Supply-Sider Investment Advice

Sunday, June 11, 2006

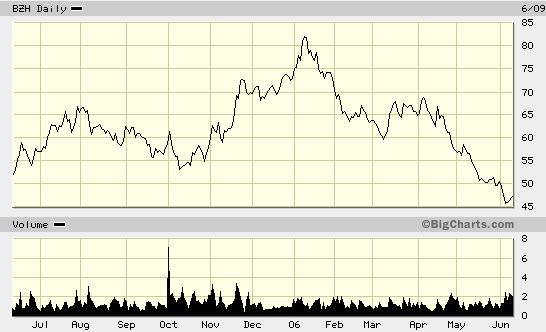

There's been a little yellow sticky note at the top of my computer monitor since the end of January of this year. It says, "1/21 - Cavuto - Herman Cain - BZH - $75", in reference to a recommendation made by Herman Cain on the Fox business news show Cavuto on Business to buy Beazer Homes at $75 about five months ago.

It's been sitting there for a while now, and it wasn't really clear what should be done with it aside from maybe adding it to the collection of prognostications that are kept in a text file on my computer desktop. But that text file contains predictions from people whose opinions are respected here, so Herman's little stock tip really didn't fit neatly into that category.

So, when John Rutledge started talking about commodities the other day on Larry Kudlow's show (a program that is viewed here about once every few weeks, and then only to listen to Barry Ritholtz and Herb Greenberg unsuccessfully try to beat some sense into Larry's skull on Thursday afternoons) the idea was hatched to combine these two bits of supply-sider clairvoyance into a short little Sunday post to demonstrate the dangers that lie in wait for anyone taking investment advice from these types.

First, what followed Herman's prediction: OK - it's not clear what could possibly be added in words, the chart says it all. Whoever those poor saps are that bought Beazer Homes back in January on Herman's advice - they deserve what they got.

OK - it's not clear what could possibly be added in words, the chart says it all. Whoever those poor saps are that bought Beazer Homes back in January on Herman's advice - they deserve what they got.

So, what did John Rutledge have to say?

The exact words are now lost, because the Thursday afternoon Kudlow show has not moved up from "Keep until space needed" to "Keep until I delete" status on my faithful Tivo, but it was something like the following.

After Herb Greenberg gave a thumbs up to buying gold at Thursday prices (adding that he'd buy more if it went lower), and new favorite Jeffrey Saut of Raymond James gave it a big booyah, and then Barry hesitated, mumbling something about looking for a slightly lower low said he'd be a buyer at between $580 and $600, Larry quickly cut off that discussion which was not going in his favor and turned the mike over to John Rutledge so someone, anyone, could say something that didn't trigger Larry's cognitive dissonance synapses which just make him talk louder than he usually does.

Like a true supply-side, Reagan Republican, trickle-down savant, John Rutledge explained that the commodities bubble has burst and the clear confirmation comes from the widespread purchase of commodity ETFs by grandmothers.

Larry liked that answer.

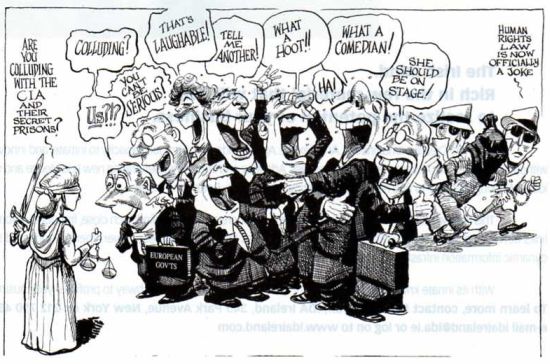

This week's cartoon from The Economist.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

2 comments:

Mumbling? Greesfracdarnedsasassfras!~

I said I was a buyer between $580-600

Maybe it was because Larry was talking so loud at the time that I couldn't quite make it out - I'll fix it up.

Post a Comment