Debunking the Dismal Duo

Wednesday, April 05, 2006

So, the one economist says to the other, "Honey, how do you estimate the fundamental value of a Southern California house?" While it is not known what the response was, or in fact who asked the question, Pomona College economics professors Gary and Margaret Hwang Smith later purchased a $950,000 Southern California property and labored to produce a sixty page report to convince themselves and the rest of the world that they were not the greater fools about whom housing naysayers have spoken so often in recent years.

No, the Smiths are not the greater fools, they are the greatest fools - they should have known better.

But, then again, they are economists.

After getting so far into the production of a detailed report that actually contains a good deal of very interesting data about the buy/rent calculation that prospective owners/renters should consider, they just didn't know when to stop.

Lights were flashing and alarms were sounding, but they either didn't notice or were too determined to complete an analysis that supported the real estate purchase decision that they had already made.

They just didn't know when to stop poking at their financial calculators in search of net present value, investment rate of return, and discount dividend, and instead just use a little common sense.

What they ended up with was something that Richard Peach, Vice President of the Federal Reserve Bank in New York deemed "an important paper".

An important paper indeed.

A paper that provides yet another marker for the great American housing bubble that will only be appreciated for its profundity with the passage of time. It is best captured by a single sentence:Housing prices in all of these areas can be justified by plausible, if perhaps somewhat optimistic, assumptions about the future growth of rent and prices.

Ahhh ... memories of 2000, when at the height of the tech bubble there where still those who insisted on twisting and contorting bits of data to justify that which they must know in their gut is just wrong.

Data Please

A few pencils have been sharpened, the cat has been put out, the doors have been secured, and we're ready to roll. Here are the links:

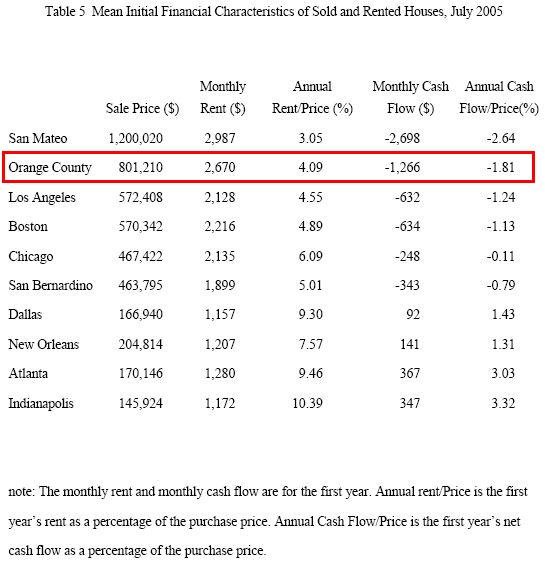

Skipping directly to Table 5 in the back of the report we find first year figures for a number of sold and rented home pairs in different parts of the country. The Smith's task was to find near-identical homes in the same neighborhood, one just sold and one rented, that could be used to calculate the investment rate of return for the home that was just sold were it to be rented at the same rate.

By calculating the rate of return, they figured they could determine if the sale price was too high, too low or just right.

The example that we'll use to test the Smith's handiwork comes from Orange County, California, the world-wide headquarters of sub-prime lending, where according to the last report from DataQuick, a median priced home fetches about $600,000.

The subject home sale from 2005 was for $801,210 and the rental equivalent brought in $2,670 per month. As indicated in the table, after all the calculations were done, the monthly cash flow starts out as minus $1,266 per month - nonetheless, the Smith's concluded that, at $801,201, the price was just about right.

We'll assume everything up to this point is hunky-dory and work from here. The idea here is that even though you're starting with a negative cash flow, things will go up over time, and as long as you come out with a six percent return on your investment, then the purchase price was right at the time of the sale.

In this case, 20 percent of the purchase price is about $160,000, and six percent of that is just under $10,000 a year. Figuring that the $1,266 per month in Table 5 works out to over $15,000 in the hole for an entire year, the first year looks to be a real loser.

But Things Change

The Smiths figured that rent and maintenance go up three percent a year (expenses start at an annual rate of one percent of the purchase price), and taxes go up two or three percent per year depending upon where you live. Most importantly however, the value of the home increases at a rate of three percent, which doesn't seem like much at first, but you'll soon see how important this seemingly innocuous three percent rise really is.

These were the only changes identified in the report - rent, maintenance, taxes, and the value of the home which is sold at the end of the ten year period.

