Jobs, Commodities, and Black Holes

Friday, April 07, 2006

Another week, another multi-decade high for gold, silver, and other metals, and thousands and thousands more homeowners begin noticing rising commodity prices and either flat or falling housing prices. Where will it all lead? We'll know much more by the end of the summer - the direction is clear, the degree seems to be the only question.

The Jobs Report

The jobs report came in at 211,000 this morning. Construction and manufacturing were about a wash, while the big gains came in Retail Trade: General Merchandise with 26.3K new jobs and Leisure and Hospitality: Food Service and Drinking Places with another 33.1K.

The much-touted 52K new positions in the Professional and Business Services category breaks down like this:

Sorry, but when looked at in total, this has the distinct feel of a peaking housing market, with a home equity withdrawal enabled shopping spree that has yet to peak, along with the effects of Gulf Coast rebuilding.

Silver and Gold

The trepidation that many people feel today when looking at charts like these and considering dipping a toe into the precious metals market should be evaluated in light of the very real possibility that they'll look back at $12 silver and $600 gold in a few years and realize that today's prices were a bargain. On CNBC the other day, when asked about the long overdue correction in the gold price, Ron Insana pointed to the months of February and March and replied, "We just had a correction". The questioner got that "deer in the headlights" look.

On CNBC the other day, when asked about the long overdue correction in the gold price, Ron Insana pointed to the months of February and March and replied, "We just had a correction". The questioner got that "deer in the headlights" look. The funny thing about gold and gold stocks is that you just can't ignore them forever, unless of course you're an economist. The Wall Street Journal Online had this on their front page yesterday. Is "Go Figure" a title that is used frequently at the WSJ or does the choice of words reflect disbelief and/or denial on the part of the writer?

The funny thing about gold and gold stocks is that you just can't ignore them forever, unless of course you're an economist. The Wall Street Journal Online had this on their front page yesterday. Is "Go Figure" a title that is used frequently at the WSJ or does the choice of words reflect disbelief and/or denial on the part of the writer? There's no denying cold hard numbers like these - actually, you can have a lot of fun if you "Go Figure" with these rates of returns.

There's no denying cold hard numbers like these - actually, you can have a lot of fun if you "Go Figure" with these rates of returns. They say to be careful not to chase performance - well, maybe it's OK to chase performance a little bit.

They say to be careful not to chase performance - well, maybe it's OK to chase performance a little bit.

In a continuing sign that the mainstream financial media still doesn't know quite what to make of the whole commodities craze, this CNN/Money writer weighs in:Analysts caution, however, that investing in gold can be a risky move, one that's usually handled by traders who've built up years of experience understanding metals markets.

When CNN/Money and other mainstream financial media writers are almost unanimously bullish on commodities, then you'll know that the peak is past. That point is still years away.

...

Few investment vehicles have seen as much shakeup over the past 25 years as gold. In 1980, it touched $873 an ounce after rampant inflation engulfed the nation, but then plunged to a low of $254.80 in August 1999.

And these huge long-term swings are now being complemented by larger day-to-day shifts.

"We're seeing price swings that we haven't seen in decades. We used to see a $6 range in gold over a week, and now we see it in a single day," said Quinn. "The gold market is really going to be in play over the course of the year."

For investors, that means that they should be prepared for the possibility of major short-term losses.

"Not everybody could handle losing 40 percent in one year," said Wallace. "Most people probably don't need an investment in precious metal funds."

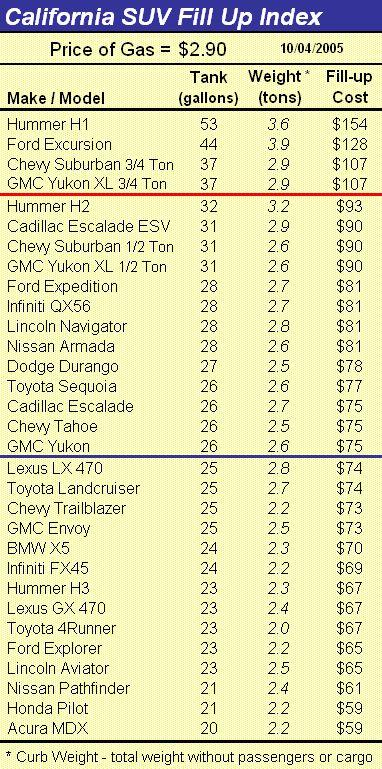

Dusting off the SUV Fill-Up Index

It's been just over six months since our SUV Fill-Up Index was last updated. From what they've been saying about filling up your tank next month, it's probably a good idea to be ready for an update - continuing a promise made to update it with every ten cent rise in the price of regular gasoline.

In fact with what they've been saying about this hurricane season, it might be a good idea to keep this chart at the ready all summer long. The new Cadillac Escalades that are seen in these parts have that distinctive "upgrade" look to them - tinted windows and expensive tires and rims to go along with the temporary plates. Buying one of these must be a lot like buying a new home these days - the manufacturer/builder is loading them up with extras to move the inventory while starry-eyed consumers continue to sign on the dotted line without thinking beyond the next three months.

The new Cadillac Escalades that are seen in these parts have that distinctive "upgrade" look to them - tinted windows and expensive tires and rims to go along with the temporary plates. Buying one of these must be a lot like buying a new home these days - the manufacturer/builder is loading them up with extras to move the inventory while starry-eyed consumers continue to sign on the dotted line without thinking beyond the next three months.

