Should People Be Protected?

Thursday, May 25, 2006

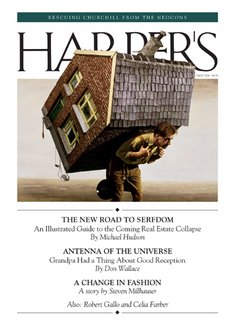

Last summer, in a post titled Valuable Lessons About Debt, it was noted that buying a home today is much like buying a car was ten or fifteen years ago - if there was something that you really wanted, someone would loan you the money.

In previous decades, borrowing money to buy an automobile or using credit cards taught people about managing debt before they would go off and make a major purchase like real estate. When buying a home, the barrier to entry used to be much higher - hefty down payments were required and qualifying was difficult.

That has changed dramatically in this decade.

The result, of course, has been the creation of trillions of dollars in credit and debt helping to create a world wide real estate boom that has unmistakably been good for the economies of the world when gauged using traditional measures such as economic growth and employment - the long-term impact is yet to be seen.

~~~~~~~~~~~~~~~~~~~~~~~~Advertisement~~~~~~~~~~~~~~~~~~~~~~

The marketing department has been disappointed with the effort made so far to promote the new website, Iacono Research, through ads inserted in the daily posts. Their displeasure is understandable, since there have been none since the website launched almost two weeks ago.

This should make them happy, if only for a day:

With a major correction now underway and many prices now at very attractive levels, this is an excellent time to get started investing in commodities or to add to your investment portfolio. To learn more about a unique approach to investing, click here.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Many predict the massive amount of new credit and debt will one day cause serious problems, while others are dismissive of these warnings, claiming that our current condition is the natural result of a new world of global finance.

They say complex financial instruments and processes have fully quantified risk and we are reaping the rewards - credit has been extended to more people in more ways in recent years than ever before, and that's just the natural evolution of a dynamic, flexible world economy. It is, of course, impossible to know how this will all work out, however, one thing is clear today.

It is, of course, impossible to know how this will all work out, however, one thing is clear today.

Individuals have taken on more debt in recent years than ever before, and with the help of low interest rates and lax mortgage lending standards, more and more of the money owed has been borrowed against the value of real estate.

The matter of "lessons learned" was addressed in the post referenced above, which closed with the question:

"Is the entire Anglo Saxon world about to be taught a valuable lesson about debt?"

Now that higher interest rates are starting to affect people in material ways with foreclosures and bankruptcies on the rise, today we consider if mortgage lending should have been done differently in recent years. Should people have been prevented from borrowing so much money:

"Should people be protected from taking on too much debt?"

Free Markets and Consumers Awareness

It seems the discussion here reduces to two issues - free markets and consumer awareness. The freedom of markets to determine the best outcome in an economy, weighed against the awareness of consumers regarding the manner in which they are participating in the economy, and most importantly, the possible consequences of their actions.

If the worst fears of housing bears are realized, the debate about free markets in mortgage lending is likely to continue for many years. How much should the government regulate lenders? Should they be regulated at all? Is guidance sufficient?

Regulation in recent years has been mostly non-existent, as regulators seem wary of enforcing their will on a system that is showing few of the traditional signs of stress. Mortgage foreclosures rates, while rising, are still historically low and troubled lenders are still few and far between - bank failures seem to be a thing of the past.

By traditional measures, there is little stress on the system.

Traditional banking, however, only accounts for a portion of outstanding mortgage debt, much of which has been securitized by Wall Street firms and sold to investors along with insurance in one form or another via derivative products. As these products have not been "stress tested", there may be a good deal of unwarranted complacency, but within the banking system today there is little reason for concern.

On other side of the lender-borrower relationship is the average American homeowner, who, after mostly watching the stock market boom from afar, has participated in the current real estate boom in a very big way. Many average Americans do not understand simple interest, let alone the myriad of complex loan products that have become wildly popular in recent years.

Average Americans do, however, understand a few things.

They understand that some of their friends and relatives have made big money in real estate in recent years. They also understand that getting a real estate loan these days is easier than ever before. And, they understand monthly payments (or at least the initial monthly payments).

Many of today's home buyers have little knowledge of broader market trends and are surely influenced more by friends and relatives heeding their advice rather than the dire warnings emanating from some parts of the media about a potential bubble in housing.

When you hear stories about people viewing home equity withdrawal as income, then you know that there is a basic misunderstanding about the role that credit and debt are now playing in people's lives.

Condo flippers who barely graduated high school can be despised, however, they will get their comeuppance. But, unlike stocks in 2000, there are a lot more innocent bystanders in today's housing market who really don't understand what they've gotten themselves into in the last few years as easy money has coursed through the land.

Many average Americans think that somehow fundamental changes have occurred and their standard of living has been permanently improved - they have little understanding about what their future debt service will be like.

