Home Ownership Costs and Core Inflation

Monday, October 17, 2005

There has been much discussion in recent days about the disparity between "headline" inflation and "core" inflation. Last Friday, headline inflation, which includes all items in the consumer price index, measured 4.7 percent over the last year, while core inflation, which excludes food and energy, came in at 2.0 percent over the same period.

Many have rightfully bemoaned the attention that economists, central bankers, and the financial media have given to core inflation. They say, excluding food and energy from the inflation discussion is disingenuous to the many millions of Americans putting gas in their tanks and heating their homes at ever higher expense.

This is sensible criticism to be sure - most people would have difficulty disputing the misleading nature of core inflation to the average consumer. However, there is an even more glaring problem with core inflation - the extent to which inflation reporting for owner-occupied housing distorts the end result.

Removing Home Ownership Costs from the CPI

It is common knowledge that the homeownership component of the CPI consists of owner's equivalent rent instead of the real cost of homeownership. As described in this New York Times article, this was done back in 1983, for what some would say were dubious reasons:Until 1983, the bureau measured housing inflation by looking at what it cost to buy and own homes, considering factors like house prices, mortgage interest costs and property taxes. But given the shifts in interest rates and housing prices, those measures could show big bounces from month to month. Besides, homes are a strange hybrid of a consumable good and a long-term investment. As part of a long-running evaluation, the bureau wanted to "separate out the investment component from the consumption component" of the housing market, said Patrick C. Jackman, an economist at the bureau.

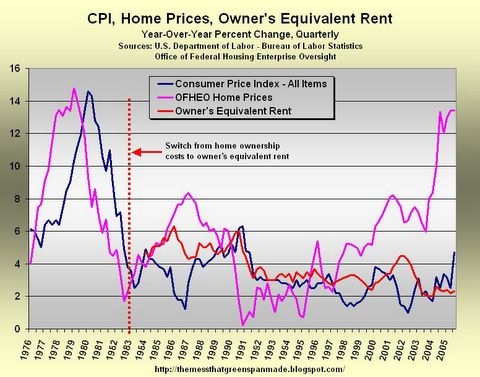

Not coincidentally, taking home prices out of inflation reporting seems to have had a very calming effect on reported inflation, as can be seen in the chart below. The effect has been particularly calming in the last seven years.

Click to enlarge

Note the relationship between CPI and home prices before and after 1983. It is clear that there is an entirely different relationship between the two before and after this time.

From 1976 (when OFHEO data first became available) to 1983, there was a clear relationship between the two - a one or two year lag between changes to home prices and changes to inflation, according to this chart.

Since 1983, home prices and inflation have mostly gone their separate ways. At times there has been a distinct inverse relationship between the two, as can clearly be seen during the housing boom and bust of the late 1980s. During this time, initially home prices rose as inflation fell. Then, when that housing boom went bust in 1990-1991, inflation ticked up noticeably.

This is significant and, no doubt, driven by the same dynamic that has been evident in recent years - as home prices rise, homeownership rises and demand for rental housing wanes, therefore depressing rental prices and ultimately putting downward pressure on the CPI. When housing cools, this process works in reverse - higher demand for rental housing, and upward pressure on the CPI.

This is an ominous sign for today's economy where housing now appears to be cooling - if home prices stagnate or decline, the impact on rental costs, and hence reported inflation, could be quite significant (it is natural to wonder whether, in this scenario, those calculating inflation statistics would deem it prudent to put real homeownership costs back into the CPI, replacing rising owner's equivalent rent).

Back to the Core

So, a natural question to ask, given all the discussion of inflation over the weekend, is "What if homeownership costs were to once again be included in the inflation calculation?" Home prices have clearly become "disconnected from their moorings" of rental prices, to borrow a phrase from Fed Chairman Alan Greenspan - maybe it's time to include them again.

In light of the discussion of "headline" inflation vs. "core" inflation, it is natural to ask, "What would core inflation be today if home prices were included?" Core inflation excludes food and energy, but it does include housing.

Your answer:

Yes, that's right - almost triple the 2 percent core rate of inflation that has been hammered into the nation's collective consciousness over the last ten years, and particularly over the last few years.

