Gold Stocks On the Move

Thursday, September 07, 2006

While the major stock indices just lay there, attempting to claw their way back to unimpressive highs achieved in May of this year, precious metal mining stocks have been making bold moves in recent weeks.

It seems that acquisition fever has struck the gold mining industry and, like Pac Man gobbling up energy dots, the major producers are going after smaller companies in search of resources to meet current and expected demand for the shiny metal that has little or no practical use, that is, aside from the obvious one as an alternative to paper money.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~Advertisement~~~~~~~~~~~~~~~~~~~~~~~~~~~

It's September, vacation is over, and the kids are back at school. With the Nasdaq down two percent and both the Dow and S&P500 up only mid single digits, maybe now's a good time to have a look at the Iacono Research website - as of Tuesday, the model portfolio was up over 24 percent on the year.

For a free, no obligation two week trial, click here.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Call it an inflation hedge, real money, a safe haven, or anything you like, but the redeeming quality of precious metals today, and the reason for its newfound popularity in the last year, is that it is not the dollar, and more and more people are realizing this.

Combined with the beginning of seasonal price strength associated with the purchase of jewelry for winter weddings in India, the new round of mergers has attracted investor interest in gold stocks once again.

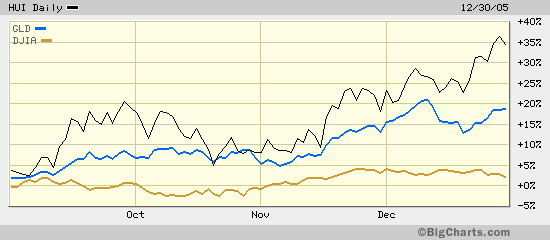

In recent weeks the unhedged gold miners index (HUI) has forged ahead of the metal (GLD) for the first time since the May highs earlier in the year, while smaller mining companies, the object of desire of said major producers in the HUI, have in many cases risen by multiples. Of course much of this is lost on your average investor who likely will wait another year or two before being convinced that the last half-decade of rising prices for both the metal and the related equities are indeed real - then it will really get interesting.

Of course much of this is lost on your average investor who likely will wait another year or two before being convinced that the last half-decade of rising prices for both the metal and the related equities are indeed real - then it will really get interesting.

Much of the recent action in gold stocks was kicked off by the July 24th hostile takeover bid for NovaGold (NG) made by Barrick (ABX). This has turned into a real free-for-all with law suits flying this way and that since the Barrick offer grossly undervalued the NovaGold resources, as reflected in the premium the market has assigned to the shares since the bid was tendered.

Coming at a time of seasonal weakness for both the metal and the equities, and when considering the long and sordid history of Barrick, this as-yet-unresolved acquisition may mark the beginning of a great wave of acquisitions, given now nearly unanimous expectations of higher gold prices in the future.

In a friendly bid last month, Yamana (AUY) will be purchasing Viceroy (XVE) and about a week ago Goldcorp (GG) announced plans to purchase Glamis (GLG), a move that would make the new Goldcorp the number three gold producer in the world behind Barrick and Newmont Mining (NEM).

It's all becoming quite a wild ride and is certainly not for the faint of heart, as the volatility is something that compares to the rise of Nasdaq stocks in the 1990s. Daily double digit moves in share prices (both up and down) have a way of quickly discouraging investors new to the sector, unsure of their decisions when their wisdom in stock selection is not confirmed by their peers.

One look at what happened in the fall of 2005 should explain why some of the recent interest has materialized - shortly after Ben Bernanke was nominated to take the conductor's baton from former Fed chief Alan Greenspan, it was off to the races, and many are expecting a repeat in the months ahead. Where things will go from here is, of course, unknowable - as this is being written, the dollar has strengthened and both gold and silver have fallen two percent in just the last few hours. But, short term fluctuations in the metals and the stocks should make no difference to individuals secure in the long term prospects for both precious metals and paper money when entrusted to governments and central bankers.

Where things will go from here is, of course, unknowable - as this is being written, the dollar has strengthened and both gold and silver have fallen two percent in just the last few hours. But, short term fluctuations in the metals and the stocks should make no difference to individuals secure in the long term prospects for both precious metals and paper money when entrusted to governments and central bankers.

The U.S. dollar and other government money around the world have made too many commitments, having spent the last two decades in the care of masters who were all too willing to use quantity to solve problems, and in the process forsaking quality.

Months, years, who knows - it takes time for good money to push out bad money. It is only through the collective judgment of billions of individuals that fair value is determined, and conditioned to believe the unbelievable, minds are slow to change.

Just to be on the safe side, maybe it's time to put a few of these in your pocket.

You can then ponder why something that the government stamps 50 DOLLARS will fetch more than ten times that amount at coin shops.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

lately you've had a knack for writing about gold on big down days - any explanations?

See what is happening to uranium prices?

I've noticed that too - it used to be the other way around. On the day that I would write an entire piece about gold - once every couple weeks - it would be up ten or fifteen dollars, now it's the opposite.

Uranium was up over $50 the other day, up from about $8 in '04.

Another Gold run again ?? I am still a bit worried whether we are going to face a commodity bull run or not as the commodity market is always volatile and instead of trending up, it could be trending down the next minute.

Evina

Evina,

This is a good example of the sort of logic that keeps people out of bull markets until the end, when they do become bubbles. You have to figure out for yourself whether to believe the primary trend is up for commodities/energy/pms? Why? And do it before everyone else does.

If you happen to decide it is yes, then just wait for Tim to write about it so you can accumulate on big down moves.

Post a Comment