The Big Mac Index Turns Twenty

Sunday, May 28, 2006

Finally, an article from The Economist that's not behind the subscription wall. Their Big Mac Index turned twenty this week and to no one's surprise, in its latest revision, the country with the most undervalued currency relative to greenback is none other than ...

China. Big surprise.

Here's a little tidbit for you. According to Wikipedia, the "Greenback Party" was a post-Civil War American political party that was in favor of printing even more of the little green slips of paper that were used as money during the Civil War, but had no backing of any sort. They believed that this would help the economy by causing prices to rise and making debts easier to pay.

If you look at the history of inflation in the U.S., you find that there is basically zero inflation up until the formation of the Federal Reserve in 1913, one of the very few exceptions being when the Northerners fired up the printing presses to pay for the Civil War. Temporarily set free from the moorings of a commodity backing, the currency lost value relative to goods that it was used to purchase.

It looks like every political party is a Greenback Party today.

Anyway, the Big Mac Index ...WHEN our economics editor invented the Big Mac index in 1986 as a light-hearted introduction to exchange-rate theory, little did she think that 20 years later she would still be munching her way, a little less sylph-like, around the world. As burgernomics enters its third decade, the Big Mac index is widely used and abused around the globe. It is time to take stock of what burgers do and do not tell you about exchange rates.

The Economist's Big Mac index is based on one of the oldest concepts in international economics: the theory of purchasing-power parity (PPP), which argues that in the long run, exchange rates should move towards levels that would equalise the prices of an identical basket of goods and services in any two countries. Our “basket” is a McDonald's Big Mac, produced in around 120 countries. The Big Mac PPP is the exchange rate that would leave burgers costing the same in America as elsewhere. Thus a Big Mac in China costs 10.5 yuan, against an average price in four American cities of $3.10 (see the first column of the table). To make the two prices equal would require an exchange rate of 3.39 yuan to the dollar, compared with a market rate of 8.03. In other words, the yuan is 58% “undervalued” against the dollar. To put it another way, converted into dollars at market rates the Chinese burger is the cheapest in the table.

The index was never intended to be a precise predictor of currency movements, simply a take-away guide to whether currencies are at their “correct” long-run level. Curiously, however, burgernomics has an impressive record in predicting exchange rates: currencies that show up as overvalued often tend to weaken in later years. But you must always remember the Big Mac's limitations. Burgers cannot sensibly be traded across borders and prices are distorted by differences in taxes and the cost of non-tradable inputs, such as rents.

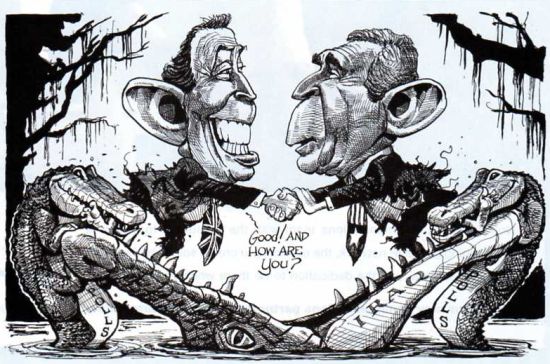

This week's political cartoon:

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

1 comments:

Tried a big mac for the first time in eighteen years.

Not good.

Now I get to wait again.

Post a Comment