yield the following conclusion.Regardless of the precise mix of factors that explains the decline in interest rates, the associated run-up in housing values has left households with a substantial pool of available home equity. According to data recently developed by Jim Kennedy of the Federal Reserve Board staff, and me, discretionary extraction of home equity accounts for about four-fifths of the rise in home mortgage debt.

Instead of stopping to marvel at what he was instrumental in creating, that is, the nearly trillion dollars per year of home equity that Americans are "extracting" from their homes, he casually continues with an explanation of how the data was interpreted, how half of this money goes directly to consumer spending, and how this explains our country's abysmal savings rate. A more appropriate response to this finding would be:

Holy Sh**t! What have I done? People are using their homes like ATMs!

Further on there is a discussion of housing market froth (little bubbles, lots of them) in local markets (lots of local markets) and how there has been a marked increase in the turnover of second homes and investment property. This increase may be an indication of speculative activity, but it probably just needs to be studied.

We are then introduced to a novel concept - that housing market froth has "spilled over into mortgage markets". Well! Those homebuyers just can't seem to keep their froth to themselves - they're spilling it on the mortgage lenders! Maybe a better way of putting this would be that the Fed started a credit bubble that turned into a mortgage bubble that enabled a housing bubble that is now only sustainable through interest-only loans and other exotic mortgages.

This characterization, as excerpted from the speech, just doesn't give proper credit to the source of the credit:The apparent froth in housing markets may have spilled over into mortgage markets. The dramatic increase in the prevalence of interest-only loans, as well as the introduction of other, more-exotic forms of adjustable-rate mortgages, are developments that bear close scrutiny.

So, just to be clear. Holding real interest rates below zero for years at a time and failing to regulate the banking industry while encouraging people to use ARMs - not froth-like. Homebuyers and mortgage lenders participating in a once-in-a-lifetime housing mania, desperate to buy and finance homes at astronomical prices - frothy.

Finally, we learn that we should all sleep well at night because loan-to-value ratios are just fine. Or, at least they are fine when looking at the 90 percent LTV mark combined with the last couple years of double-digit price appreciation.In summary, it is encouraging to find that, despite the rapid growth of mortgage debt, only a small fraction of households across the country have loan-to-value ratios greater than 90 percent. Thus, the vast majority of homeowners have a sizable equity cushion with which to absorb a potential decline in house prices.

But what about the marginal buyer who bought six months ago, surely not part of the "vast majority" cited, but still important. How about if prices decline at double-digit rates for a few years? How about a 40% drop in Southern California housing prices similar to what occurred about ten years ago after a far smaller run-up in prices? How much cushioning will there be then?

Tuesday is for Flexibility

In Tuesday’s speech on economic flexibility, after reviewing the impact of Adam Smith and John Maynard Keynes, we learn how 1980s deregulation loosed what Joseph Schumpeter termed "creative destruction" on an American public which had been conditioned to expect very little from their economy or its policymakers.

Deregulation, along with information technology, financial market creativity, reliance on market forces, and competition are the areas of "flexibility" that are considered critical to continued prosperity, according to the Fed Chairman.

Hmmm ... flexibility ... financial market creativity.

At least for the last few years, that's been the key area of flexibility, we postulate. And, reliance on market forces instead of government intervention - maybe not so much. Especially when it comes to exchange rates and long term interest rates.

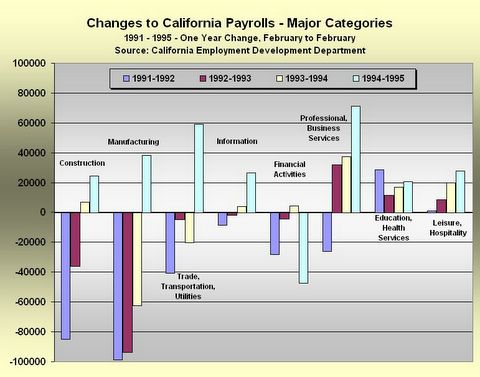

About half way through re-reading the section on financial market flexibility, we had a feeling of deja vu and began to suspect that maybe we have postulated correctly. It seems that maybe "financial market flexibility" has an older brother named "productivity improvements", where the relationship can best be described by two series of events, the first series having started about ten years ago:

And, the second series having started about five years ago:

So, the stock market is to housing market as productivity is to flexibility. An interesting theory, and perhaps a future graduate level economics final exam question.

