The Stage is Set

Wednesday, February 01, 2006

The Greenspan Era came to a close yesterday as the Federal Reserve raised short-term interest rates for the 14th straight time, from 4.25 percent to 4.5 percent, and said goodbye to Alan Greenspan.

In the statement accompanying the release, the word "measured" was finally removed and the wording now seems to be almost completely neutral, allowing Mr. Bernanke a free hand to formulate policy and put his stamp on the official rate setting communique when he presides over his first rate setting meeting in March.

Comparing the December statement with yesterday's, this was clearly the most "womb-like" of all baby steps that the Fed has taken in quite a while.

Absent significant developments between now and the next FOMC meeting, it is likely that Mr. Bernanke will raise rates by another quarter point to show his inflation fighting mettle, then all bets are off.

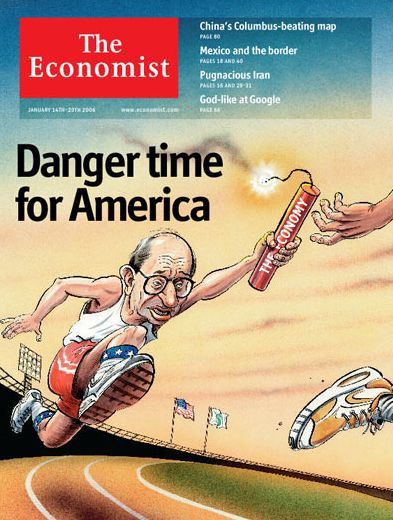

These were the photos in the Wall Street Journal write-up ($) for the policy announcement. Can you tell who's coming and who's going? Maybe the cover from The Economist a few weeks back can explain the grin and the grimace.

Knowing what The Economist thinks, what do other economists think about where monetary policy stands with the transition from one Fed Chief to another now complete? From this story($) in yesterday's Wall Street Journal, these opinions are offered:The Greenspan legacy came to an end this afternoon with a resounding yawn. … We do not believe the omission of the "measured" reference is significant. The minutes from the December meeting revealed that there was considerable discussion regarding this phrase and it was retained at that time simply in order to avoid any confusion regarding the magnitude of future rate hikes. Since rate hikes are no longer guaranteed, there was no need to describe the size of the rate hike.

They are generally an optimistic and care-free lot on this side of the pond.

-- David Greenlaw, Morgan Stanley

Greenspan will depart the Federal Reserve having completed (or very nearly so) his final task of restoring a "neutral" monetary policy. Ben Bernanke, confirmed today as his successor, will inherit a policy that will likely require little if any "fine tuning." His first task, however, will be to explain to Congress the actions his predecessor has taken in the waning months of his tenure. Undoubtedly, many will be keenly interested in his take on why the FOMC found this last move to be necessary in the wake of the slowest advance in real GDP in three years.

-- David Resler, Nomura Securities International

The risk suddenly increases that the U.S. may experience a less than graceful soft landing this year. That's because the weakest link in the economy right now is the consumer. Americans have been spending far more than they earned the last five years, borrowing an additional $3.8 trillion during this time and bringing total household debt to a record $10.7 trillion. That may be manageable when borrowing costs were low, but with rates now 3.5 percentage points higher than just a year and a half ago, the burden to service much of that debt becomes more difficult. With household finances already under considerable stress, one has to wonder if another round of rate hikes will lead to a more severe cutback in consumer spending in the months ahead.

-- Bernard Baumohl, The Economic Outlook Group

We would not read much in the elimination of the now famed word "measured." Indeed, the December FOMC minutes were quite clear that it would be a misinterpretation to believe its elimination would be a signal of potentially larger policy adjustment increments in the near future. Back then, the Fed already thought that the number of additional firming steps required would not be large. … For now, we still believe that recent changes in financial regulation and tighter supervision for mortgage lending limit the need for a further usage of the overnight rate as a policy tool.

-- Paul-Andre Pinsonnault, National Bank Financial

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

The removal of the word "measured" just means the next increase won't be by a quarter. If there is any increase, it will be by a half.

it's more like measured is a longer term telegraphic-type signal meaning that far off in the future there may be neither changes or measured changes - another quarter point hike is pretty certain for March

Could I get my next tax refund in Swiss francs? Kthxbye.

> Could I get my next tax refund in Swiss francs?

:-)

Hmmm. I wonder if I could just have mine direct-deposited to the coin shop where I'm a regular. I'd rather have my refund in yellow metal myself.

It's all a canard, as the Fed ticks up interest rates, while pouring money into the system via M3. It gives the illusion of fighting inflation, while at the same time creating it. Inflation- thy name is The Federal Reserve.

Post a Comment