Something More Ominous

Wednesday, August 16, 2006

Yesterday, DataQuick released the Southern California real estate sales data for the month of July. Attached herewith are a few updated charts showing the dismal state of affairs in most of the Southland.

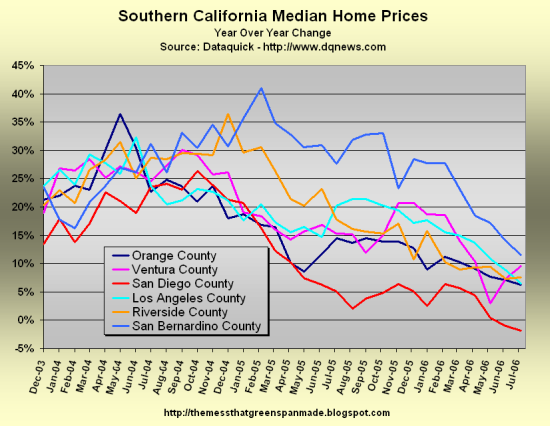

While price changes in Ventura County are once again the low-volume outlier this month, all other counties are plotting a clear path downward in year-over-year price changes. From last year at this time, prices fell two percent for housing in San Diego, continuing its trek below the zero level on the y-axis, not likely to re-emerge in positive territory for some time, since comparisons versus the price peaks of last fall will be particularly difficult.

Though San Diego real estate prices have surprised observers before, it's a good bet that the next few months are not going to be one of those times.

While two percent doesn't sound like much, the decline from last November is a much more significant 6 percent and anecdotal accounts of falling prices far exceed single digits. San Bernardino County appears to be quickly catching up to the other counties in decelerating price increases, falling from almost 30 percent to just over 10 percent in only five months.

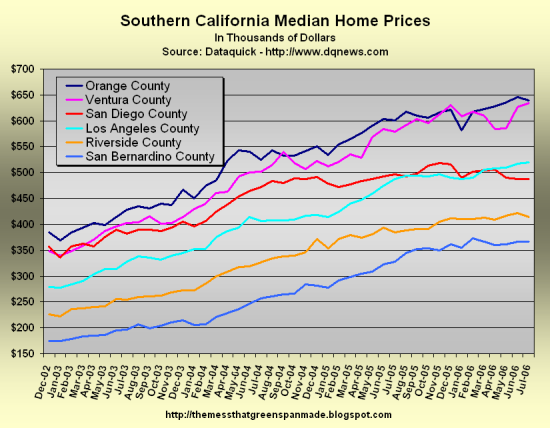

As shown in the chart below, for those comparing the recent performance of San Diego real estate versus other investment options, you can now go back almost two years and see the same median price at just under $500,000.

Other counties are flattening out, however prices in Ventura County have jumped up the last two months in a row, now once again challenging Orange County for highest median price just under $650,000. As noted yesterday, this is about ten times the median household income for this area.

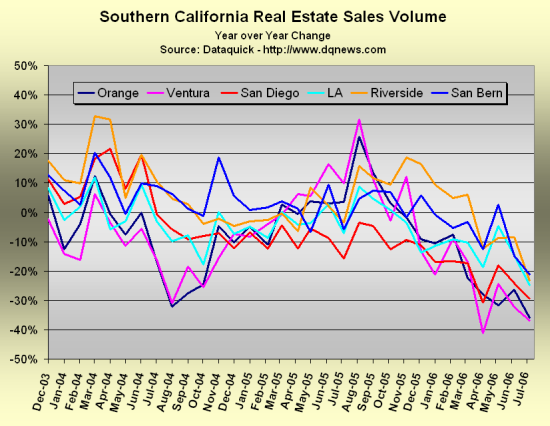

Marshall "almost all, if not all, of those gains are here to stay" Prentice is growing less and less sanguine with each passing month. His once reassuring remarks have turned to hesitation and fear mongering amid the rapidly declining sales volume. Being the real estate market expert that he is, Marshall knows what rapidly declining sales volume usually means for future sales prices."The relatively large drop in sales last month may be nothing more than a statistical blip, but it could also be a sign of fast-petering demand for homes at today's prices," said Marshall Prentice, DataQuick president.

Coincidentally perhaps, Marshall's price guarantee referenced above occurred in November of last year - right around the time that prices in San Diego peaked. The DataQuick reports originate from La Jolla, adjacent to San Diego.

"Our sense has been that many who bought homes in recent years purchased them sooner than they otherwise would have because of very low interest rates and a great sense of urgency, given the fear of being priced out forever or missing out on a great investment. That phenomenon helps explain why there's not more demand today. Whether July's data also signal something more ominous at work in the market – something that would cause a severe correction in home values – is unclear to us. We'll know a lot more in a few months."

Good to know.

Maybe what's got the DataQuick Prez spooked are the dreadful sales volume parallels with the 1990s. Last month's year-over-year decline in sales volume was the sharpest since August 1992, which, as anyone living in Southern California at the time will recall, was about a year past the price peak that occurred in 1990-1991.

After that it was five years to the bottom which was forty percent lower than the top in some areas. The change in sales volume is the antecedent to much lower sales volume, and much lower sales volume is a prerequisite for lower prices.

