Undaunted, Uninformed, Unprepared

Tuesday, October 18, 2005

Southern California real estate sales data for the month of September was released yesterday by DataQuick. Our charts have been updated with more lines that go to the right and upward. There's not really much new with this data - just more rising prices and satisfied buyers it seems.

It looks like Orange County and Ventura County may be heading for a showdown for the highest median price (they have tangled once before), while Los Angeles County and San Diego County have swapped places again this month a little further down.

Click to enlarge

Yes that's right, a median price, above and below which half the sales lie, of $600,000 for these two counties, home to almost 4 millions people.

San Bernardino continues to be the leader in year-over-year price appreciation, while San Diego has succeeded in reversing the 10 month long trend of declining year-over-year price increases. San Diego was headed for the zero line, but pulled up just in the nick of time to record a 3.8 percent annual increase, besting last month's 2.1 percent figure.

We make very few predictions here, but we did predict some time ago, that in the October data we would see the San Diego year-over-year median price crash through the zero threshold. We'll see - maybe the September uptick is an indication of a market in its "last throes".

Click to enlarge

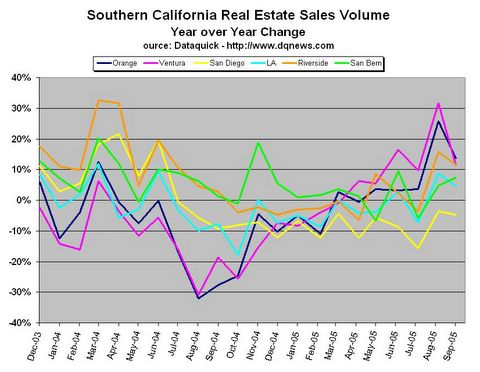

Volume has been steady and rising - all year long. With the exception of surging San Bernardino County, all areas posted significant drops in volume from a year ago, but that doesn't seem to be that unusual - there have been a few steep fall-offs in volume in the last couple years, and real estate sales just keep on rolling.

Click to enlarge

It seems that Southern Californians remain undaunted in their quest for the American dream. As indicated in the DataQuick report, "strong demand and readily available financing" seem to be just the ticket to ever increasing home ownership. It is natural, however, to wonder how strong the demand really is and how readily available the financing can be.

This account from last week puts things in a little better perspective, here in Southern California:I am a lawyer and I represent illegal aliens in deportation. In all but one of 35 cases I currently have on docket the illegal owns a home. But it is the loan terms that fascinate me. One lady finished school at second grade, speaks no English, and works for a recycling company binding cardboard boxes. She makes about $30K per year and is a single mom with three children. She has a $430K interest only loan that she used last year to buy a $430K condo - 100% financing - she paid $3,000 in closing costs. I tried to explain that her monthly payments will rise substantially in four years. She does not believe me, did not understand what I said and told me the loan and real estate agents specialize in real estate and would have told her if her payments could go up. If 34 of my clients with risky loans and no school past at best eighth grade are surprised by rising loan payments, we should be afraid. This is the last group desperate lenders pander to, meaning we're near the end.

That doesn't sound like the solid underpinnings of a healthy real estate market - not something on which you really want to base your future home appreciation estimates ... or your retirement plans. This is surely not typical, but it is telling.

It seems some Southern California homebuyers are uninformed and unprepared in addition to being undaunted.

Related to yesterday's topic of housing inflation we find this interesting tidbit from the DataQuick article:The typical monthly mortgage payment that Southland buyers committed themselves to paying was $2,098 last month, down from $2,123 for the previous month, and up from $1,809 for September a year ago. Adjusted for inflation, current payments are slightly below their peak in the spring of 1989.

That works out to be a 16 percent increase from one year ago in mortgage payments. It's not clear how it was arrived at, and whether it includes any of the wacky financing options being chosen by more and more Southern California homebuyers, but it is one more data point that is inconsistent with the Bureau of Labor Statistics owner's equivalent rent increase of 2.3 percent over this same period.

Two point three percent. Ha!

4 comments:

The PPI is up, but the 10 yr. is down.

Go figure.

Ooops, I meant the 10 year rate is down.

I guess the bubble continues.

I am an Ivy League educated banker with a 6-figure income, US citizen, single with no kids, and I can barely afford to rent a 1-bedroom in Manhattan.

This country can, and will, go to hell. And the people who send it there will be laughing all the way to the Swiss bank.

"This country can, and will, go to hell. And the people who send it there will be laughing all the way to the Swiss bank."

Except for the ones who ride the country all the way down. We won't be laughing, and we won't have our liquid assets in numbered accounts in Luxembourg or the UAE, and we won't give a flying fsck about your precious social contract between labor and capital anymore. The phrase of the day is liquidated damages, m*f*'er.

Get out now, Mr. Ivy League 6-figure-income banker. You don't want to be here when we hit bottom, and I don't want to see you.

Post a Comment