What to Do?

So, should people be protected from taking on too much debt?

Should mortgage lending standards be dialed back to the pre-bubble days?

On one side of this argument are those who contend that the market should be left to work its magic and that the best lessons in life are learned first hand. Let banks and consumers battle it out and see who's left standing when it's over.

At the end of the day both parties will be smarter and the world will be better off for it.

On the other side of this argument are those who say that you just can't educate people well enough for them to resist the lure of rapidly evolving lending products designed to make the American Dream a painless and profitable undertaking.

Now, many consumers find themselves in way over their heads.

Since mortgage lenders will seek profits in any manner that a free market will allow, and borrowers are in many cases ill-informed and/or ill-equipped, should somebody be preventing these people from taking on too much debt?

Should people be protected?

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

16 comments:

There has been such a push, in the country to protect people. I feel like I'm living in a gaint "special class". All these SUV's are starting to look like short buss's full of window lickers

The free market works well in establishing relationships between equals, but fractional reserve banking with no restraint on the amount of money that can be created out of thin air is not a free market. When the only money available to loan is that which has been deposited (or some small multiple thereof), this is self-correcting and a true free market. Then, when people borrow too much, the amount of savings available to be lent drops and interest rates move up to curtail borrowing and attract more savings.

Instead, in this twisted mass of fraud and corruption that we call a financial system, there are no intrinsic checks and balances on the banks. They can essentially loan out as much money as they want at whatever terms they establish because of ridiculously low reserve requirements. In that case, checks and balances need to be established externally to the market to keep it under control.

if you think people have gotten themselves into a jam with real estate borrowing, wait til the baby boomers try to retire -- the 60 year olds with $85,000 in their 401k are going to have to keep working for the rest of their natural lives

Protecting the hapless consumer is the American way. The FDIC insures bank deposits. No matter how feckless and incompetent the directors of your bank are, your money is safe. There is absolutely no responsibility for a consumer to know anything at all about his banks business practices. Mortgages are protected by the government through agencies like Fannie Mae. In Florida, if you can't get insurance because of hurricane risk, the state governement will be the insurer of last resort, all in the name of protecting an "investment" in a house or condo that make no sense at all without that protection from the state.

Protecting consumers who get into debt over their heads is only another tiny step in a long established trend of diminished personal responsibility.

Whoaaa!

In the Good-Old-Days this was not about protecting the people doing the Borrowing it is about protecting the lender. The notion of putting 20% down and having a percentage of your income stream available to service the mortgage was done to protect the lender. In fact it protected "people" by preventing the poor and dissolute from getting a loan....

In those days the banks were much smaller and the bank president might well be the owner or a significant owner.

In those days the bank held much/most/all of the risk.

Now banks farm a large part of the loan and the risk to Fannie Mae et al which in turn convert the loans into these Mortgage Backed Securities (MBS) derivatives.

So...

At all levels of the Lending Chain we have two major shifts:

1. Ownership of the business is now most likely to be:

a. remote (not local),

b. large corporate (not small private) and

c. run by managers with an annual incentive plan based upon Growth of sales and profits (not by owners who think long term to selling the business and retirement).

2. The RISK gets pushed away - to another level. Even if there is some continuing attachment to the Risk the way it is packaged any snapback will be delayed.

NET: a License has been issued to the lenders to be very risky. Just look at the last 8 years of fraud at Fannie Mae will the CEO who pocketed something like $245 million in incentive pay is gone from the scene.

Sound familiar? Think of the Saving and Loan mess under Reagan when S&Ls were given license to pay higher interest rates to savers to attract money while having much of thier income tied to fixed-rate long-term loans.

Funny thing to THINK about. for the past 6-8 months the saving rate in the United States has been negative.

Who is holding the bag?

AnonyMoose

.

So, in the past, borrowers were prevented from taking on too much debt because that's the way banks worked. There was no protection, per se, just banks going about their business.

Now that everything about mortgage lending has changed and this 'accidental' protection has been removed, millions of people will learn the hard way about too much borrowing.

Sounds like a plan!

to Ben,

Well it may just be "The Plan" for those folks who could not afford the house and were too stupid to SEE that they could not afford the house.

BUT - Who is holding the bag?

When the mortgages were collected and converted into the MBS all sorts of people may have some. e.g. perhaps somebody's pension plan - if you have one.

That negative savings rate? That math is due to massive borrowing. Some of which is borrowing against inflated house values on Adjustable Rate Mortgages - all done while interest rates were are or near a 40-year LOW.

That has been fueling the economy for maybe 2 % points.

Over the next 20 months something between one and two Trillion $ of ARMs are going to adjust UPWARD.

If the mess is big enough it will touch us all.

AnonyMoose

