The Housing Bubble Poster Boy

Tuesday, August 23, 2005

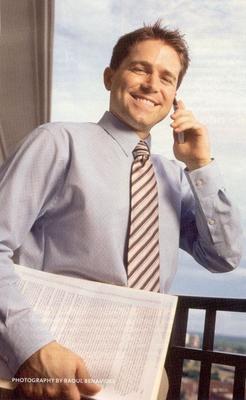

Meet Chris Cowen.

In another era, he would probably be doing something entirely different at this point in his life. But, having found himself in the middle of the biggest credit and debt orgy ever created by man, he is seizing the opportunity with which he has been presented, and he is buying condos. Lots of them.

He's racked up some hefty gains so far. Why not?

At the spry young age of 32 years, Chris Cowen graces page 57 of the September issue of Money Magazine, the lead character in this story about how so many people have gone Cuckoo for Condos! Here he is working on another real estate deal, managing a portfolio of investment properties, which has been growing in value at an astonishing rate. Cell phone at the ready, legal documents in hand, and with a big smile, Chris has done well for himself - his friends and family must be proud.

Cell phone at the ready, legal documents in hand, and with a big smile, Chris has done well for himself - his friends and family must be proud.

At a relatively young age, he has achieved what most others can only dream about. He has taken on risks that his more conservative contemporaries would refuse to take on, and it seems to be paying off handsomely.

Having quit a well-paying job, cashing-out his 401k in the process, Chris somehow managed to assemble $246,000 in investment capital that has been deployed in the purchase of "28 condos (solo or with partners) in various stages of completion", with an estimated equity of $868,000 and market value of $6.2 million.

So, pre-construction or under-construction condos, no carrying costs - just read the purchase agreements carefully, then ante-up with the down payment, and watch the prices rise.

What could go wrong?

We don't know how this is all going to work out for Chris, and we wish him well. But we don't blame him.

Chris is a capitalist in a segment of a free-market economy that is experiencing a boom. A big boom. During booms, people get excited and bid prices up beyond what would seem reasonable in retrospect - this is what excited people do. There are risks and there are potential gains.

There is nothing new here except for one thing - the availability of money and credit.

Without the inordinate amount of money and credit available to Chris and people like him, none of the excesses we see in the housing market today would be possible. We saw the same sorts of excesses some time ago during the internet boom, and, like today, these excesses would not have been possible without easy access to money and credit.

We don't blame Chris or other people caught up in the housing bubble. We just look back and think that, at least after the stock market bubble burst five years ago, there was something good left behind when everyone came to their senses. Then, once all the pieces were picked up, the excess capacity left behind resulted in a high-quality communications infrastructure and inexpensive broadband connections for everyone.

If things turn sour for Chris over the next few years, and real estate goes bust like stocks did, what kind of excess capacity will we be left with this time?

Towering, vacant high rise condominiums next to the half completed construction?

[We don't know what to make of this new, somewhat cautionary tone that Money Magazine has adopted toward real estate in their September issue. As chronicled many times on this blog - here, here, and here for example - they have been one of the biggest real estate cheerleaders in the mainstream financial media for some time. Maybe, when the only two people they can get on record to defend the real estate boom are David Lareah and Gary Eldred, with books to peddle and masters to please, they figure they should tone it down a bit.]

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

4 comments:

Greenspan is trying to reign in the drunken party that Fannie May is causing...

http://wallstreetexaminer.com/?imagepopup=28/20050821-TFannieX.jpg&width=959&height=678&imagetext=Fannie+Mae+is+out+of+control.

or

http://tinyurl.com/7fysn

Repeat the following statement ten times before buying any condo:

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

"The value of Real Estate is in the land."

I wonder where Chris got the $246K to start with - he's 32 years old, can't have worked more than ten years at his job - how do you get $246K in a 401k in ten years? Company stock? And now he's more than tripled it? What a country.

Minneapolis/St. Paul homeownership rate close to 80%. How much longer can it go with so few buyers left?

Post a Comment