The United States Oil Fund

Monday, April 10, 2006

The new oil ETF (USO:AMEX) starts trading today. What impact will it have? Who knows. But, you can imagine the kind of excitement that might result in a few months if the tornados of spring are a harbinger of hurricanes this summer.

The loss of life and property in the Midwest has been tragic and one can only hope that the Katrina experience is not experienced again, but think what might happen with an oil ETF where, with the click of a mouse, anyone can place a bet on the price of oil as a category five monster bears down on the Gulf Coast.

It seems that the 2005 hurricane season, which saw oil prices spike to over $70 a barrel, has conditioned a world full of speculators to be at the ready come summertime, and now they have a convenient tool.

According to the filing with the Securities and Exchange Commission, the United States Oil Fund, formerly known as the New York Oil ETF, will invest in oil futures contracts on the New York Mercantile Exchange (NYMEX) with the objective to reflect the performance of the spot price of West Texas Intermediate sweet crude oil, less fund expenses.

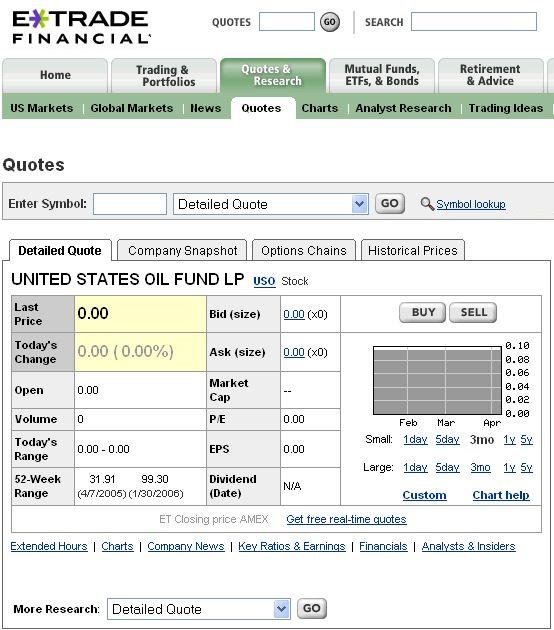

Here's what an ETF looks like before it starts trading:

It looks so docile just sitting there with little benign zeros all over the place. This ETF is different than the gold ETF and upcoming silver ETF where they purportedly take physical gold and silver off of the market. The new oil ETF buys futures contracts and never takes delivery (which makes a lot of sense, since, if you think storing silver is problematic, try storing barrels of oil at $60 apiece).

What are oil futures contracts? Again, according to the SEC filing:Oil Futures Contracts are agreements between two parties. One party agrees to buy oil from the other party at a later date at a price and quantity agreed-upon when the contract is made. Oil Futures Contracts are traded on futures exchanges, including the New York Mercantile Exchange. Oil Futures Contracts trade in units of 1,000 barrels. For example, on the New York Mercantile Exchange futures contracts are priced by floor brokers and other exchange members through an “open outcry” of offers to purchase or sell the contracts. In contrast, another exchange, ICE Future, uses an electronic, screen-based system that determines the price by matching electronically offers to purchase and sell.

It sounds like there are all sorts of contingency plans to handle big inflows of money and it should be fun to see how the public reacts to this offering. This is really the first commodity ETF product that just about everybody understands.

...

Once the daily net assets of the portfolio exceed approximately $1.2 billion, USOF anticipates that a majority of all further investments will be made in Oil Futures Contracts, other than the current Benchmark Oil Futures Contract, and in Other Oil Interests. These other Oil Futures Contracts would be purchased on New York Mercantile Exchange and on other exchanges, including non-U.S. exchanges such as the ICE Futures.

USOF anticipates that once the daily net assets of the portfolio exceed approximately $2.4 billion, the ability of the portfolio to invest in additional current Benchmark Oil Futures Contracts may be sharply limited due to certain position limit rules in effect on New York Mercantile Exchange. Assuming the current Benchmark Oil Futures Contract is at the same price level as indicated above and half of USOF’s assets were then fully invested in such contracts ($1.2 billion), the current New York Mercantile Exchange position limits for such contracts (20,000 contracts for WTI light, sweet crude oil futures contracts) would be met. Under that scenario, all additional investments above the $2.4 billion level would be required to be invested in other Oil Futures Contracts and Other Oil Interests. USOF anticipates that at or above the $2.4 billion daily net asset level, the majority of the total portfolio holdings will be in other Oil Futures Contracts or Other Oil Interests.