Using publicly available government data, here is how that number was calculated:

According to the BLS (warning, PDF), owners' equivalent rent of primary residence makes up 23.1 percent of the All Items index. Since food and energy make up 22.2 percent of the total (14.3% food, 4.0% housing fuel, 3.9% motor fuel), then as a percent of "core" inflation, owner's equivalent rent is:

Also per BLS data, core inflation for the last twelve months has been 2.0 percent while owner's equivalent rent was 2.3 percent. Before we can calculate a new core inflation rate using homeownership costs, we first solve for the core inflation rate exclusive of owner's equivalent rent:

(29.7% equivalent rent component * 2.3 percent) =

2.0 percent core inflation

x = 1.87 percent

Now, using the 13.43 percent increase in home prices from Q2-2004 to Q2-2005 as reported by the OFHEO, and as quoted by Fed Governor Susan Bies just the other day, substitute for owner's equivalent rent and calculate core inflation anew:

(29.7% equivalent rent component * 13.43 percent) =

5.3 percent core inflation

It seems that including homeownership costs instead of owner's equivalent rent in the calculation for core inflation gives it an entirely different feel.

Notes:

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

21 comments:

Awesome work Tim.

Thanks for doing the heavy lifting.

Now, brace yourself for character assassination . . .

Great post.

Now, what does that do to the long bond? To the fed funds?

One last point: Property taxes have risen dramatically over the past few years, as states and towns are making up increased costs and lowered Federal disbursements.

Interesting line of inquiry, GLR. When you look at it, low fed funds rates had such a stimulative impact on home prices, and if they were honest enough to include home prices in core inflation, it would mean higher home prices leading to MUCH higher fed funds... another great example of no free lunch.

Barry,

As I mentioned in one of the notes, the calculation used before 1983 was more complicated than just using the change in home price, and included mortgage rates and property taxes.

Since 30-year mortgage rates have been flat over the last year, I was trying to keep things simple, by showing how owner occupied housing makes up 30 percent of core inflation, but using 13 percent instead of 2.3 percent produces a radically different result.

GRL,

I think the long bond question is really a game theory question (see Friday's post) - who's got a vested interest in popping the housing bubble? Even if reported inflation was 10 percent, would bond holders "demand" a positive real return, knowing what the consequences would be for the housing market?

Awesome post Tim, I was wondering what inflation would be calculated correctly and comparable to the 70's. I am shocked we havent seen anyone else calculate this in the general media.

fantastic post, I was hoping for awhile that someone would do this

Tim, good point. The Asian central banks want to keep their countries selling their goods in the U.S., so they'll do whatever it takes to keep U.S. interest rates artificially low.

Another thing that might be worth looking at in terms of CPI calculations is healthcare. People are paying ever more for health insurance, prescriptions, deductibles, etc. I would be surprised if the deviation between "core inflation" and real inflation is not even greater for healthcare than for housing.

BTW, on CNBC today, they were talking about the Bush tax commission's proposal to cap the mortgages eligible for the interest deduction at 350K.

This, of course is just part of the tax reform game. The repos come in and eliminate deductions in exchange for lowering rates, then the demos come in and raise rates back up, without restoring the deductions.

It doesn't take a weatherman to tell you which way the wind is blowing . . .

YES! healthcare i was reading was also underepresented in the CPI. I think I read healthcare was actually 15% of people's expenses, not what the allocation the CPI gives. so the numbers are even higher! we might have had negative interest rates of 3-5%.

The problem with inflation measurements seem to come from the rapid rise in some components while others have stayed flat. Yes, oil is way up. Home prices are way up. But prices for cars, apartments, computers, wages, and the crickets I buy for my kid's pet frog have been pretty stable.

Is that a distinction worth drawing, or should we just ignore it altogether?

