Silver and Gold

Friday, February 03, 2006

A quick search turned up this site containing lyrics for the U2 song with the same name as today's post. From the 1990 Rattle and Hum CD/film, the following words may apply in some way to today's musing:

Maybe the sun is the metaphorical America that Benjamin Franklin pondered during the signing of the Constitution and the exit is retirement in the 21st century.No sun in the daylight

Looks like it's chained to the ground

Chained to the ground

The warden said

The exit is sold

If you want a way out

Silver and gold

And, maybe not.

Commodity Bubbles

Three times in the last week the phrase "commodity bubble" has been seen or heard in the mainstream financial news media. In all cases, the reference occurred when the discussion turned to where money might flow, if equities fail to deliver in the coming months and real estate continues to cool.

Hmmm...

What has been building for six years is going mainstream and seems to be gathering pace.

Jim Cramer should certainly help the cause when it comes to silver. His loony, Mad Money CNBC gig seems to have a pretty devoted following of after-hours traders and perhaps an equal number of rubber necking channel surfers.

His recommendation for Pan American silver on Monday caused a seven percent spike at the open on Tuesday, with more follow through yesterday.

Having missed this episode (and every other one, for that matter), it is left to the imagination what it may have looked and sounded like as he uttered, "We can't crucify our portfolios on a cross of gold".

This is a reference to William Jennings Bryan's Cross of Gold speech delivered during a bid for the Democratic nomination for President in 1896, when the nation was torn between the gold standard and bimetallism. Backing the currency with inflationary silver favored farmers in repayment of their debt, whereas Republicans preferred deflationary gold.

Ironically, 29 years later William Jennings Bryan was one of the principals in the Scopes Monkey Trial, defending the prohibition against teaching theories in conflict with the Biblical story of the Divine Creation.

It's funny how a hundred years later, Bryan is relevant again on two subjects that most would have thought long since settled.

Silver has been rising nicely in anticipation of a silver ETF that is set to launch in the coming weeks. It looks like $10 an ounce, still a historically low price, is only a matter of time.

As you'll recall the announcement and launch of two gold ETFs over a year ago had a big impact on gold prices - the response to the silver ETF may prove to be even more pronounced for two reasons.

First, historically, silver is much more volatile than gold - it's a smaller market and is subject to much wider and dramatic swings.

Secondly, a silver ETF completely solves the storage problem, which as anyone who has ever purchased physical silver already knows, is a bit problematic.

Silver at $10 with the convenience of a mouse click should attract lots of buyers.

"Remonetisation of Gold: Start Hoarding"

That's the title of a new report (PDF) from Cheuvreux, the equity brokerage for Credit Agricole, a large French bank. This report has received lots of attention in the last day or two, particularly because it has endorsed many of the findings of GATA, the Gold Anti-Trust Action Committee.

Gold had been looking pretty good lately before this report came out.

The price action is really something to behold - not just the general trend but how, after brief sell-offs, buyers appear with little delay. Since November, when Ben Bernanke was nominated to replace Alan Greenspan and the announcement was made that reporting of the M3 monetary aggregate would cease in March, gold has risen almost 25 percent.

The Cheuvreux report is notable for many reasons, most importantly the first two major findings in the executive summary, though all these findings are pretty significant:

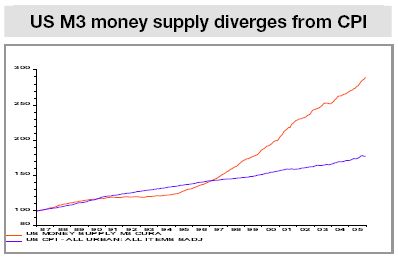

It's a long report, which has not been read carefully yet here, however, the following chart was hard to ignore, as it contains the M3 money supply plotted against the most widely used measure of inflation , the Consumer Price Index.

It's not clear what the timescale is, but that's probably not that important anyway.

Resource Investor, normally a GATA critic, has this story on the Cheuvreux findings and Mover Mike has a few comments as well, including some previous posts on activities on the Japanese commodity market (TOCOM) and the massive short positions of Goldman Sachs at the COMEX.

One thing is clear - momentum is building for commodities of all types and silver and gold seem to be getting a lot of attention lately.

Maybe too much attention actually, and perhaps from the wrong people if there is any truth to this story about Homeland Security and Safe Deposit boxes. Note the comments section where blogger Randy discussed the issue with the folks at his bank.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

11 comments:

There's more to the Chevreux story here:

http://groups.yahoo.com/group/gata/message/3638

There's a lot of speculation about the intent and

impact of the Credit Agricole/Cheuvreau report. Some

people note that Credit Agricole is a big French bank

and that France always has been more supportive of

gold than most Western countries and indeed was

the country that pulled the plug on the London gold

pool 35 years ago by insisting on converting its U.S.

dollar surplus into gold.