Has anyone seen the new oil ETF?

It was supposed to start trading on the AMEX under the ticker symbol USO, but there's been no sign of it. What's happening? Surely an oil ETF can kick-start oil prices a bit after an unusually warm winter has lulled much of the Northern Hemisphere into thinking that last year's energy shock was an aberation.

Those Crafty Chinese

Just like when the Chinese yuan rose abruptly prior to the arrival of Lindsey Graham and Chuck Schumer in Beijing to discuss trade relations and currency flexibility, the arrival of Chinese Vice Premier Wu Yi next week in Washington followed by Chinese President Hu Jintao's visit later in the month is being preceded by a spate of positive news regarding our Asian trading partners.

While it's nice that they're purchasing planes from Boeing and other high-tech gear, you have to wonder what percentage of the goods they buy as part of this goodwill gesture will ultimately be disassembled and evaluated by their industrious engineers and businessmen, eager to expand into new markets.

New Investment Website

Since the hints have been dropped with increasing frequency as of late, it seems prudent to satisfy a bit of reader curiosity by divulging today that your humble scribe will be launching an investment website in a few weeks or so. It has been in development for months now - it is a pay-site (with special pricing for regular readers) and it's based on commodities (there should be no surprise there).

After tallying the first quarter results for the model portfolio, the excitement is difficult to contain - even with two of the five categories flat, the overall return was just over 18 percent for the first three months of the year, with another few percent gain this week.

Surely this pace can't be maintained. Or, can it?

Subsequent announcements prior to the big launch will be contained in these Friday posts - the current plan is to offer a multi-day free pass to the subscribers section just prior to the official launch. Stay tuned.

Bloglines

It's about time someone said something about Bloglines. There are likely other services out there that do the same thing at the same cost (free), but there seems little reason to look for them. Bloglines has been the preferred RSS aggregator here for some time now, and it's hard to imagine not having it.

For those of you who have never tried something like this, you are encouraged to check it out. If you get information from many different sources that supply RSS feeds, this is a very, very convenient way to manage all that information. Here's a screen shot to give you an idea how it works.

When it finds a new item, the source turns bold and the number of items is displayed in parentheses. When you click on one of the sources, it displays all unread items in the window on the right including links to individual posts or to the main page of the source.

When you click on a different source, it assumes that you've read the ones that you just left, so it deletes them. You can save individual items or you can just tell it to re-display all items for the last 24 hours, 48 hours, or longer time periods, and it will go get them for you.

The best part about the whole thing is that you never have to go to the source to see if there's anything new. All new posts show up in your Bloglines account within an hour or two, sometimes a little bit longer, making it easy to skim a ton of material in a short amount of time.

Black Holes

In what may be part of an ongoing attempt to explain how the massive U.S. trade deficit is in fact part of a near-perfectly balanced current account with the rest of the world, comes this report about dark matter from Yahoo! via Space.com.Two supermassive black holes have been found to be spiraling toward a merger, astronomers said today.

Two super massive black holes spiraling toward each other. Hmmm...

The collision will create a single super-supermassive black hole capable of swallowing material equal to billions of stars, the researchers said.

Mergers between black holes are thought to be one way they grow. A handful of similar setups have been observed in which black holes appear inevitably on a merger course. This pair, at the center of a galaxy cluster called Abell 400, was known to be close but their fate hadn't been determined.

"The question was: Is this pair of supermassive black holes an old married couple, or just strangers passing in the night?" said Craig Sarazin of the University of Virginia. "We now know that they are coupled, but more like the mating of black widow spiders. One of the black holes invariably will eat the other."

Western consumption and Asian manufacturing. Old married couples, strangers passing in the night, or mating black widow spiders?

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

8 comments:

This articel talks about RSS readers:

http://google.blognewschannel.com/index.php/archives/2005/07/06/my-yahoo-6th-most-popular-rss-reader

This is the ranking:

* Bloglines 19.49%

* NetNewsWire 10.07%

* iTunes 9.53%

* Firefox Live Bookmarks 7.25%

* iPodder 7.17%

* My Yahoo 6.68%

* FeedDemon 4.23%

* NewsGator Online 3.83%

* Reader not identified 3.07%

* Pluck 2.07%

P.S. Looking forward to the website :)

(While it's nice that they're purchasing planes from Boeing and other high-tech gear, you have to wonder what percentage of the goods they buy as part of this goodwill gesture will ultimately be disassembled and evaluated by their industrious engineers and businessmen, eager to expand into new markets.)

never thought of that.

is this blog still going to be up and running?

Yes. The blog is the fun part, the other stuff is kind of like work.

thousands and thousands more homeowners begin noticing rising commodity prices and either flat or falling housing prices. Where will it all lead? We'll know much more by the end of the summer - the direction is clear, the degree seems to be the only question.

The 39 yr hit 5% today, and the 10 yr is not far behind at 4.96% -- not very friendly to the economy or the stock market, as Barry points out.

That should wake some homeowners up.

The Go Figure title at the WSJ is a regular thing. Today it points to job hunting.

Unrelated to this particular post, here's a link to a CNN article about a housing development that's supposed to house 500,000 people and take fully fifty years to develop (by a company that's never been involved in RE development before).

http://www.cnn.com/2006/US/04/07/new.town.ap/index.html?section=cnn_latest

Too easy?

(Yes. The blog is the fun part, the other stuff is kind of like work.)

nice.

Post a Comment