Last month's Southern California sales volume of 22,712 was the lowest since 1997, but still significantly higher than the low of 15,077 in July 1995, which locals will recall as being about the bottom last time around.

This is a marathon, not a sprint - it is far too late for last year's buyers to benefit from Marshall Prentice's newfound caution. All part of the business it seems - stocks, housing - a mania is a mania.

Soft landing or hard landing, a landing is certain.

One last note - please don't say that the real estate market will do fine because without a broader decline in the economy housing will not be affected in a big way. We are living in a time when, as never before, the housing market is the economy.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

8 comments:

I'm betting that Ventura County is the next one to go negative. It's volatile enough that it could just bust down below zero in a two month period, just like it has jumped up recently.

hello from germany,

it seems that the first bigger builders are in deep trouble.

http://immobilienblasen.blogspot.com/2006/08/jade-homes-shut-down-operations.html

Betting on Ventura is a suckers bet up or down. Small market that escaped much of the building frenzy with strict zoning and high land prices. People forget that agriculture is our #1 industry. In many respects VenCo is neither fish nor fowl wrt to the usual rural/urban classifications. VenCo is headed down no doubt. What is different is that it will take a little longer to show up in the data and the market will probably bifurcate. There'll be a lot of high end excesses sold at a loss and a jaw dropping number of overleveraged low end homes lost to the credit bubble but a great many long term owner/occupiers in the middle aren't like what we see elsewhere. High prices alone will make for losses. Proximity to LA will make for losses. Locals who extracted equity to invest elsewhere will make for losses. The large hidden underclass and credit predation will make for losses. Those are the reasons why VenCo will participate in the downturn but the results will look different. The biggest thing that VenCo has going for it is that prices have been so high for so long that there never was an investor wave, thus the slower response to changing conditions.

The biggest thing that VenCo has going for it is that prices have been so high for so long that there never was an investor wave, thus the slower response to changing conditions.

I could say precisely the same thing for Marin County but we have clearly had investors and flippers...they're just doing so at higher starting prices.

Yup, sales in San Diego are slow - I'm seeing homes sit on the market for months here, including most of those listed at the beginning of the summer sales period in May.

The ones that are selling now post signs with "sale pending" or "in escrow". I wonder if a lot of these sales are falling out as buyers realize waiting a bit will get them a better deal.

Marinite,

I can't speak for Marin directly but we Ventura County owners and/or investors could never find anything worthwhile for 6-8 years. We all went to LA or IE, etc. Our zoning regs also inhibited speculation here. Less speculation is probably a good thing now.

I shall expand. There surely were "flippers" here in VenCo. By 1996 there was so much hidden value even people that didn't buy then with the intention of flipping were enticed to flip. Beachfront for $250k. Recent construction on the channel with 40' of dock, $350k. 1ac golf course view homes for $250k. Not everyone saw the value back then but enough did. What didn't happen was wholesale upzoning or gross annexations or any new major development corridors.

Don't uniformly bust on flippers. They perform useful functions in normal markets. They only become a problem in times of excess. The kinds of flippers VenCo didn't get were of the greater fool variety. One of the saving graces is as the Census confirms how many homes are owner occupied primary residences. Don't get me wrong, there's also a lot of negatives as I have listed previously.

VenCo will see large numerical drops, large percentage drops, growth in defaults/foreclosures, pain. Those impacts will be more targeted and with less ripple effect than in the rest of SoCal. Marin in the north shares many of the same pluses and minuses along with its own different pluses and minuses.

Robert, I disagree completely.

I just follow Moorpark and Simi daily, not all of ventura, but to say Ventura avoided a wave of building seems way off. Not only is there the huge developments in Simi (newest being Big Sky, but I can point out a new big development almost every year from 2000 in Simi) but there is a huge amount of both speculation and flipping ("upgrade" flipping, I wouldnt call it rehab). I watch the MLS every single day and I can point probably two hundred cases of speculation/flippage in a market of about 1k homes.

As for Ventura as a whole, just driving out the 101, will show you massive buildup of new homes where once was nothing but farms (and mor on the way). And that is just the stuff in eyesight, not including the more hidden communities like Dos Vientos.

My take on the Ventura median is because of low volume you get more volatile data. Watching what has sold in Simi every week, the high end is selling ok (places like Wood Ranch for example) and the very low end (right around 500k) is low volume but still has a lot of sales relatively. It is that huge swath in between, 550k-850k that is extremely slow. The upper low end and the low to mid move up market, that stuff isnt moving well at all. So you get the upward bias to the median due to the housing mix sold.

Remember, median price != appreciation. With high volume, median price comes closer to reality, but with historic low volume (lowest volume on record since before 2000, I dont have data for Ventura before then), the median in Ventura is extremely deceptive.

I went back to look at my Simi data, I overstated the speculation/flippage number, I said around 200. That number was in my head because at one time I went through the whole MLS and picked out all the flips and speculators as well as everyone who was trying to sell around/under 1 year of purchase or had "significant" non-paying of property taxes. This number at the time (early June) was 184 and was not all flippers/speculators.

I made a overstatement and wanted to correct it.

Post a Comment