Money Magazine Does a One-Eighty

Friday, September 30, 2005

Times sure have changed.

It was less than four months ago, in a post titled Money Magazine Does Real Estate, that we were ridiculing the nation's leading personal finance magazine for adding to the housing mania by encouraging even more speculative behavior in real estate with their June special edition on housing.

In this memorable issue, where six of the seven articles dealing with real estate were unabashedly bullish, we were introduced to a number of wonderful people, who were all making a killing in real estate, most notably the San Diego Rothschilds who graced the cover and were featured in the story Boomtown USA.

What a difference four months makes.

In the October issue, we note five items related to real estate. Four of them are negative and one of them is, well ... it's kind of hard to characterize in just a few words. You'll see in a few minutes.

So, what gives?

Has the staff at Money grown a conscience, or is it that they just can't find anybody to say anything good about real estate these days?

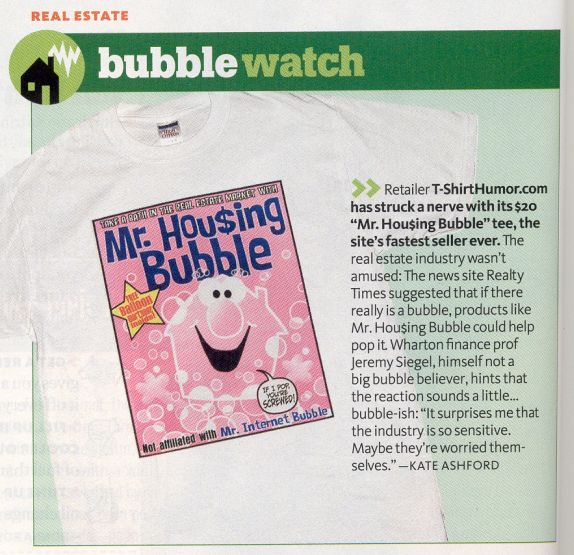

The first item, under the banner Real Estate: Bubble Watch concerns an over-reaction by news site Realty Times to a harmless little T-shirt. Note that four months ago, what few references there were to the bubble-like nature of real estate markets were more geared to denying that a bubble existed.

Imagine that! A little pink T-shirt with a smiling face helping to pop the real estate bubble.At greatest risk, says David Lereah, chief economist with the National Association of Realtors, are markets where a majority of buyers are opting for nontraditional loans.

That all sounds rather dour. We've been conditioned to expect nothing other than full-throated cheerleading from Mr. Leareah - that's how we've come to know and loathe him over the last year. What's gotten into him? He should be saying things like "slowing pace of price increases" and citing low mortgage default rates as evidence of a fundamentally sound market.

"There will be cases where lenders and borrowers will be caught with their financial pants down," he says.

Finally, the explosion in innovative mortgages could sting the housing market in one other way. As banks have heavily marketed these loans, critics say, they may have stretched themselves too thin by lending money to consumers who wouldn't have qualified a few years ago. If those borrowers default, banks may pull back, leaving the marginally qualified buyers -- the ones who have kept the market bubbling along -- frozen out.

Lenders counter that new credit scoring models have eliminated most of the risk of defaults. But Lereah notes that lenders have been testing their new scoring systems in an unusual time of low rates and economic growth.

"In a rising rate market, they're going to discover that some people are riskier than they'd thought," he predicts.

Now, this next one is really funny ...

In the third real estate piece, Big Cities, Bright Prospects, we get the issue's only neutral-to-positive assessment of today's real estate market. We're not sure how hard it was to track someone down who would say something that wasn't negative, in fact Chris Mayer is a little concerned about South Florida and Southern California, but he refutes the bubble characterization elsewhere:Are home values in America's biggest cities out of whack with the rest of the country?

So, what’s so funny about this?

Chris Mayer, a finance and economics professor who heads the Milstein Center for Real Estate at Columbia University's business school, tackled that question by looking at price changes in 129 cities since 1940.

He spoke with MONEY's Cybele Weisser about his study, "Superstar Cities," which concludes that despite the recent boom, prices in most big U.S. cities have remained in line with long-term trends.

Q. What are superstar cities?

A. They are cities with persistently low new-housing supply and high price growth -- an average of one or two percentage points a year more than other cities over decades. In a given year, that sounds small. But over a 60-year period, that extra growth causes prices in superstar cities to increase three times as much as those in the rest of the country.

