The Gold / Gold Stock Tango

Wednesday, March 01, 2006

The tango that gold and gold stocks have been doing lately has become fascinating to watch. While generally following the lead of the underlying metal, gold stocks have recently appeared confused and somewhat untrusting of their dance partner. At other times they have embraced like passionate Latin lovers.

Why?

On the one hand, gold stocks are company shares that rise or fall based on the profitability of the company's primary business - digging gold out of the ground and selling it at market rates. As the gold price goes up, they become more profitable without changing a thing, similar to vertically integrated oil companies like Exxon Mobil.

On the other hand, gold shares rise and fall along with the broader stock market - drug stocks, financials, technology, and the like. The bottom lines for other companies are completely unrelated to the price of gold, however, the herding instinct is still quite strong amongst investors today - when the broader market moves in one direction, often times mining stocks follow.

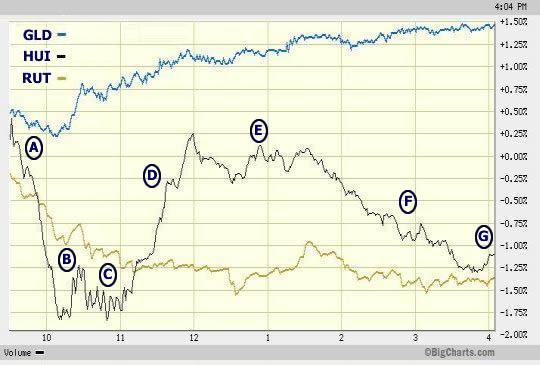

Sometimes the two hands look a little silly and the dance becomes chaotic - yesterday was a good example as shown in the chart below. GLD - StreetTacks gold exchange traded fund - tracks the spot price of gold

GLD - StreetTacks gold exchange traded fund - tracks the spot price of gold

HUI - Gold Bugs Index - contains the top fifteen unhedged gold miners

RUT - Russell 2000 Index - smallest 2000 securities in the Russell 3000

Having gotten all the mileage out of the dance metaphor as seems prudent at the moment, a brief narrative may better convey one day in the life of the HUI Gold Bugs Index.

A. Up a little bit overnight gold gets its thrice weekly New York breakfast whacking - other stocks are down - best for the HUI to get ahead of the trend and go directly south.

B. Hmmm ... maybe that was too much - small caps are showing a little life and gold has now swung $4 in the other direction - it's time to ease up a bit.

C. Uh... getting confused now.

D. Time for some independent thinking here - someone's 'gotta do something with gold headed back over $560 - let's go a little higher to get a better look at gold - pretty unbelievable how it stays up like it does after months and months - isn't it supposed to head back to the $500 range for a few months so everyone can catch their breath?

E. Uh... confused again - not sure where to go from here, but the feeling of hanging out here in the middle is a little uncomfortable.

F. Getting scared now - can't just hang out here all day - maybe head back to the other stocks for a while and wait for gold to come back down - surely it will come back down.

G. In a safe place now with the other stocks - maybe one last jog to the upside before trading closes for the day.

It sure is fun to watch. Traders must be confounded by the buoyant gold price after so many months, as many have predicted early and often of a large correction coming for the precious metal and the equities, but it just never seems to come.

As long as gold rises, it seems mining shares will rise too - it's as simple as that.

Most gold bugs would generally concur with this assessment, it's just that when the price of gold defies explanation to the upside for such a long period of time, longtime followers believe that the rug is about to be pulled out from under them.

But the rug stays put, and the tango becomes more unpredictable.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

7 comments:

While amusing, the daily fluctuations are really unimportant. It is the long term trends that are important. Gold and gold stocks will move in tandem for the foreseeable future, although, as you've alluded to, gold stocks do become influenced by the broader market from time to time.

Homestake mining is a good example of gold stock that prospered during the Great Depression.

http://www.gold-eagle.com/editorials_99/taylor051799.html

Buying stock in a company in the gold industy equals estimating future profits for the company. Buying gold bullion means estimating the future price of gold. The two are obviously linked, but not identical, so we shouldn't expect the shares to constantly move in parallel.

(sorry about the deleted post- I had a major typo and I didn't know how to edit the earlier one)

Ig,

I removed the remnants of the deleted comment. I don't think you can edit a comment once you've submitted it, but if you have a Blogger account, you can transform it into that harmless message, "This comment has been removed by the author".

Gold went to $1500 in the 1970's fuel crisis spike (in terms of 2004 dollars, or thereabouts).

You ain't seen nuthin' yet.

I think gold is rising and will rise on economic disruptions that are coming.

And if these did not happen I still think it was due for a rise after a generation of stagnation. Especially with more wealth in the hands of traditional buyers.

I think the mining stocks a bit overpriced for the current market, but medium and long term they will do ok.

Gold miners, such as those that make up the HIU, do not strictly mine gold. For example, Agnico-Eagle derives a lot of revenue from the recovery of zinc and copper, although gold is what they are primarily interested in. Each mine and, therefore, mining company's revenues vary according to the various base and precious metals prices. For gold miners, the price of gold can best be viewed as an updraft or downdraft that raises and lowers all boats. Their share prices are mainly affected by this, but there are other forces acting on them in unison.

one more line for your chart: oil/energy.

gold miners' revenue tracks gold. their expenses track energy.

Post a Comment