California Jobs

Tuesday, September 20, 2005

Last week, the California Employment Development Department released the August jobs data, which showed an unchanged unemployment rate of 5.2 percent and a total of 17,200 new jobs for the month. Press reports noted that job growth was steady and in some areas the unemployment rate had dipped below 5 percent.

Some press reports also included a cautionary paragraph or two about the potentially problematic relationship between a peaking real estate market and job creation in recent years - job creation that has been heavily dependent on home construction and the "wealth effect" of rising home prices. In a weekend article, the Los Angeles Times noted the following:Analysts, however, are concerned that the state is vulnerable to another potential economic storm: an expected slowdown in the state's sizzling housing market.

We often wonder what kind of jobs are being created in this state to support the kind of real estate prices that are being fetched. It is clear that low interest rates and "innovative" financing are a large factor in today's astronomical home prices, but just what kind of jobs are being created to provide the future stream of income that will enable homeowners to continue making mortgage payments in the years to come?

Much of the state's recent job growth has stemmed from the real estate boom, in such fields as construction, mortgage lending, insurance and home sales. Strong consumer spending has been fueled by the so-called wealth effect of higher home prices, as homeowners have tapped refinancings and home equity loans to pay for new luxury automobiles and Caribbean cruises.

Last month, these sectors accounted for all of the net new jobs (i.e., gains and losses in other sectors offset each other - these sectors accounted for 17,600 new jobs while the total number of new jobs was 17,200, on a seasonally adjusted basis):

Last month, as well as for the last few years, the dominant category within each of these sectors has been:

Which roughly translates to the creation of a whole lot of jobs for:

But we already knew that ...

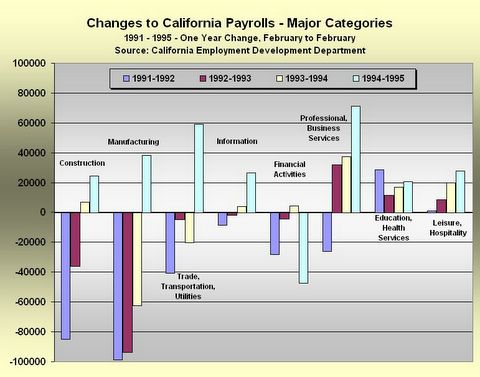

Today we take a look at job creation by sector for the state of California for the four years following the end of the last two recessions - that would be from February 1991 to February 2005 and from August 2001 to August 2005. All charts are year-over-year changes, so seasonal adjustments are not a factor.

Click to enlarge

Click to enlarge

First, note that these are private non-farm payrolls only - no government or farm employment is included and it excludes the tiny, and mostly inconsequential sectors of Natural Resources and Mining, and Other Services.

The scale is the same for both charts to make absolute comparisons easy. There was greater job loss in the early nineties, and greater job gain in the last two years - cumulatively, for the two periods, there was a total net loss of 119,000 jobs from 1991 to 1995 and a total net gain of 211,000 from 2001 to 2005. While the magnitudes are different, the timing is similar for the losses and gains in the two charts - both show two years of net job loss, bottoming out roughly two years after the last quarter with negative GDP growth, followed by two years of net job gains.

The question we seek to answer is, "Compared to a decade ago, how has recent job growth positioned the California economy for the future?" We all know what happened to job growth between 1995 and 2000 - it is well off of these charts. What can we expect for the second half of the current decade?

A crucial difference between the two periods is that in the early nineties, the California real estate market had just peaked. This explains the loss of Construction jobs during this period. However, in the 2001-2005 period, Construction is the leading source of job growth after technology had peaked. Manufacturing job growth is abysmal for both periods, but at least in the early nineties, there was some improvement which then led to a brief resurgence in the late nineties.

In the 2001-2005 chart, the impact of the wealth effect can be clearly seen in the Trade, Transportation, and Utilities sector as well as in Leisure and Hospitality. Remember these two sectors are for the most part Retail Trade and Food Service - shopping and dining. It is clear from this chart how job growth in these sectors followed growth in Financial Activities and Construction a few years prior.

The Professional and Business Services jobs were largely employment agency jobs (temporary jobs) in 2001-2005, so there is not a lot to get excited about there. In stark contrast however, the period of 1991-1995 showed excellent growth in both Professional and Business Services jobs as well as in Information. This set the stage for tremendous growth in these areas in the latter half of the nineties. This is what most consider to be high-quality service jobs - the kind of jobs that these days are being outsourced to India.

When looking at job creation in 1991-1995 versus 2001-2005, it is hard not to notice how much healthier the job growth was a decade ago. The nascent technology boom is evident in the 1991-1995 chart and both housing and finance were bit players in job creation. When looking at the 2001-2005, it appears almost like a desperate attempt to keep things from really falling apart - first Financial Activities, then Construction, then wealth effect-enabled consumer spending.

The light blue bars on the 1991-1995 chart look promising, the light blue bars on the 2001-2005 chart do not.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

Half-related comment: I learnt yesterday that the "Silicon Valley Manufacturing Group" (SVMG), a consortium of SV companies, has recently changed its name to "Silicon Valley Leadership Group" (SVLG). Not sure whether to call it hilarious, but ominous it is.

Charts are very interesting, especially the Finance-Construction-Spending sequence. I wonder how much of consumer spending is home-equity related. Probably about impossible to determine.

I wonder where the job creation is gonna come from for 2006-2007.

I assume aerospace falls under manufacturing or, less likely, information. While aerospace still exists in California, with some leaning toward homeland security, it is not large and continues to shrink as these jobs don't really pay well enough to compete in California and employers continue to move out.

Real estate (finance) and trade (China) have been the big winners. At least we don't have to worry about the latter.

GRL,

I believe most of the engineering and management jobs in aerospace would be in the Professional and Business Services sector in these categories:

Professional, Scientific & Technical Services

Computer Systems Design & Related Services

Management, Scientific & Tech Consulting Services

Scientific Research & Development Services

Other Professional, Scientific & Technical Services

This is what I always think of as the "good" service jobs. Unfortunately, many of these are already in Asia or headed there. The manufacturing jobs within an aerospace company would be part of manufacturing I believe.

I was curious, so I just looked at the data again.

In California, from 1995 to 1999, the number of Professional and Business Services jobs created per year were 87,000, 104,000, 153,000, and 73,000, respectively.

Post a Comment