Ventura Passes The O.C.

Thursday, January 19, 2006

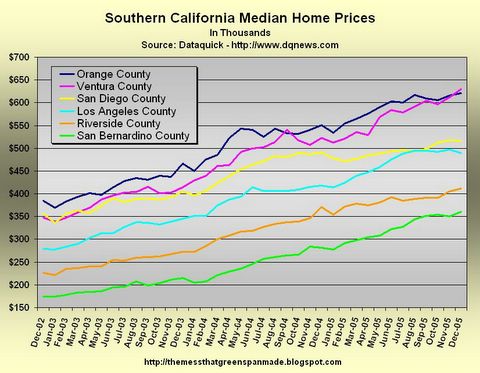

Dataquick reported on Southern California real estate sales for the month of December yesterday - more signs of a slow-down, but nothing to get too worked up about. The Southern California real estate market appears to be pretty resilient these days.

Ventura County just passed Orange County as the median price leader at a new all-time high of $630,000. Sales volume drops off by a third or more around this time of year causing more volatility in prices, so seeing monthly declines in median price for some counties during the winter is not unusual.

January and February volumes are the lightest of the year, since these purchases would have been made during the Thanksgiving and Christmas holidays, so the March sales, which get reported in April, should be the first real indication of what's in store for the Southern California real estate market in 2006.

Click to enlarge

A median price of $630,000 is quite astounding. The median price for a Ventura County home ten years ago would have been right around $200,000, whereas in the early 1990s peak it would have been closer to $300,000.

The same house and the same location, but a different time and a different real estate market.

So, what does a median price house look like within the city of Ventura, in Ventura County? There wouldn't be much too it really, but any place in Ventura is within a few miles of the Ocean, and the downtown area is really nice.

This would be typical.

Randomly picking an area near Cleveland, Ohio to see what an equivalent house might fetch there yielded this result. It looks like you'll pay a fifth to a quarter of the price for about the same digs in Streetsboro, wherever that is.

Popping directly back to Ventura on the west coast, then heading north to Santa Barbara, it seems the same house there would be closer to $1 million.

California is a nice place to live, and there has always been a fairly large differential between this area and many other parts of the country, but it has really become extreme in the last few years.

Year-over-year prices are getting a little more interesting too.

The yearly price change for Riverside appears to be lagging San Diego by about six or eight months. It was a high flier a year or so ago, up there with San Bernardino, but in the span of just a few months, it has gone from second best to second worst.

Click to enlarge

San Diego has once again managed to stay positive for another month - just under five percent annual appreciation, but again reversing course and perhaps headed back toward another test of the x-axis. The first half of 2006 should be full of intrigue as all counties except Ventura and San Bernardino seem headed for single digit year-over-year price increases, and then, who knows where they'll go.

If some or all of these lines cross the x-axis and stay below that mark for what some are guessing could be a very long time, Gillette Edmunds may have to update his latest book Retire on the House, or write a new one.

It seems Mr. Edmunds has a less than impeccable record on timing and his writing may prove to be one of the best contrary indicators in recent years.

In February 2000, he penned How to Retire Early and Live Well With Less Than a Million Dollars, in which he recommended a portfolio of multiple non-correlated asset classes, the bulk of which were equities - large, small, foreign, etc.

Equity index funds were his favorite.

Those buying the book when it was first released, and adopting his recommended course of action have not likely seen the returns that Mr. Edmunds may have had in mind when he wrote the book.

His website is full of information about his writing, but also includes this section on addictions and other maladies - it's not clear what the connection is here, but maybe it will become clear over time.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

Well, it would have hurt to retired on a California house.

But, any individuals that had spread their protfolio out on "non-correlated" asset classes, is definately not in a shabby situation.

The problem now is that, there is hardly anything out there that is "non-correlated". The hedge-funds have moved a long way the last 30 years.

Deb,

I did see something strange in the sales volume for Los Angeles county.

Normally there's a little pick up from November to December, then in January and February volume drops off dramatically - this is the seasonal pattern, which you can see clearly for ALL counties over the last couple years in this chart:

SoCal Sales Volume

For the current report, volume from November to December in L.A. County was down, which is consistent with what you say about the San Fernando Valley, and is probably significant.

Bay Area data point:

3/2, 1200 sf, 0.15 acre, Mtn View CA (5 miles from GOOG), ~$850k

3/2 1200 SF .15 acre Granite Bay CA

The best neighborhood in Sacramento area. Around the corner (1/4 mile) are 10-15,000 SF homes. Great neighborhood. 0 crime, Fantastic Public Schools.

1 hour to snow skiing. 1.5 hours to San Francisco and the beach.

Home of Beautiful Lake Folsom State Recreation Area (water ski)

$389,000.

Please contact me for all your Granite Bay Real Estate Needs...

Gillespyre@yahoo.com.

Geez, realtors are blogging for prospects now!

Post a Comment