The Yuan, the CPI, and the Fed

Monday, July 25, 2005

After China took the first baby-steps toward a floating currency last week, it is natural to wonder what effect the continuation of this process may have on consumer prices and monetary policy here in America.

After all, one of the Federal Reserve's duties is to conduct the nation's monetary policy in pursuit of:

- Maximum employment

- Stable prices

- Moderate long term interest rates

The two percent move last week should affect consumer prices negligibly, however, as we look further down the road to what many feel will eventually be an adjustment in the 20% to 40% range or beyond, there could be a significant impact on life as we know it - could this turn out to be a case of "be careful what you wish for"?

[Note: In chapter II of the recent Bank of International Settlemenst 75th Annual Report, referenced in a recent Stephen Roach article, the point is made that changes to import prices do not make their way through to consumer prices like they once used to - perhaps this has as much to do with how consumer prices are calculated today as it does with other factors sited in the report. If this truly is the case, it seems odd that Treasury Secretrary John Snow would have spent so much time pounding the table for Asian currency reforms.]

Consumer Prices

It is no secret that U.S. consumers have grown accustomed to inexpensive Asian imports. In fact, whole categories and subcategories of the Consumer Price Index are dominated by falling prices for Asian goods. These falling prices are primarily due to the continuing transition of manufacturing production from higher cost producers around the world to low cost producers in Asia, while at the same time the Asian currencies are either explicitly or implicitly pegged to the dollar.

The result? Low prices and big trade deficits.

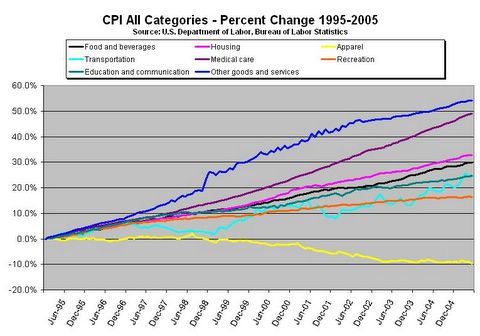

The effect on prices can be seen in dramatic fashion (excuse the pun) in the apparel category of this chart of CPI price changes over the last ten years:

Click to enlarge

The yellow line above represents a full 10 percent decline in this major category of consumer prices. One walk through any department store will make clear the state of the U.S. apparel industry - just look at the labels on clothing for sale. In stores like Wal-Mart and Target, China is the predominant supplier, and in higher end department stores you'll see a variety of labels from all over the world, but very few, if any, will be found that say, "Made in the U.S.A".

It is amazing how inexpensive clothes made in China can be.

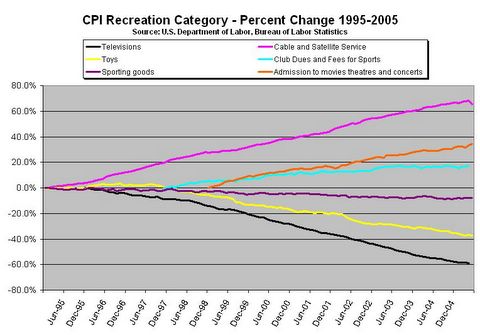

Low and falling prices can be found in other areas as becomes clear when selected sub-categories of the CPI recreation category are broken out. When was the last time that you heard of televisions or toys being made in America?

Click to enlarge

As a result of changing currency valuations in Asia, the price of imported goods, in U.S. dollar terms, will rise over time - how much depends on how freely the currencies are allowed to float. But, the important point is that instead of falling prices, which have helped to offset rising prices in areas such as energy and health care, rising prices for imports will soon be adding to the calculated inflation index.

This is not too different from the social security surplus making the federal budget deficit appear less than it would otherwise be - at some point the artificial adjustment begins to work in the opposite direction, and the misrepresentation of previous years becomes clear ... very clear.

Monetary Policy

So, what does this mean for monetary policy?

Many economists seem to be fond of the phrase "non-inflationary growth", which is repeatedly used to describe the unique ability of the American economy to maintain excellent growth in recent years, with inflation that is historically low.

As long as inflation is low, the thinking goes, there is no reason for money to be anything other than "easy".

The fact that a large part of the inflation index is based on cheap imports and currency pegs is never disclosed when "non-inflationary growth" is touted. Similarly, the fact that there is such a disparity in price trends for U.S. based services and imported goods, as evidenced in the charts above, is also not disclosed.

It is as if this is just how the world works - they sweat, we shop! The money we save by purchasing cheap imported goods is used to pay for expensive services provided here in America, and in the end, inflation is benign.

Did anyone ever really think that this was sustainable?

Low inflation, in and of itself, is not dangerous. That is how globalization works - absent trade restrictions, the business goes to the low cost supplier, wherever they may be. The trade imbalances between nations that build up are supposed to be brought back into balance through relative changes in currency valuations, and over time, the cost of goods from low cost suppliers gradually rises as their currency strengthens.

With the rise of imports from Asia, China in particular, huge trade imbalances have been built up which have not been allowed to be brought back into balance because of the currency peg. Many have argued that what would otherwise show up in inflation statistics now shows up in the trade deficit instead - a trade deficit that just keeps getting larger.

So, back to the monetary policy question ... how wise is it to base monetary policy on inflation data that is so heavily influenced by something that is not sustainable?

Has the Federal Reserve been fooling themselves in thinking that easy money to stimulate the economy was justified by low inflation?

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

1 comments:

http://www.latimes.com/classified/realestate/news/la-re-blogs24jul24,0,5278830.story?coll%3dla-class-realestate-news

Post a Comment