More Gold Stories

Tuesday, December 06, 2005

The mainstream financial media is cranking out the gold stories at an astonishing pace these days. It seems there is some sort of urgency to recognize the rising price and publish a few keen observations, perhaps some wry commentary, before the "barbarous relic" either falls quickly back down into the $400 range, or possibly takes off in the other direction.

Some economists are even writing about gold now. As a group, they are generally mum about number 79 in the Periodic Table of Elements, due to its irrelevance in their line of work. That may change, of course, but right now, only a few of them are talking about it - grudgingly.

For some economists, there is perhaps an inner compulsion to acknowledge gold's rising price - a compulsion that now co-exists uncomfortably with the more instinctive response, that of wondering what all the fuss is about. Most economists say the same thing when they talk about gold - it's as if there has been a set of talking points, in circulation since the days of John Maynard Keynes, a sort of trained response.

We'll get to the economists in a couple minutes.

Gold Stories from Asia

The most interesting gold stories lately are not coming from the West, but rather from the East - Middle and Far. From a couple months ago, this Morgan Stanley commentary suggests that Asian central banks should be buying gold:Gold is not really a good inflation hedge, but a decent hedge against the business cycle. We argue gold is a good hedge, or, more precisely a ‘neutraliser’, against currency risk.

This story from the English version of the People's Daily foretells the gold buying binge of Asian central banks:

This favours central banks holding more gold in their reserves to dilute their exposure to foreign currencies. First, the USD could falter and thus erode the USD value of the Asian central banks’ foreign reserve holdings. Second, the Asian currencies could appreciate leading to a valuation loss on official reserves. Gold holdings could partly ‘neutralise’ or dilute the first risk but can do little about the latter, especially if the country in question has low gold holdings. For the same reasons, petrodollar holders should also consider buying gold.Russia, Argentina and South Africa have decided this month to increase their gold reserves, which reversed the selling trend in six years by world central banks, especially European ones.

Now, there are many who would dispute the 63.8 percent number for the gold reserves in the U.S. central bank. Think about it a minute - the whole reason the gold window was closed in 1971 was that the French, among others, were rapidly depleting the U.S. supply of gold bars to settle international trades during Johnson's guns and butter years.

It is only a question of time for Asian central banks to follow and buy in gold: they hold 2.6 trillion US dollars in foreign exchange reserves, and able to change more of them into gold as a hedge against US dollar falls.

...

Asian countries have good reasons to hold more gold. Compared with developed countries, their percentages of gold in foreign exchange reserves are apparently small. As the World Gold Council pointed out, Asian investors are the world largest gold consumers, but gold only takes 1.1 percent in China's official reserves, or 1.3 and 3.6 percent in Japan and India respectively. A sharp contrast is the American percentage of 63.8 percent, and over 50 percent in Germany, France and Italy respectively.

If indeed it is still there, Mark Cuban asks an excellent question - why not sell it?

It has clearly outlived its usefulness and the U.S. government has many debts to square. In his final congressional testimony last month, Rep. Ron Paul asked Fed Chairman Alan Greenspan the same question, to which The Maestro replied, "We might need it in a time of crisis."

Hmmm...

Gold Stories from the Mainstream Media

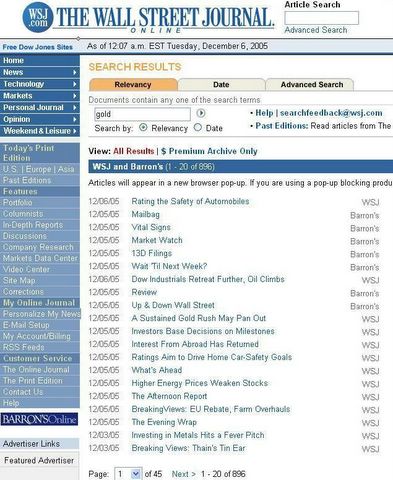

What does the mainstream financial media think? Well, this screen shot of a Wall Street Journal / Barron's online article search for "gold" provides an idea:

Click to enlarge

Not all of these are about element 79, as there are gold and silver auto safety awards to dole out and those Goldman Sachs bonuses have been in the news, but gold does seem to be getting lots of attention. And, look what was in the mailbag from a Mr. Paul Yusem of Illinois:In the Nov. 21 Up & Down Wall Street column, "Plethora of Bulls1," Alan Abelson asks, "What's got into gold?" He offered several factors for the rise in gold prices, including huge trade and fiscal deficits, the fragility of paper money, economic woes and inflation.

