Benign Inflation

Friday, July 15, 2005

In looking at yesterday's inflation numbers, it seems that we live in the most ideal of all worlds. Unchanged from May to June, the Consumer Price Index rose at a rate of 2.5% for the twelve months ending in June. This is what everyone has been calling benign inflation, and the expectation is for more of the same.

How can inflation be so low?

We all know that house prices are not included in the CPI. Instead, equivalent rents are used, which have not risen much due to the housing mania of recent years. It is also clear that quality adjustments and other measures lower many prices that go into the CPI.

So, that explains some of it, but with high oil and gas prices and rising medical expenses and tuition, the reported inflation rate still seems to be too low.

Can we be importing that many inexpensive goods from Asia?

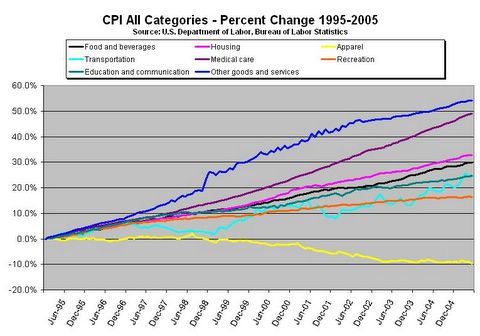

Today, we get a hint at the answer. First let's take a look at the major expenditure categories within the CPI for the last ten years:

Click to enlarge

The eight major categories have a varying number of sub-categories for goods and services related to the major category. In examining these sub-categories, we find that the relative weight of the goods and services within each major category is the primary determinant of where the major category appears on the chart above.

For example, the apparel category contains no services at all - just clothes, footwear, watches, and jewelry. These prices have declined significantly in the last ten years, and much of the reason for this decline can be attributed to Asian manufacturers and U.S. retailers such as WalMart.

At the other end of the goods/services spectrum are medical care and other goods and services. There are virtually no goods in those categories and these prices are up significantly.

What about the categories in between?

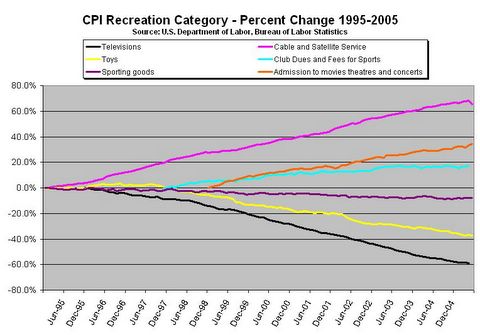

Let's take a look at selected sub-categories for recreation:

Click to enlarge

As a whole, the recreation category has increased about 18% in the last ten years, however, individual sub-categories vary widely. From the chart above, the same pattern regarding goods and services is clear - cable service costs go up and television prices go down, admission to movies goes up and prices for toys at Christmas go down.

It is as if there are two parallel and very unequal price structures within the index - one for cheap Asian imports, and another for services rendered by U.S. citizens. When the two are combined, and other categories are added in, benign inflation results.

Isn't this grossly misleading when formulating monetary policy?

To say that inflation is benign, giving a green light for a stimulative monetary policy, when there are two extreme sets of prices, which just happen to add up to 2 percent?

It would be interesting to see what the two inflation rates would be if the inexpensive imports were extracted from all major categories to calculate one number, then services were extracted to calculate another number ...

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

Wow. never looked at it like that.

Nice.

It's not just "cheap stuff from Asia". Things of the same categories (consumer products), or goods & services on behalf of those products produced in the US (and more generally the Western world) have met a similar fate of "substandard" price leverage. Layoffs and the hollowing out of well-paid goods-producing jobs embellished with good benefits is as much a consequence as a cause for it.

This is a great blog...one of the more informative.

There are lies, damn lies and statistics. The CPI is a statistic. As such, it is "derived" in the government's favor. Do you need a statistic to tell you that everything is much more expensive? This is just another way for the government to steal your money.

Post a Comment