As shown in the top portion of the table below, given the starting monthly deficit along with the changes to rent, maintenance, and taxes, after ten years, this rental is still losing almost $1,000 a month. It is only with the tiny three percent per year appreciation that this deal makes any sense - that three percent increase on a $800,000 property results in a gain of over a quarter of a million dollars.

That's how the Smiths figured the $800K was the right value - because in ten years, they figured the house would be worth over a million dollars.

Note that there are many simplifying assumptions made in the table above. The disparity of losing almost $130,000 on the rental side of the deal while gaining over $280,000 on the appreciation won't be affected in a material way by properly accounting for taxes, the time value of money, or other details.

Also note that the rental net value is calculated based on the starting monthly cash flow, then figuring the changes to that cash flow based on changes to rent, maintenance, and taxes.

The point here is that the expected appreciation of this property is the dominant factor in the calculation that results in a fair valuation - something that is not mentioned in the study itself. One has to dig into the details of the report to learn this.

It's Just Three Percent

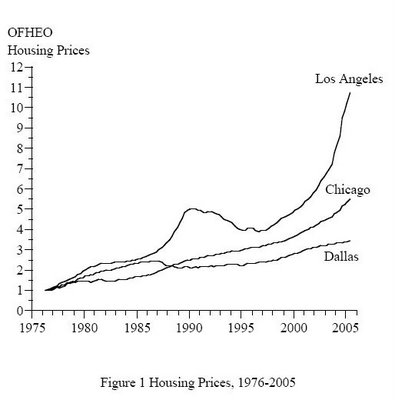

So, is three percent a reasonable annual increase to expect of Southern California real estate? It all depends on the timing. Veteran real estate investors would probably look at the chart below, which was included in the report, and think that maybe the timing isn't so good right now.

After rising at near 20 percent a year for the last five years, what would make anyone think that home prices will now rise at an average of three percent for the next decade? Without the appreciation, this investment is a big loser, and if prices reverse, as they did in the 1990s, then things could really get ugly. This is the fundamental flaw in this valuation methodology, which, by the way, overestimated the value of a Diamand Bar, California home by 24 percent when applied by a New York Times reporter in the second link above.

This is the fundamental flaw in this valuation methodology, which, by the way, overestimated the value of a Diamand Bar, California home by 24 percent when applied by a New York Times reporter in the second link above.

Like many economists, the Smiths fail to realize that we are living in a bubble economy where nearly all the things they learned in school no longer apply. They are likely teaching a whole new generation of future economists all the things that no longer apply.

Economists!

P.S. (The Smiths moonlight as certified financial planners - their website is www.smithfinancialplace.com should you wish to have them help you with your own buy/rent decision or other personal investments.)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

32 comments:

One final note - the report claims that you can remove the value of the home as a factor in making a valuation by assuming the home is never sold. Given the calculations in the table for the Orange County house, you can clearly see how the increase in rent is greater than the increase in maintenance and taxes, but it seems that the time horizon to make the net income a positivie number and then to compensate for all the previous years of losses would exceed normal lifespans.

I think these people forget there is a world outside Cali'. My house I just bought two years ago is $75,000. And its a nice home came with stove, frig, washer, dryer all new. The house was built in 72' and was a rental till 04'. Next town over there are new house of the same type for sale for $175,000. Someone getting hosed! Its not me and its not the guy I bought my house from. Buyer beware! Today's new McMansions are tomarrows gettos. Go look at what were the Oppulant homes in the early 1900's.

I would view this as "everything will turn out well in the end" and to a large extent it is true. The question is whether you have until the end for it to do so. That is why blithely ignoring timing can be so dangerous. If prices fall and the economy isn't doing so well, will you be able to rent it out for what you have, and when you have lost your job will you be able to afford that negative cash flow? Eventually is a very long time. It isn't always necessary to grab one while you still can or you won't be able to.

consistent 3% future returns after 100-200% rise? this P.O.M.O.N.A economist must be smoking or he must be rationalizing or he must be a dumb professor (pitt the P.O.M.O.N.A students!)..

A 3% rise from 1997 base yes...plug that in professor and see how your finacial life turns out..hope u.ur wife has a tenure.or else god bless..

Sort of off-topic...

Is this you?

No, that's not me.

I find it hard to believe that the NY Times gave this so much credibility (two stories) even after they found that this method was way over on the the Diamond Bar test case. A couple of the people interviewed said they questioned the asssumptions used, but that was about it. Shouldn't someone aside from Tim have spent an hour or two seeing how the numbers back up the conclusions?