Mr. Yusem seems to be well informed - either that or he's crazy. Or, maybe crazy like a fox. A well informed crazy fox is our bet.

A possible trigger for the recent gold rally might be the announcement by the Federal Reserve that it will discontinue publication of data on M3 and repurchase agreements. M3 has been published by the Fed since at least 1960 and is a pretty good predictor of inflation over the long term. Repurchase agreements show the Fed adding or draining liquidity from the financial system. The sudden announcement that these figures will no longer be published probably contributed to the gold rally.

...

But the overriding factors are supply and demand. Since demand exceeds mine supply plus scrap, gold prices have been rising. The central banks have been selling and leasing gold for years to contain the price rise. However, the gold market has finally entered a major inflection point.

The BBC had a nice story about gold yesterday:"The overall feel in the market at the moment is of diversification away from the US dollar and other currencies into gold and also from shares into gold," said a trader in Singapore.

Robert Samuelson heralds the return of the gold bugs and the possibility of many more in Asia, with this story appearing in the December 12th issue of Newsweek:

...

"There was a significant drive in Japan in recent weeks," said Darren Heathcote of NM Rothschild. "People are very happy to be jumping on the bandwagon and basically riding the thing up."

...

There is also speculation that Asian central banks will cut their US dollar holdings - which have been boosted by export sales - and increase gold stocks.Though new mines often require a decade to bring into production, supply could ultimately overtake demand. Or prosperity in India and China might multiply by many times the world's gold bugs. They may regard gold as a more trustworthy form of saving than any currency, even though gold investments don't pay interest or dividends. Whatever happens, the fears and anxieties that give gold its speculative appeal could intensify or dissipate. Gold is an unending mystery, because its value lies less in what it does for us (it is not like sugar, copper or oil) and more in what it symbolizes. It is almost as unfathomable as the human drama itself.

Be on the lookout for the Time Magazine cover. If this honor portends for gold what it did for the housing bubble a few months back, that will be the signal to gather up all those American Eagles, Canadian Maple Leafs, and South African Krugerrands and start calling coin shops.

And Finally, Gold Stories from Economists

So, what do economists think? Last week one of The Economist's economists suggested that even at $500, the little yellow metal is still a little old and barbarous:This being gold, the resurgence has brought forth all manner of alarming prophecies. The price is an omen of rampant inflation; bonds are doomed; the dollar is about to fall prey to the United States' reckless deficits; the euro will shortly be revealed as a worthless creation of bureaucrats.

This neatly covers all the arguments against gold as an investment - inflation is under control, the global imbalances can be managed, gold pays no interest, and most importantly, gold is irrelevant because all the world's central bankers and economists are firmly in control.

The world is an unpredictable place. But, with the possible exception of a fall in the dollar, not much of the above catalogue of doom looks likely; and none of it has much to do with gold's good run. The dull truth is much less bullish for gold. Investors have put money into a wide range of metals, and precious metals' prices, including gold's, have risen with the base. Meanwhile, gold remains fundamentally unattractive. It yields nothing and central banks are sitting on vaultfuls of the stuff that they want eventually to sell. Gold bugs hope that $500 is the threshold at which mainstream investors will start once again to take an interest in the metal. Caveat emptor.

...

Gold is still cheap compared with its peak of $850 in 1980. Today, adjusting for changes in American consumer prices, it is worth only a quarter as much. Gold bugs might see that as a chance to buy; others as a reminder of gold's enduring capacity to disappoint.

Apparently, the only thing left out here are the benevolent actions of Western central banks toward the world's mining industry in not selling all of their gold.

James Hamilton at Econbrowser concurs:Besides, other investments that appreciate with inflation also generate income for you while you're waiting for the capital gain-- real estate yields rent, corporate stocks pay dividends, inflation-indexed Treasuries give you a coupon. But gold you can only look at.

Yes, the inflation battle has been won - just don't tell that to a middle class family of four who find it necessary to borrow against their home to make ends meet. That is, if they were lucky enough to be able to purchase a home a few years back, before housing prices started rising at five to ten times the rate of "inflation".

...