.

A new report(.pdf) on exotic loans has been published by the Consumer Federation of America:

"African Americans and Latinos More Likely to Receive Payment Option Mortgages: Latinos are nearly twice as likely as non-Latinos to receive payment option mortgages.

...

Many Non-Traditional Borrowers Have Only Average or Even Weaker Credit Scores. More than half (53.8%) of payment option borrowers and nearly two-fifths (38.0%) of interest only borrowers have credit scores below 700. More than one fifth (21.4%) and about one in eight (12.1%) interest only borrowers had credit scores below 660."

They are protected. It's called bankrupcy. These go through cycles. The problem is the cycles are too long for human beings to acclimatize to. Instead they react to current affairs to correct previous problems while introducing the very ones which were eliminated previously in the cycle.

Bring back sabre tooth tigers!

It's time we stopped protecting those who lend money to people who can't afford to pay it back, methinks.

Tim,

The problem is that we are all connected via dollars. The mixing of claims ( ensures that stupid actions by a few can bring the whole economy down.

It would be nice if the fippers money flowed in a parallel flipper economy, which boomed and crashed in its own world. At least then people would have the chocice whether to get into the flipper economy or not, and they would bear the consequences.

I agree that if you are big enough, you can withstand a crash. But not if you are small. Even if a worker today did all the sensible things, saved, rented and worked hard, he is going to get hit because of reckless lending, when the boom turns into a bust.

Private money? Would be much better.

In a central banking system, credit must be regulated. Otherwise accountability would not exist.

Let idiots be allowed to borrow what they want. But they should not be allowed to borrow more than they can afford to pay, beacuse INEVITABLY others end up paying. So protect others from the fruits of idiots.

I'm with anonymous #1. What we have is not a free market system.

Its even worse than fractional reserve banking being fundamentally bad: fractional reserve requirements were actually eliminated for the "higher" forms of money in the past decade. This means banks have an essentially unlimited license to print unlimited money and collect fees on it.

Further, we have an international capital system that is polluted by the machinations of governments (like China and Japan) doing unnatural things to huge chunks of the capital market that distort interest rates downward.

Take these two phenomenon and add them together, and you get a perfect storm of powerful entities giving the little guy all the wrong market information and acting upon all the wrong incentives.

I don't think the question of whether "people are responsible enough" would even come up in a more laissez-faire system.

http://www.krdotv.com/DisplayStory.asp?id=11269

COLORADO FORECLOSURE RATE #1 AGAIN

Colorado is one only a few states in the country with an unregulated mortgage industry. Consumer advocates say some lenders take advantage of their loose leash.

Critics say lenders in the state don't fully educate their buyers. And worse yet, FBI statistics put Colorado in the top ten states for mortgage fraud each of the last three years.

Many buyers are apparently talked into using loans that aren't right for them. For example most buyers shouldn't be setting up interest only loans that will increase to include principal payments after just a few years.

For most buyers, once they start paying the principal their payments go up substantially, forcing foreclosure.

In Colorado the responsibility to avoid these problems is with the consumer. The Better Business Bureau recommends calling them before deciding on a lender.

If you start down the path of protecting the consumer from himself, where do you end? What debt level is right? How should we define that level? 35% of net income or 50% of gross? What if your income is from sales vs. salary? Should we have lobbyists sweet talking congressmen to make these decisions?

It's an impossible question to answer and the distortions we'd introduce would be worse than the cure! So we have companies that take on this risk and make their individual determinations. Remember that SOME banks maintained intelligent lending standards throughout this insanity.

The first poster nailed it. The Fed and fractional reserve banking accelerated and distorted this situation far beyond anything that could have been attained under a controlled monetary base. And the balloon will keep getting bigger until the day it doesn't.

Honest history will show this end-game started with the Bank of Japan in conjunction with the Fed.

What a mess they've made.

Should people be protected?

I think this is a restatement of the moral hazard dilemma. The answer is NO. Borrowers and lenders should be left to work out their own terms and risks. Why should lenders be protected by taxpayers? The essence of problem is that every financial entity now believes the Fed will back them in order to prevent a potential for systemic collapse. What most do not realize is that nobody (not all the central banks combined) have the ability to bail out a systemic collapse. Like FDIC, it only works if a few small banks fail, not if the failures spread to major institutions.

Which "people"? The FBs and flippers stuck with properties in Phoenix suburbs? I don't have a lot of sympathy for them.

I don't have much sympathy for the get-rich-quick flippers, real estate investors, renovaters, or anyone who jumped into careers in RE or lending.

Ya know who I do feel sorry for? People who are unknowingly (through their retirement funds or pensions) exposed to the debt these lunatics have dumped on the markets.

If anyone should be protected, it's the folks who put their money in a "stable income" fund, after being presented a with low-risk, lower return fund than equities.

There's no way in hell are they being compensated by the risk they are taking. Nor are they being adequately informed of the risk of the MBS portion of their funds. They'll learn soon enough though.

Post a Comment