I disagree with the notion that rents will rise as demand increases. The massive inventory of unoccupied properties, those that have spent their entire existence changing hands in this pyramid scheme, will certainly end up being

1. Foreclosed by banks, and then

2. Sold en masse to RE management firms at fire sale prices. These firms will then

3. Convert them into rental buildings.

ignorant investor,

I don't think you'll ever get an inflation index that pleases everyone - it just bugs me when we say, "Look how bad inflation was back then 1980, and it's so low now", when, in the case of housing, we have dramatically changed the way inflation is calculated.

l'emmerdeur,

You have a good point - in the long run, there will be a housing glut and rental supply will outstrip demand. But in the short run (if this next time is anything like the early 1990s in Southern California), the banks will be overwhelmed with foreclosed properties and they will sit there for a year or more, become vandalized, and then fixed up and sold. During the short run, you may see rental prices spike because of lots of new renters, and lots of foreclosed property that the banks haven't gotten around to dealing with.

Tim:

Yeah, I agree with that. Adjusting for changes in the way stats are calculated when comparing different time periods is always tricky and a matter of contention. In the end you need someone who is a fair and impartial analyst without an axe to grind or product to sell. There don't seem to be a lot of those types of analysts on Wall Street or in the financial press. Maybe government departments are taking the same direction now, which seems like a great shame to me.

I am no economist and my memory is a bit hazy, but wasn't the elimination of the mortgage deduction being considered "back in the day" along with the elimination of the deduction of consumer credit interest?

From where I am sitting, economic conditions have been created to deliberately lead to the eventual elimination of that particular deduction. When that happens, to my way of thinking, there will be disincentive to incur "homeownership." When you combine the loss of that deduction along with higher property taxes, how will the "over-extended" American consumer fare at that point?

Just really curious,

Truewater2

Tim,

Great work. Always loved your blog. I see things a bit differently. There has been a huge bandwagon of bloggers taking stabs at the mainstream media regarding their stance on the core rate. I'm taking a position that the core rate is equally as important as the headline AND your new inflation indicator. All three components should be viewed equally as they tell an important story. Energy prices are almost collapsing from their highs a few weeks ago. This will have a noticable effect on the headline. What the core tells us is that what inflation is there, hasn't crept into other elements of the economy. So, if energy price fall, then the headline should fall as well, leaving the core to inch up at a normal moderate pace. From there, I wonder what the effects of Greenspan's cleaning up his mess of overly-loose money supply is going to have on your "inflation rate" for home ownership going forward now that interest rates are rising? Perhaps your analysis can answer that question going forward looking at the historical perspectives.

David,

I intend to come back to this subject again soon. On your question:

"I wonder what the effects of Greenspan's cleaning up his mess of overly-loose money supply is going to have on your "inflation rate" for home ownership going forward now that interest rates are rising?"

I think I'll be able to answer that after the next piece on this subject which will include historical home prices, mortgage rates, and property taxes to calculate real housing costs over time. I've already seen 30-year mortgage rates plotted on the above chart (easy to do and very interesting to look at), but creating a sort of "home debt service" inflation component based on the other factors is a bit more difficult.

A great piece! Anyone interested in this should also take a peek at http://www.alliancecapital.com/DomesticPortal/StoryPage.aspx?nid=5341&cid=25051.

One additional point made there is that in 1997 the BLS abandoned its effort to reindex the owners equivalent rent using real homeowner data... note that in your chart that is precisely when OFHEO home prices rocket out of the range of the other two variables.

john,

The Alliance Capitol article is interesting - there's also lot of historical info at the Fed websites.

I didn't know about the reindexing issue in 1997 - interesting as well.

Your fanciful story confuses inflation with prices.

No where in your fanciful story telling do you mention production of hard goods. Prices reflect clearing of what is available and wanted for sale with how much cash and credit exists in the hands of buyers.

CPI gives anyone a meaningless measure. There is no such thing as a Monolithic Price, one number, that captures all price data -- only what bogus economists tell you.

Inflation happens when those in power (central bank) increase internal trade through these: increased number of opened contracts, increased rate of cash payment transaction settlement.

The rate of inflation is the rate of accretion of new cash (notes and coins) into circulation plus accretion of new consumer credit (30 day balances).

If you want to delude yourself using a fake analytical framework -- CPI -- you can tell any story that you want to tell, simply by changing what want included into the CPI.

We can’t really say that we are completely out of the woods yet. But then also you all did a nice job. Keep it up!

========================

napster

Homes in Albany, GA at www.BestInAlbany.com: is the site to begin your search for real estate, buying or selling a home or property.

Homes for sale and homes for rent in Albany, GA

Post a Comment