This is the fundamental flaw in this valuation methodology, which, by the way, overestimated the value of a Diamand Bar, California home by 24 percent when applied by a New York Times reporter in the second link above

It is not a flaw at all. The test case demonstrated a 7.5% IRR. If the Smiths were demanding a 6% [9.0%]IRR on the test case property, they would be prepared to pay a higher [lower] price than the actual consummated price.

Long time reader, first time poster. I have always had this question in mind: Is it even reasonable to compare renting and buying options by comparing only their net present value? I mean, the risk profile of these two options is so different (the risk with buying is getting stuck with an investment losing its real or nominal value, the risk with renting is that the rents may increase faster than one's income grows in future). So why would I as an investor be willing to pay the same price for these two options? Shouldn't be there some calculation on which investment is riskier (i.e., has higher variance) given the current situation, and ask for a lower price for that option? R.E. prices and rents don't necessarily grow in tandem as we all know by now!

That's what's funny about theirr analysis. like you can have negative cash flow forever and it will all work out in the end because houses go up 3% a year based on todays bloated prices. It's all so dumb when you think about the range of possibilities when buying today. They've made the case that comps are the only way to value a house, and comps can change a lot in a short period of time.

All of this analysis seems to convolute 2 simple ideas:

1. Houses don't appreciate. Dollars depreciate against them. ie. inflation.

2. Inflation hits different areas of the economy at different times. It has shown up in asset prices lately, but it will show up in rent eventually.

So. Their analysis is 100% correct and if they hold for 30 years, they will certainly come out ahead.

But. They forgot to notice that inflation in assets has run ahead of rents lately (quite substantially). So their timing could certainly have been better.

There will be a sweet spot coming soon where inflation in rents will not have caught up, while the oversupply in housing will be pushing prices down. 3 years from now maybe?

House arrest

this is pretty irresponsible of them...

Couldn't that 3% be used to justify any assets valuation?

And I don't get these buy to rent arguments either when you buy you buy much more than you would rent. I'm renting an apartment 1200 a month but if I were to buy it's going to be a house so it's basically double in rent and triple for buying with the current house prices.

Friends of mine just bought a house in So cali despite my warnings over 3.5K a month to the bank and it's nothing special suffice to say we don't see them out anymore and they certainly won't be going on vacation for a long, long time. A house isn’t so nice when your stuck in it.

There are some very sad times coming our way. Let's just hope the prudent ones taxes aren't going to be used to bail them out it is already evident that we are going to have to pay a price for these fools.

You also make the assumption that the house is always rented. There can be times where you can't rent out the house for 6 months at a time. This whole paper is best case scenario. It rarely works out that way.

What a dope, this guy is actually using a future price assumption of the asset he's valuing to value an asset. WOW! Unbelievable how an ecconomist could violate such a basic rule of modern financial asset pricing. I went to a real college and majored in finance (minor in RE). I learned from a REAL real estate practitioner how to value an asset off of rent. What I learned about building RE valuation models is simple:

Rule One: Deal must be solvant in the first year.

Meaning that there must be not only enough cashflow to cover debt service, but also enough cash flow to cover an imputed 'rate of return' on your down payment. Why? b/c this is the most reliable form of return owning a property. That's right, the cash flow you make at todays rent, minus the full cost of debt service.

Rule 2: Break down expected returns into 4 or 5 catagories so that you can assess its impact on changes to your assumptions, and which assumption are being most relied upon to create your return:

Catagories:

1) Steady-state equity build up: also known as the year one fully-taxed free cash flow (calculated with a pre-tax cost of debt) divided by the down payment

2) Taxes benefit of debt (income tax deduction on debt)

3) Depreciation vs Capital Gains Tax Recapture benefit (optional, you can put it in catagory 2 for simplicity)

4) Rental income vs cost growth assumptions

5) Terminal year cap rate expansion/contraction assumption

Now the secret here is that these are listed in the order of decreasing reliability (e.g, from most dependable to least dependable)

If you break down his analysis into the only 3 catagories above you can apply (no tax data was disclosed in this article), you will see that a large positive return is coming from catagory 4 and a massive positive return from cat 5, while the most realiable catagory 1 (first years cash flow carried out steady-state over holding period) is hugely negative.

Other posters have already pointed this out, but I just wanted to put a little 'science' to it....

FC

When the price of an asset is at a level that is historically unprecedented (and housing is, at least based on Shiller et. al.'s 375+ year Amsterdam series) there are 2 possibilities. 1) the price is too high due to cyclical reasons in a notoriously cyclical asset class; 2) the valuation methodologies used for the past 300+ years were wrong.