Fed Chair Paul Volcker's determination to eliminate inflation proved to be a disaster for the gold bugs. And today's Fed looks to me even more committed than Volcker was to preventing even the smallest whiff of inflation.

In any case, if you did want to bet on inflation, there are better vehicles out there for doing so, such as going short 10-year bonds and long on inflation-indexed securities.

And, as for central banks raising interest rates to double digits to contain inflation, that went out with the Rubik's Cube and Paul Volcker in the 1980s. The squealing sound will be deafening if short term rates are pushed much higher than they are today. Does anyone really think that this country can handle 1980s style tough love with the amount of government, corporate, and personal debt that exists today?

In partial defense of Professor Hamilton's comment about only being able to look at gold - this is not necessarily a bad thing. It is beautiful to look at.

Over at Wikipedia, among many other things, including a beautiful picture of gold bars against a blue background, they have this to say about gold as an investment. Specifically, how inflation (reported, perceived, or otherwise) is one of the many factors influencing the price of gold:Most paper currencies which ever existed have been inflated out of existence. Even the very few which have survived a hundred years or more, have seen almost all of their value eroded by the printing of paper money, or the inflation of the money supply. Rising prices, known as inflation are a symptom of the inflation of the money supply. In times when inflation is high, or is expected to be high, because it is rising, people seek protection through holding real assets rather than fiat money, which can be printed ad infinitum. History is littered with examples of currencies which have collapsed in hyperinflation. Gold, which is a real asset, can never be printed by any government, nor is it a claim against any creditor. The demand for gold rises in inflationary times, pushing up the gold price.

Do economists read Wikipedia?

If so, it is natural to wonder what they think of the treatment of such topics as inflation, fiat money, and gold, the content not being written exclusively by economists.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

9 comments:

I would suggest that the reason nonAustrian or proCB economists don't talk much about gold is somewhere to be found in the old (perhaps too old for many blog readers) saying: Does Macy's tell Gimbel's?

the fact that gold is treated so ignorantly by the mainstream press and economists just means that it will be a really good ride to the top.

I think Leviathan tells us all we need to know. Government does not voluntarily become smaller. In a social democracy where constituents can vote themselves benefits, the currency will be abused, and badly.

I forgot to say that in a lot of real estate markets people are buying properties where the rent doesn't cover the mortgage. just a few years ago people didn't care about dividends. now they claim that that is a reason not to hold gold? people won't believe in gold until the price rises. nobody will care about dividends if the price of gold returns 15%/year for 10 years.

An article showed up on FSN discussing the value of US gold. According to the article, the US apparently has 8000 tonnes of gold, which would be worth $120 billion. That ~10 weeks worth of deficits?

Economists are too trusting and need to get out more. If they would spend some time with struggling families, or sit in a mortgage brokers office for an afternoon, or listen to some other anecdotal accounts about today's economy,they might be more willing to look beneath the surface of what are an all-too-friendly set of economic statistics.

RE: Anonymous said...

An article showed up on FSN discussing the value of US gold. According to the article, the US apparently has 8000 tonnes of gold, which would be worth $120 billion. That ~10 weeks worth of deficits?

But if we revalue gold to, say $5k/oz, it would be good for almost 2 yrs. Better yet, while we're at it, why not $50k/oz or $500k/oz? This must be the Fed's master plan!

On Remulak, we are debating pegging our curreny to the hummer. Instead of hiding our currency reserves in a vault, we would just park them in a big parking lot in the desert.

> Be on the lookout for the Time Magazine cover.

Such classic signs of a top are at least a decade out in the future, maybe even further out. A gold top would basically imply that all fiat money (US dollars, Euros, yen, etc) is suspect, in the opinion of the general public. Despite all the hoopla, the current price is not even 70% of the prior peak from 25 years back! A tripling or quadrupling of that previous peak (putting us north of $3000/oz, for example) may provide a better reason to worry about an aging bull market. We'll get there in the usual fashion: over a period of several years, in fits and starts, as is typical of bull markets. Meanwhile, I'd accumulate at any meaningful pullbacks should I have cash lying around.

Personally, I'd be relucant to sell gold merely for paper-dollar profits. I simply do not trust Government-issued paper anymore. It's only a question of time before debt repudiation by major Western governments becomes routine. Many of us should live to see that, and the consequent societal outcomes (which are unlikely to be pretty).

Post a Comment