Q. So why do their prices grow so fast?

A. To be a superstar city, you need two things: limited ability for new construction and big demand. Boston, L.A., New York, Seattle and San Francisco are all good examples. San Francisco is the extreme example of a superstar city: Since 1940, housing prices have increased 2.1 percent more each year than they have in other cities. As a result, you see increasingly rich people moving in and relatively poor people moving out. These cities are simply attractive places for high-income people to live.

Q. Does that make real estate in these cities immune from a price drop?

A. Not at all. If interest rates go way up, we will see some temporary declines. But there is no evidence that Boston, New York and San Francisco are in a bubble. These cities have appreciated at higher rates than other places for 60 years and will continue to do so.

Q. What cities are running ahead of historical growth rates right now?

A. I think things have gotten out of hand in South Florida. Southern California also looks a little overheated.

These are comforting words, refuting the existence of a bubble in what many believe are the bubble-like housing markets in Boston, New York, and San Francisco, while just urging caution for Southern California. The part that Money Magazine didn't mention about Chris' study was that it only included data up to the year 2000!

It's right there in the article - "since 1940" and "over a 60-year period".

You can go see the study(pdf) at UPenn - all the data stops at the year 2000.

His conclusions about the non-existence of bubbles are based on the omission of the five wildest years of real estate price appreciation the world has ever seen!

Is that the smell of crazed desperation wafting through the air vents at Money Magazine or is someone punking me?

In A Tale of Two Yields we learn that REITS might be starting to reek:Now take S&P 500 stocks, expected to grow 6 percent annually during the next five years. If by 2010 they trade at their historical P/E ratio of 22, price appreciation plus dividends will create a total return of 47 percent.

Mind you, this is not a prediction. No law says that stocks or REITs have to return to their average valuation in the near (or not so near) future. But it does strongly suggest which market sector is on the right side of the law of probabilities. And it's not REITs.

And finally, in the cover story Fear Factor (premium content), in the list of "Your Six Biggest Money Worries and How To Solve Them", coming in behind dying young, a crashing stock market, a collapsing economy, and an outsourced job, is ... the bursting of the housing bubble. The only thing that you have less to fear, according to Money Magazine, is having your identity stolen.FEAR No. 5

Ask your financial advisor to consider the retirement planning impact of a 30% decline in home prices? Unti this month, that would have been a very un-Money Magazine like thought.

The Housing Bubble Pops

REAL DANGER You're in over your head

If the bursting of the tech bubble is seared into your memory, you'll tend to call up that readily available interpretive scheme as you analyze the surge in housing prices. Result: You see a giant ball of air. That would be an eminently sensible conclusion--if houses were stocks. Of course, they're not; they're bought and sold in particular local markets and infrequently traded and, well, you live in them.

On the other hand, if you're using interest-only financing to snap up condos in Fresno because you "know from experience" that this market only rises, good luck. Markets can suffer precipitous declines--ask anyone who bought in Massachusetts in the late 1980s. Even Alan Greenspan, a man utterly free of alarmist bias, recently warned that "the housing boom will inevitably simmer down" and that prices could fall.

The real bubble, though, isn't in housing but in housing finance, says strategist Ed Yardeni of Oak Associates. Variable-rate, interest-only mortgages have seduced people into buying more house than they need. (See "Crazy Loans: Is This How the Boom Ends?" on page 53.) Most at risk? Those who bought in late and are stretching themselves even to make their IO payments. "These people could be in some serious trouble," says Yardeni, if interest rates rise or home values fall even on a modest scale.

WHAT TO DO

» Downsize. If you've used an interest-only loan to buy a McMansion when you can really only afford a three-bedroom split-level, get real. You're not building any equity, and if prices decline and you have to sell, you'll end up owing the bank. Also, if you're at a point in life when a smaller house is starting to look good, move now and secure your gains.

» Think about what can go wrong. If you're counting on home equity to provide for your retirement, ask a financial adviser to assess what will happen to your plans if your home's value drops by 10%, 20% or 30%, says Joe Davis, a research analyst at Vanguard.

» Look at locking in. The gap between variable and fixed-rate loans has been narrowing as the Fed pushes up short-term interest rates. So grab a fixed rate of interest now. Waiting could add hundreds of dollars to your monthly payment.