Those of you that remember the Dow 36,000 book, already have had a preview of option 2. In some ways, this is similar stuff. If you ignore risk by claiming a long time horizon, then you can always generate large valuations.

So what are the risks to the assumptions used here? Let's think hard, but, not too hard.

Are all rental houses occupied 100% of the time? Is there ever any damage done to rental housing that might require cash greater than maintenance to repair? Given that we are assuming negative rental cashflow for the full 10 years above, is there any refinancing risk? Do housing prices over 10 years always increase at the rate of inflation (the 3% assumed here)? Have there been cases where individual houses (you aren't buying the entire housing stock, so aggregates don't count) have increased at a rate less than inflation? Have a material number of houses ever fallen in real value over 10 years? Is there any possibility that you may have to sell before the end of the 10 years? Are there any other costs you might have missed (um, like the cost of selling the house = realtor + moving + legal).

If we're going to assume a rational framework, shouldn't we expect to be compensated for the above risks?

By the way, if you are willing to use a similar methodology for the S&P 500 through an earnings discount model (assuming no compensation for risk and a 6% required return [not that there is ever any risk in the equity markets]) you can get a fair value around 5x today's trading level.

My suggestion is that the professors stop playing around in the real estate market, lever up like crazy and buy equity futures. How could they possibly lose money over 10 years?

Just don't ask the Japanese.

>>>> If you ignore risk by claiming a long time horizon, then you can always generate large valuations.

Excellent point. Is real estate a good long-term investment?

Of course, but if you are illiquid and overleveraged at the housing cycle peak, you won't be around for the long-term.

Wow, Great economics here. I am going to have to start reading all over.

I will say this, There is a neighborhood near where I live. It is brand new near Sacramento California. (Elk Grove). It is in the path of blight. The houses are about 3000 sf and go for over $500,000. Regardless of CCR's, there are beat up cars all over the neighborhood. Many of the houses are for sale right next to a house that is not even completed yet being sold by the subdivision. The house that I was in was 1 year old and had severe cracks in the plaster inside. Somebody posted that the McMasions are tomorrows ghettos.......Tomorrow is here in Sacramento.

You know what their cop-out will be? The recession. There wasn't a housing bubble. The recession caused the economy to slow to the point that there were less jobs and less people who could afford to pay rent so property values went down and more foreclosures occurred.

It wasn't a housing bubble that caused all the mayem. It was the recession.

Someone should keep tabs on these two economists. Do they work for a state school teaching this country's youth? Then their salaries should be public record.

When the downturn begins, someone should be very pissed off if they continue to get raises as professors. Especially, those who are paying tuition.

Don't you guys notice that the asian women is pregnant? She is pregnant and believe me, asian pregnant women NEED to OWN a house no matter how expensive it is.

So these alleged economists don't figure the inflation rate into their calculations--or how much it will cost them to sell that home and reap that appreciation? In my calculations, I've never found that 3% appreciation would ever clear an investment property short-term. Am I missing something here, or just another case of what I call the "Silicon Valley Syndrome": self-delusional entrepreneurial genius?

Did anyone notice the date on the NY Times Articles?

A older friend got totally Burned in the last real estate Bust. I asked him what had happened as he was well educated and he said " Even monkeys FALL OUT of Trees " to which I might have said " most monkeys DON'T have MBAs like You "

All I'll add is I've been renting in San Mateo since 2000 (6 years) and my rent hasn't gone up 3% per year. It actually went DOWN and I'm paying less than I did when I initially rented it. I don't think I just have a nice landlord.

This report is bogus, .... but .... most people are mis-interpreting it.

The question the report is trying to answer is: "Now that I've found a house I want to live in for the next 10 years, do I want to rent it or buy it?"

Vacancy rates (and other factors that have been mentioned) have nothing to do with the calculation, because they are going to live in it for the next 10 years.

They are just looking at what their bank balance will be in 10 years when they sell it, vs what their balance will be if they rent it for 10 years.

Their analysis shows that on the $900,000+ house, they will be ahead of the game in 10 years if they buy it. And that's a valid conclusion IF their assumptions turn out to be correct.

The problem with this report is:

They conclude that house prices have been low in most areas, and are just now becoming fair.

SO WHAT.

If house prices have been low for the last 10 years, what in the world makes them think that they won't return to those lows again. Obviously the market has valued them at those lows for much of history. Why would the market now decide to value them at this new amount?

I don't care that $900,000 is a "fair" price for my home. If no one will pay "fair" price for it when I go to sell, what good does it do me that I paid a "fair" price?