It is as if the productivity miracle of the 1990s explained and justified the existence of the stock market bubble which everyone then sat around and watched burst. And, today, it is as if the new flexibility provided by asset-backed securities, collateral loan obligations, and credit default swaps explain and justify today's real estate prices. We don't know what the end result of the housing bubble will be, but it sure seems like there are a lot of people sitting around watching it.

Apparently it's all about the risk. And, how we have somehow, through innovation and technology (and with help from a real estate market that goes briskly in one direction - up), managed to disperse all of today's housing market credit risk to the point that it almost doesn't even exist anymore. Almost.The new instruments of risk dispersal have enabled the largest and most sophisticated banks, in their credit-granting role, to divest themselves of much credit risk by passing it to institutions with far less leverage. Insurance companies, especially those in reinsurance, pension funds, and hedge funds continue to be willing, at a price, to supply credit protection.

Yes that's right - much of the system today is based on hedge funds selling credit default swaps (i.e., loan default insurance). This is the major support of today's financial market flexibility, and about the only thing that can sustain today's home prices given rising interest rates and current incomes of home buyers. Reading the multiple qualifiers and meager results sought in the concluding parapraph of the excerpt above, it is clear that the author is under whelmed.

These increasingly complex financial instruments have contributed to the development of a far more flexible, efficient, and hence resilient financial system than the one that existed just a quarter-century ago. After the bursting of the stock market bubble in 2000, unlike previous periods following large financial shocks, no major financial institution defaulted, and the economy held up far better than many had anticipated.

If we have attained a degree of flexibility that can mitigate most significant shocks--a proposition as yet not fully tested--the performance of the economy will be improved and the job of macroeconomic policymakers will be made much simpler.

The section on "too much stability" is one of the more intriguing parts of this speech. Mr. Greenspan has been talking about this a lot as he nears retirement - good to have all plausible explanations out there ahead of time just in case the whole thing comes tumbling down next February (recall that the crash of 1987 occurred only six weeks after the Fed Chair transitioned from Volcker to Greenspan).

It is as if he laments having been too successful at his job - that by providing too much stability he has created instability.... history cautions that extended periods of low concern about credit risk have invariably been followed by reversal, with an attendant fall in the prices of risky assets. Such developments apparently reflect not only market dynamics but also the all-too-evident alternating and infectious bouts of human euphoria and distress and the instability they engender.

We can only conclude that should something go awry with the housing bubble, we will see things that we never dreamed of before - flexibility on a grand scale. Just think back to late 2000 when asset backed securities were little more than a twinkle in the eyes of Wall Street, struggling at the time to understand reversals in equity markets.

Therefore, because it is difficult to suppress growing market exuberance when the economic environment is perceived as more stable, a highly flexible system needs to be in place to rebalance an economy in which psychology and asset prices could change rapidly. Indeed, as I have pointed out in the past, policies to enhance economic flexibility need to be as integral a part of economic policy as are monetary and fiscal initiatives.

And lastly, the oft repeated "I did the right thing by not popping the stock market bubble" rationale - once again, for good measure. It doesn't really fit in with the flexibility theme of this speech, but maybe it just hadn't been stated publicly in the last week or so and there was fear of this truism fading from our collective memory. Clearly, after a year or so of questions about whether the stock market bubble had morphed into a housing bubble, the "no-popping policy" of the Fed warranted repeating. If people hear something repeated enough times, they tend to believe it, regardless of its merit.Relying on policymakers to perceive when speculative asset bubbles have developed and then to implement timely policies to address successfully these misalignments in asset prices is simply not realistic. As the Federal Open Market Committee (FOMC) transcripts of the mid-1990s duly note, we at the Fed were uncomfortable with a stock market that appeared as early as 1996 to disconnect from its moorings.

See, it just wasn't realistic to pop the stock market bubble - it's as simple as that. Better to wait for the boom to exhaust itself, then play the hero. Better to swoop in and save the day, taking no responsibility for creating any of the problems in the first place.

...

By the late 1990s, it appeared to us that very aggressive action would have been required to counteract the euphoria that developed in the wake of extraordinary gains in productivity growth spawned by technological change. In short, we would have needed to risk precipitating a significant recession, with unknown consequences. The alternative was to wait for the eventual exhaustion of the forces of boom. We concluded that the latter course was by far the safer. Whether that judgment continues to hold up through time has yet to be determined.

It is clear that "exhaustion" is and will continue to be the monetary policy prescription for the housing bubble - it is not clear, however, what can possibly be done to save the day.