As if this all isn't enough to have developed a completely different perspective about Money Magazine (and, with the exception of the Chris Mayer study, it certainly is), there is this little bonus in FEAR #3 - A Collapsing Economy. There we are advised to:Put a sliver of your holdings--5% tops--in gold. The yellow stuff tends to soar when the economy goes to hell. Use low-cost exchange-traded funds (ETFs) to buy in. Then hope your investment goes nowhere.

Well we'd go a little higher than 5%, actually maybe a lot higher, but nonetheless, Money Magazine recommends buying gold. We can't wait to see what appears in next month's issue.

Is someone punking me?

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

8 comments:

wow

- chris and his five year old housing study is the best they could come up with

Deb,

I don't recall anything like this in '89-'90 as far as the media goes - I remember the L.A. Times kept saying in 1989 that California real estate has NEVER gone down.

I think as far as the marginal buyer goes - the ones buying real estate today - there is probably little difference in awareness, between then and now, despite all the media coverage. Think Jerry Springer, and realize that many people are buying homes today simply because they can.

They don't read Money Magazine or blogs, they learn what they learn about the world through friends and family, and everyone's got a cousin or a friend of a friend who has made tons of money in real estate in the last couple years.

People reading blogs like this one are overestimating, by a very wide margin, the awareness/intelligence of today's homebuyers.

Tim:

I was here in '89 and I remember that LA Times comment that said real estate can never go down. That was your sell signal.

5 years later ('94), the LA Times said real estate would never go up again, that the CA RE market was all washed up. That's when you should have bought. Had you done so, you would not be here writing this blog, except maybe as a second hobby between golf games.

Tim, you might want to take a look at Stephen Roach's daily economic commentary today (Friday, Sept. 30). He has some very interesting things to say about Greenspan.

grl,

We bought in 1995, but we didn't know anything about signals at the time - like most people we were just lucky.

One of the reasons I write this blog is because I don't play nearly as much golf as I used to - all the house-rich Southern Californians around here have bid up greens fees to levels that I have great difficulty stomaching.

Who the hell came up with the silly idea that if

people think there is a bubble it isn't one?

Wives tail?

If 20% don't think it's a bubble can they sill drive prices to unsustainable levels? Or maybe it takes 51%?

Let's look at the obvious, the people buying houses for whatever reason and bidding the prices up clearly don't believe there is a housing bubble, no?

Unless they are high, sadistic and stupid. Of course they don't.

It isn't a futures market and selling is a BIG decision for a homeowner but if prices are way overvalued and the home owners knew it wouldn't they just sell for a profit? People that wouldn't have sold otherwise, people that didn't buy for speculation. Yeah that would provide the resistance! and the market balance!

So that would serve to confirm this know-bubble-no-bubble theory? except ....

1. If the homeowner had already tapped all the equity out of their home a couple of years ago. Who wants to sell, go to a rental, and loose the tax benefits if you've spent the profits already? when you can hope interest rates stay low? How long are you willing to hang on? When I'm just underwater? When prices start to drop? or ... most likely when everyone else is trying to sell.

2. The wash of liquidity and ultra low interest rates will continue?

3. Wages will suddenly rise and catch up to house prices?

4. America will open it's boarders and let hoards of immigrants in to take up the rental slack and push rentals up to a level where rental property gives a decent yield?

5. Germany and Japan won't recover and there the world will continue to pour money into US debt. Taking it from 70% of the worlds deficits to 100%?

6. China's businesses overcapacity and shrinking profit margins will suddenly disappear cause zillions of tons of commodities are suddenly found on a lost ship? and the spike in commodities won't translate into inflation?

7. Consumer spending won't slow, as it's is in the UK, Australia, South Africa... cause everyone will inherit a large sum of cash from their great aunt they didn't know they had?

8. Wages will stop stagnating and jump by 100% cause your CEO is in a good mood?

Thank you for this... my husband and I have been looking for a house in Los Angeles for the past 9 months, and we've noticed a change- right now things are staying listed longer, getting reduced... I hope waiting will pay off...

What no one has been willing to state so far is how foolish all the participants in the housing bubble were. We need to find a bad guy. Perhaps it's Tony Montana.

All the real data points to a severe decline in values on a scale never witnessed before. Values are already crashing right in front of our eyes. Appraisals for financing based on comps are substantially lower on a year to year basis. This is happening on a National scale.

Post a Comment