In Boston, we have a housing bubble plus an exodus of professionals to cheaper locations.

My rent's been consistently going down since 2000, not even 2002 like for everyone else in the country. Today, landlord's have little pricing power and most renters can get freebies, like extra parking for visitors, etc. from their landlords.

I predict a solid 40% plunge, starting spring of 2007, till the bottoming out whenever that is. The other point is that with all the new construction out there, even after the plunge, the new buyers on foreclosure will also be seeing weak rents with all the supply of property's bought on foreclosure being rented out.

This is not going to end well.

It is possible that this couple is simply trying to prevent their new house from losing value. They know full well that the market has been overinflated due to speculation, and that only speculation can prop it up. Their paper is "important" because it aims to influence the next stream of buyers in the neighborhood.

Big v, if the couple knows that speculation is needed to prop up their home purchase decision then why aren't they renting the place at 1/2 price, waiting for the balloon to deflate, and then buying it when the correction's over?

I think they're on some kind of Kudlow/Kramer high which is a mix of bullish anticipation and denial of the facts.

I have been in the mortgage business in Houston Texas for the past five years. From a lenders perspective, there are numerous problems with this study. First, most buyers do not put 20% down. In my practice, only one ten of my loans I perform do buyers put 20% down. Most buyers do what is called an 80/20 - this is 100% financing without mortgage insurance. 2nd lien rates are now 8.5% on 2nd liens for 80/20's, creating a "blended" interest rate cost of 6.9% for this program, with APR rates (the real cost of the loan) still higher. Their study uses 5.7% as their mortgage rate. This is unrealistic. When the 30 year mortgage rate dropped in 2003 to 6.0%, this was the lowest rate in 30 years. The current 30 year rate is about 6.375% and rising. For California borrowers over the standard fnma loan limit, probably 6.625%. In my own crude calculations, the combination of rising rates, property taxes, homeowners insurance and recent property appreciation have doubled the cost of home ownership in many markets across the nation in the span of 2 or 3 years. I can't imagine how difficult it must be to find qualified buyers in those markets when i try to imgine similar apprecition in my own neighborhood.

Bubble, What Bubble? Here is how to tell.

Take the real estate as two separate items: 1) Structure; 2) Land.

Determine a replacement price on the structure. If no home were built there, what would it cost you to build one? Account for age / deprecation and upgrade costs, i.e. if it would cost $500.00 for a new refrigerator, subtract that from the cost. The same goes for new kitchen cabinets, dishwasher, anything that would be new in a new home.

Subtract the cost of the structure form the value of the real estate. That is the cost of the land. Extrapolate that postage stamp lot size out to cost per acre. Is that number reasonable on a per acre scale? NO you say, well my friend you have a housing bubble.

Example using theoretical numbers: 80 foot x 120 foot lot. 2,000 square foot ranch home that is 20 years old. The real estate sells for $250,00.00

To rebuild a 2,000 square foot ranch house is $70,000. The cost to upgrade appliances, kitchen cabinets, carpet, windows, etc modern standard is $20,000.00.

Structure has a value of $50,000.00 That means that the lot cost $200,000.00 or $20.8333 per square foot. 1 Acre = 43,560 square feet. So you paid $907,500 per acre.

Would you pay almost a million dollars per acre for land? Nope and that is a bubble!

They also don't consider:

1) The opportunity cost of the 20% down payment

"To rebuild a 2,000 square foot ranch house is $70,000. The cost to upgrade appliances, kitchen cabinets, carpet, windows, etc modern standard is $20,000.00."

I would build on my beautiful 20 AC property TODAY if I only had to pay $35 per sq ft. A more realistic number is $75. You can do it for under $60 but that is using very poor building materials.

North Alabama. No bubble yet in Huntsville. They are building though in anticipation of BRAC people moving here.

Housing bubble arrives at its Dow 36,000 moment

Sunday, 09 April 2006

http://capuchinomics.com/news/index.php?option=content&task=view&id=232&Itemid=

Marlin's article was a generally positive review of a paper presented at the Brookings Institution by Margaret Hwang Smith entitled "Bubble, bubble, where's the housing bubble?" As one might guess from the title, Smith like Glassman and Hassett of Dow 36,000 fame, has come to the conclusion that not only is there no housing bubble, but that "in cities like Dallas, Indianapolis and Atlanta" real estate are "screaming bargains." Is anyone experiencing bubble deja vu like Capuchinomics is upon hearing this?

Post a Comment