Under current conditions, USOF anticipates it would not use non-crude oil based Oil Futures Contracts (e.g. futures contracts for heating oil, gasoline, and/or natural gas) or non-crude oil based Other Oil Interests until it reaches the speculative position limits on WTI light, sweet crude oil futures contracts traded on the New York Mercantile Exchange.

USOF anticipates that to the extent it invests in Oil Futures Contracts other than WTI light, sweet crude oil contracts (such as futures contracts for Brent crude oil, natural gas, heating oil, and gasoline) and Other Oil Interests, it will invest in various non-exchange-traded derivative contracts to hedge the short-term price movements of such Oil Futures Contracts and Other Oil Interests against the current Benchmark Oil Futures Contract.

While popular in recent years, the existing commodity funds are based on commodity indices containing such items as pork bellies and soy beans. When most people hear these terms, they probably think of either Trading Places or Green Acres, and the thinking probably stops there.

But, oil is a different story.

A pretty simple story actually - someone has recently claimed that we are addicted to the stuff. And, it has become pretty expensive in the last year or so, despite the prediction by Steve Forbes last fall of the dire consequences when oil inevitably returns to $30 a barrel.

Now, the gold ETF has been very successful since its introduction about a year and a half ago, but most investors today know little of the history of money or banking and probably just consider it to be a novelty - kind of like an odd technology stock where no one really understands what it is, but it keeps going up in price, so people keep buying it.

But, oil is a different story - everyone understands oil. Does that mean that everybody is going to be buying oil now?

We'll see.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

8 comments:

Oil Fund Very Risky for Average Investors

http://biz.yahoo.com/ap/060409/oil_fund_risky_business.html?.v=2

great screen shot.

From Scott Patterson in the WSJ (paid sub. req’d):

Investors considering purchasing the oil ETF should tread lightly, warns Bianco Research in a Monday note. The research group points out that, according to the fund’s prospectus, the average daily change in the ETF’s net asset value for any period of 30 straight valuation days comes within 10%, plus or minus, of the average daily change in the benchmark oil futures contract over the same period. “A 10% tracking error? Try that in the equity index ETF world,” writes the research group. The divergence is already in play Monday: While oil prices were up more than a buck, the USO ETF shed nearly 1% to $67.76.

Sheesh...arbitrage will take care of any tracking errors. Read the prospectus:

http://www.amex.com/etf/EtPiPrint.jsp?Product_Symbol=USO&MonthVal=12mths&link=ext

This is an ETF product where Joe SixPack can hedge his gasoline consumption as the pump price tracks the crude price.

Tim,

Its ironic you say this is a commodity fund "anyone can understand", because this is the first one I don't really understand. I am not sure I would ever feel comfortable enough knowing where my money is going to feed any to this beast. There's also something that bothers me about how this will increase the amount of leverage in play in the financial system in general, but maybe someone can show how this instrument will only serve to increase stability overall...

On the other hand, the more complex the instrument, the more often those "proofs" turn out to be not-so-solid.

Here's a pretty specific question: why don't they use the ICE as well as the NYMEX? Presumably they could double their maneuvering space below whatever onerous limits they mention in the above excerpt. And exchanges don't have exclusivity agreements, do they?

yikes.... reminds me of a bucket shop.

They trade against you, while hedging themselves with futures contracts. Limited by position limits and swaps with heating oil.

all things paper scares the hell out of me these days.

it's good for trading i guess, but i want OFF THIS MERRY GO ROUND!

The "everyone understands oil" comment was in reference to the commodity itself, rather than the trading vehicle.

As for the mechanics of the ETF, I have no particular qualms with this one - they will buy futures at the NYMEX until they reach a limit, and then they will buy other energy futures on other exchanges.

The transparency is much better than that of existing index-based commodity funds from Pimco (PCRCX) and Oppenheimer (QRAAX). With these, about all you know is that they use "derivative products" to track the index.

Bucket Shop - An institution where one could buy and sell stock, though it was not a legitimate brokerage firm. When a customer placed an order it was written on a slip of paper and tossed into a bucket rather than being immediately transmitted to the floor of a stock exchange, whence comes the name "bucket shop." These bucket shops were typically small store front operations that catered to the small investor prior to the stock market crash of 1929. The bucket shop would at a later time match up buys and sells to increase its own profit. The customer had little way to know the actual price at any exact moment. The bucket shop could match a buy at $10 with a sell at $9 and pocket the $1 difference. As long as the bucket shop reported prices within the day's high low range, the customer had no way of detecting the fraud. The bucket shop could shift its recommendations to correct any imbalance in the buy-sell orders in its own bucket. Today's instant price quotes and executions have eliminated the original scheme, but the term has come to be applied to any fradulent brokerage type operation such as boiler rooms.

Post a Comment