All that Neal Page wants to do is to get home for Thanksgiving. His flight has been canceled due to bad weather so he decides on other means of transport. As well as bad luck, Neal is blessed with the presence of Del Griffith, "Shower Curtain Ring Salesman" and all-around blabbermouth, who is never short of advice, conversation, bad jokes, or company. And when he decides that he is going the same direction as Neal...

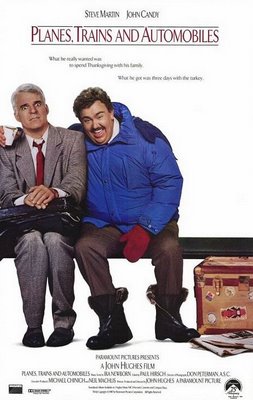

This afternoon, a brief departure from the normal fare is in order to recall the 1987 John Hughes classic Planes, Trains, and Automobiles starring Steve Martin and John Candy. Over the years, the viewing of this film on Thanksgiving eve has become a family tradition here - this summary is provided to readers courtesy of IMDb (Internet Movie Database) and various fan sites.Owen: I'm to drive you to Wichita to catch a train?

Del: Yeah, we'd appreciate it.

Owen: Train don't run out of Wichita... unlessin' you're a hog or a cattle.

[Clears his throat]

Owen: People train runs out of Stubbville.

Cue the music - doooo, doooo, doooo.

Planes, Trains and Automobiles is the story of two very different men who wind up traveling together from New York to Chicago in the day and a half before Thanksgiving. Due to bad weather and various other mishaps, it turns into a worst-case travel scenario.

Planes, Trains and Automobiles is the story of two very different men who wind up traveling together from New York to Chicago in the day and a half before Thanksgiving. Due to bad weather and various other mishaps, it turns into a worst-case travel scenario.

Neal Page is stuck in a meeting in New York, desperate to get home. He glances at his watch to see that he has less than two hours to get to the airport. He tries desperately to hail a cab, and when he finally gets one, Del Griffith steals it, accidentally. This is the first of many encounters between Neil and Del.

When Neil finally gets to the airport, he is horrified to find that his flight is cancelled due to weather. Neil recognizes Del, who is sitting across from him at the gate.

Neil finally boards the plane only to discover that he’s been bumped to coach. No sooner than he can say, “I can’t wait to see what happens next!” he finds out he’s sitting next to Del.

Neal: Eh, look, I don't want to be rude, but I'm not much of a conversationalist, and I really want to finish this article, a friend of mine wrote it, so...

Del: Don't let me stand in your way, please don't let me stand in your way. The last thing I want to be remembered as is an annoying blabbermouth... You know, nothing grinds my gears worse than some chowderhead that doesn't know when to keep his big trap shut... If you catch me running off with my mouth, just give me a poke on the chubbs...

The plane is diverted to Wichita, where Del offers to share a hotel room with Neil for the night when Neil has no luck finding one himself. Waking up after sharing the same bed (.wav file):

Neal: Del... Why did you kiss my ear?

Del: Why are you holding my hand?

Neal: Where's your other hand?

Del: Between two pillows...

Neal: Those aren't pillows!

[They both stand up and awkwardly walk around the room]

Neal: Did you see that Bears game last week?

Del: Yeah, hell of a game, hell of a game. The Bears have a great team this year - they're going go all the way.

From here, they embark on a desperate journey to get home in time for Thanksgiving. After being unable to find his rental car in the remote lot and barely surviving the three-mile hike back to the rental office, Neal has this now-famous exchange with a too-cheerful rental car agent played by Edi McClurg (.wav file):

Car Rental Agent: Welcome to Marathon, may I help you?

Neal: Yes.

Car Rental Agent: How may I help you?

Neal: You can start by wiping that f**king dumbass smile off your rosy f**cking cheeks! Then you can give me a f**king automobile: a f**king Datsun, a f**king Toyota, a f**king Mustang, a f**king Buick! Four f**king wheels and a seat!

Car Rental Agent: I really don't care for the way you're speaking to me.

Neal: And I really don't care for the way your company left me in the middle of f**king nowhere with f**king keys to a f**king car that isn't f**king there. And I really didn't care to f**king walk down a f**king highway and across a f**king runway to get back here to have you smile at my f**king face. I want a f**king car RIGHT F**KING NOW!