Is the Credit Agricole/Cheuvreau report a warning from

or even a blow struck by the French government, just

as some think that Russia has been giving warnings

and striking blows against the gold price-rigging

scheme ever since the speech by the deputy chairman

of the Bank of Russia, Oleg Mozhaiskov, to the London

Bullion Market Association meeting in Moscow in June

2004?

You picked a bad day to talk about silver and gold, they're tankin' today

PAAS down 5%

Tanking? Hardly. It's called "profit taking." For anyone who's been underwater in their gold stock picks as long as I have, only to see staggering and sustained rises in price, 5% does not a tanking market make: watch what happens tomorrow. There are loads on the sidelines, waiting to get in. Worry about "tanking" at key psychological moments, i.e. the historic high of, what was it? $850? That's a barrier to worry about from a profit consolidation standpoint, but assuming it moves past it and sustains the move, all bets are off.

P.S. This blog absolutely rocks. Consistently interesting. It's better than my morning cup of joe.

At these prices, I'd say Ron Popeil has the best advice.

"Set it, and forget it!"

Tim,

What do you say of this article:

ETF's Are Not A Real Asset!

http://www.gold-eagle.com/editorials_05/laird010606.html

You buy a gold ETF to get out of paper dollars, but the gold ETF is paper too! Your account is an electronic book entry against the ETF and is only as good as the credibility of the ETF's principals and employees. Furthermore, the laws of the host nation have to be in favor of you,(ie you have to be allowed to have gold in the first place, or there cannot be a real currency crisis, in which case, if an ETF has several hundred tons of gold I guarantee you will never see that gold yourself, but you have merely paid to have it stored so that the government in crisis can buy it from the ETF at a fixed price THEY choose, not you.)

Paper gold/silver are good because they allow lots more people to easily buy the stuff, setting a better price. James Turk, among others, complained when the first gold ETF came out that there were loopholes in the custodial agreement where gold could be shared, rather than allocated specifically for the fund.

As I recall, you can take delivery of physical gold from GLD, but the minimum amount is like 1000 ounces, so for all practical purposes, you can never claim any gold for your ETF shares.

The safest way to hold gold/silver is to store physical gold/silver outside of the U.S., but then you have to trust whoever is storing it for you to be around when you need them. The Central Fund of Canada, GoldMoney, and the Perth Mint are all pretty reputable, but again, anything can happen.

So, the only way you really know what you've got is to own the physical and store it yourself, which is kind of a pain, but in the end probably best.

Chip Hanlon recently recommended an internet outfit called Bullion Vault as a n alternative for buying gold. I haven't tried it yet as I am all stocked up at about a $420 average.

http://www.321gold.com/editorials/hanlon/hanlon012506.html

I'm tired of the "buy on any pull back." If you hit it just right, great. But, if you believe things are really undervalued, you should buy NOW, or buy as soon as you get new available funds.... Imagine the poor investor who was thinking about buying gold at $420 this summer, but was waiting for a pull back to sub-400. Still waiting... ouch.

Don't mean to knock anybody, just a different strategy to think about.

p.s. Don't listen to the analysts who say that demand from India, or jewelers, or whoever is completely gone at any a price above $550, or $575, etc. They said the same thing at $500, $450, $400, $350...

With both gold and silver 1 Oz coins now worth 10X their face value, is anyone aware of potential tax loop holes to exploit this?

On the history of GOLD as an asset class (GLD ETF):

http://www.agileinvesting.com/html/Gold%20ETF.pdf

======

1. Gold experienced a phenomenal bull market in the 1970s as the yellow metal rose from a price of $35 an ounce in 1971 to $700 an ounce in 1980, producing an annualized return of 38% over this period.

2. From 1980 through 2000, gold

produced an annual return of –4.4%. This long period of poor performance steadily eroded support for gold as a viable asset class (even though gold’s annualized return over the entire period of 1971 to the

present is a respectable 7.4%, versus 11.3% for the S&P 500 and 8.3% for intermediate-term

government bonds).

======

There are a few downsides to GLD ETF investments, however. For tax purposes, investors of this ETF are treated as though they own "collectibles," which means that any long-term gains will be taxed at a maximum 28% tax rate rather than the current 15% tax rate that applies to long-term capital gains on the sale of stocks and mutual funds.

Post a Comment