A Real Snoozer

Tuesday, March 21, 2006

Boy, that sure was a dull speech. It's hard to imagine what it would have been like sitting there last night actually listening to Ben Bernanke speak before the Economic Club of New York. As you read the prepared remarks, you kind of feel yourself sinking, unable to get traction and afraid to move too quickly for fear that it will swallow you in one big gulp.

A few in the mainstream financial media thought there was something newsworthy contained in there - see here, here, and here if you are so inclined. It seems all the words are best summarized as follows:

Fortunately, the speech was followed by a Q&A session which was covered in this Reuters story. There are a couple of interesting comments to be found there, first on housing prices and net worth:A slowdown in the U.S. housing market would still be entirely consistent with economic growth at or near potential, Federal Reserve Chairman Ben Bernanke said on Monday.

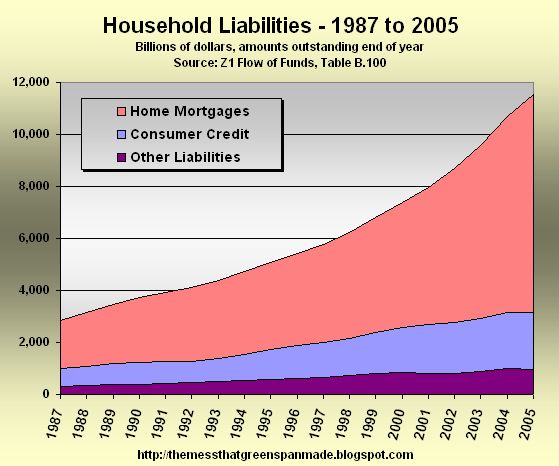

Yes, a significant increase on the other side of the balance sheet - a few charts from a while back will help to put some meat on that bone. First the chart of household debt which rises even more rapidly than before when the housing ATM shifted into high gear in 2003.

"There has not been but there may be in the future some stress in some areas, but broadly speaking I think that consumer finances are consistent with continued reasonable growth in consumption and enough to keep the economy at or close to its potential output growth rates," Bernanke said in answer to a question following a speech in New York.

"This increase in mortgage debt may not be a particularly serious problem. First, there has been on the other side of the balance sheet, significant increases in assets, so that balance sheets in general are looking stronger," he said.

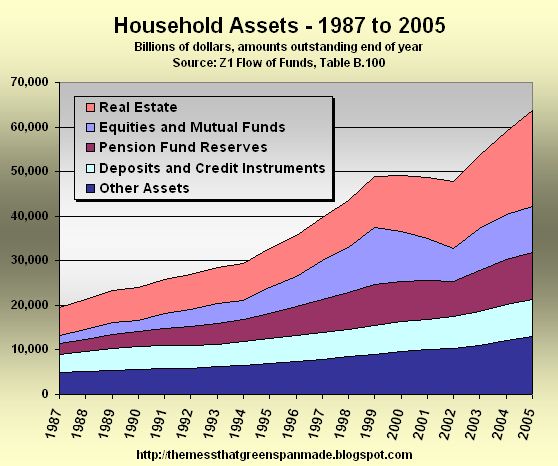

But, as the supply-siders like to point out, this puny debt of $11 trillion pales in comparison with the assets on the other side of the ledger. At last count, the total was over $60 trillion which is very impressive indeed, but as evidenced in the chart below, asset values don't always go up.

Also note that real estate, stocks, and bonds now account for 66 percent of total assets vs. 54 percent in 1987. The other asset classes, such as durable goods and bank deposits are, of course, not inflatable.

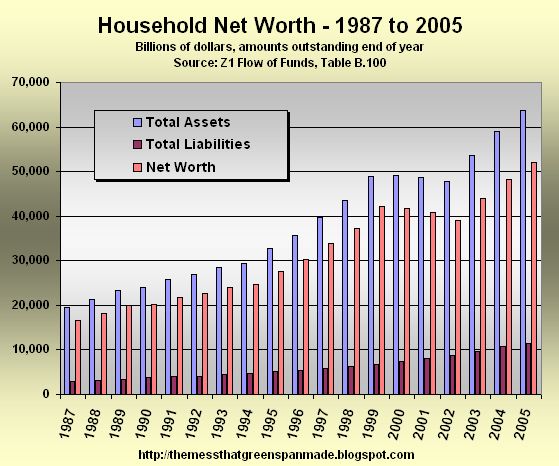

The bottom line is clear - after a brief slowdown associated with the stock market bubble meeting its pin, household net worth is again rising. A synchronized real estate, equity, and bond market decline could radically change this picture - that's probably what the Federal Reserve is trying to avoid.

All the inflatable asset classes must be kept inflated ... indefinitely.

On the subject of the current account Mr. Bernanke expressed hope that, over time, the trade deficit could be reduced to more manageable levels. He didn't mention anything about having to dramatically increase our exports while holding imports steady just to keep the trade deficit at current levels."I have expressed concern about that because while I think it is possible over a number of years to bring the current account down, it does pose certain financial risks, particularly risks in changes in interest rates and the dollar," he said.

The only problem here is that once Asia develops a robust consumer class, and they discover the wondrous effects that a little (well, actually a lot) of debt can have on assets and hence the bottom line ... they might not need us anymore.

...

"I would add that it's also particularly important for there to be greater domestic demand absorption, in the economic lingo, in the economies of east Asia. We have a lot of economies that are essentially running an export-led development strategy -- which I guess is fine except that everyone can't run an export-led development strategy," he said.

"It is necessary over time for there to be an increased reliance on domestic demand in Asia to help move toward this balance," Bernanke said.

He said while there has not yet been a great deal of progress on this front, he was moderately encouraged that there was beginning to be a cyclical recovery in Europe and Asia, which would provide more strength to the global economy.

"Another slightly positive direction I think is that China and perhaps to some extent other Asian countries, have begun to speak about increasing their own domestic demand as part of their own development process and implicitly as part of the global rebalancing process," he said.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

I'm "enjoying" Bernanke's book on Inflation Targeting. Talk about dull.

caught a few minutes of Steve Leisman of CNBC gushing over the big non-event, reading from the speech as 'lil Ben was about to go on - you'd think that Liesman sleeps with a life-size Ben Bernanke huggable pillow by the way he was talking

This is fun but completely off topic, except that I found it on a finance site.

http://www.youtube.com/watch?v=QjA5faZF1A8

I love his use of the phrase "savings glut" (that is, everywhere but in the US) to explain-away the global capital imbalances. Makes it sound like its someone else's problem entirely. I'm sure our benevolent Fed has done nothing to encourage this situation.

If you believe that, then perhaps you also believe that the dot-com bubble was based 100% on "irrational exuberance", as the Fed stood by and watched helplessly.

Hey, check out the analysis of Bernanke's speech in the March 21 "Daily Global Commentary" at Northern Trust.

Fact-Checking Bernanke's Yield Curve Comments

http://www.ntrs.com/pws/jsp/display.jsp?XML=0512/1135200780356_879.xml

The headlines in the financial press seemed to reflect at which part of the Bernanke speech the headline writer was awake during the speech. The headline in the FT was “Bernanke sees no sign of slowdown.” The writer was awake at the beginning then dozed off. The teaser on the front page of the WSJ was “Bernanke said the Fed should keep short-term rates lower than normal if a glut of world saving is keeping long-term rates low.” The writer was napping early on, and then someone nudged him at the end.

Post a Comment