Car Rental Agent: May I see your rental agreement.

Neal: I threw it away.

Car Rental Agent: Oh boy.

Neal: Oh boy what?

Car Rental Agent: You're f**ked!

After Del manages to rent a car for the two of them, they find themselves driving the wrong way on a divided highway late at night. Another motorist, driving in the proper direction on the other side of the highway, tries to tell them that they are going the wrong way, toward oncoming traffic, as Neal awakens from a nap:

Neal: He says we're going the wrong way...

Del: Oh, he's drunk. How would he know where we're going?

After barely surviving the encounter with two tractor-trailers, they accidentally set their rental car ablaze. It remains drivable (barely), until they are pulled over:

State Trooper: What the hell are you driving here?

Del: We had a small fire last night, but we caught it in the nick of time.

State Trooper: Do you have any idea how fast you were going?

Del: Funny enough, I was just talking to my friend about that. Our speedometer has melted and as a result it's very hard to see with any degree of accuracy exactly how fast we were going.

With the rental car impounded, they are left with no alternative than to seek bus transportation:

Del: You're in a pretty lousy mood, huh?

Neal: To say the least.

Del: You ever travel by bus before?

[Neal shakes his head]

Del: Hmm. Your mood's probably not going to improve much.

After more tumult, they finally make it back to Chicago, both having learned a lot about themselves and each other.

Planes, Trains and Automobiles is a wonderful film - very funny, with great performances from the entire cast, especially John Candy, who may have given the best performance of his career, which was tragically cut short by his untimely death in 1994.

Highly recommended.

Read more...

Home prices fell in a third of U.S. cities last quarter as stricter lending standards caused a 14 percent drop in sales nationwide, the National Association of Realtors said Nov. 21. Declines in sales and prices signal the housing slump that began in 2006 may extend into its third year, matching the slowdown 18 years ago that ended in the 1991 recession.

No, I'm not talking about dollars - unique visitors! This must have happened yesterday sometime and while it's not much compared to some of the other guys out there, it's still a million unique visitors and almost two million page views according to

No, I'm not talking about dollars - unique visitors! This must have happened yesterday sometime and while it's not much compared to some of the other guys out there, it's still a million unique visitors and almost two million page views according to

The most important benefit of having attended the Hard Assets Conference over the last couple days is that an updated Watchlist will be available for subscribers this weekend - after listening to a bevy of company presidents, investor relations types, and other newsletter writers, I came away with a solid list of companies that will be featured in this weekend's update.

The most important benefit of having attended the Hard Assets Conference over the last couple days is that an updated Watchlist will be available for subscribers this weekend - after listening to a bevy of company presidents, investor relations types, and other newsletter writers, I came away with a solid list of companies that will be featured in this weekend's update. Speaking of octogenarians (at least

Speaking of octogenarians (at least  I was able to sit down for about an hour or so and talk with World famous Patrick Killea of

I was able to sit down for about an hour or so and talk with World famous Patrick Killea of  I've never heard of the Paul McGuire radio program before - I only listen to Christian Radio accidentally and usually not for very long. But, while scanning to find something interesting on the way home yesterday, I heard voices on the radio bashing the Federal Reserve and begging for a recession (or worse), so I stopped and listened.

I've never heard of the Paul McGuire radio program before - I only listen to Christian Radio accidentally and usually not for very long. But, while scanning to find something interesting on the way home yesterday, I heard voices on the radio bashing the Federal Reserve and begging for a recession (or worse), so I stopped and listened. The world certainly won't run out of oil any time soon. And plenty of energy experts expect sky-high prices to hasten the development of alternative fuels and improve energy efficiency. But evidence is mounting that crude-oil production may plateau before those innovations arrive on a large scale. That could set the stage for a period marked by energy shortages, high prices and bare-knuckled competition for fuel.

The world certainly won't run out of oil any time soon. And plenty of energy experts expect sky-high prices to hasten the development of alternative fuels and improve energy efficiency. But evidence is mounting that crude-oil production may plateau before those innovations arrive on a large scale. That could set the stage for a period marked by energy shortages, high prices and bare-knuckled competition for fuel.