SoCal Real Estate: Looking for Support

Wednesday, September 20, 2006

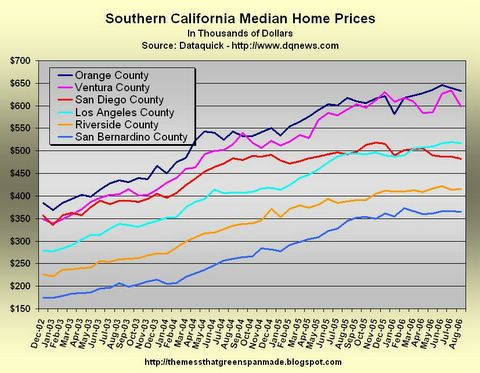

Yesterday, DataQuick released the August real estate sales data for Southern California. While San Diego County spent a third month in a row in the sub-zero climes of negative appreciation, now down over two percent from last year and seven percent from the peak last November, the other counties continue to gather in the mid-single digit appreciation range, waiting for one of them to make a move.

Checking in with a scant one percent gain from last summer and now down five percent from the November high, volatile Ventura County seems the next most likely candidate to plunge below the line separating gainers from losers.

There is one other county, however, that should not be counted out. At the rate that home prices in San Bernardino are losing altitude - a loss of four percent annual appreciation per month for the last six months - they will hit zero in just two months. See the light blue line in the chart below - it has been riding on top of all the others for almost two years now, just catching up to Riverside last month.

Prices are still quite lofty in this part of the country. Between $350,000 and $650,000 for an ordinary hovel on a tiny lot still seems like a lot of money - the weather is good, but it's not that good.

With a mean price of $489,000, DataQuick reports that the mean mortgage payment works out to $2,339 per month. To this add another $550 for taxes and insurance, multiply by 12 and you get $34,668 to match up against a median household income of somewhere around $50,000.

As usual, something doesn't add up with these figures.

San Diego County prices have clearly separated from those in Los Angeles County. After dominating its much larger neighbor to the north in the early years of the boom, the two counties meandered around the nice round figure of $500,000 for much of the last year before prices in San Diego headed, well, south.

No one at DataQuick seems overly concerned at the moment - they figure that price levels are "nearing a plateau". But, Marshall "almost all, if not all, of those gains are here to stay" Prentice does appear to be growing a bit testy these days.There's an awful lot of moaning going on right now. Potential buyers and sellers need to be careful what they believe and exercise common sense in their decision making. The market is certainly off from its frenzy, but we have to remember that it takes much more downward pressure to push prices down than upward pressure to push them up. Prices have doubled the last four-and-a-half years. So does the market keep all of that gain, or only ninety percent?

It was a lot simpler for everyone when everyone believed that prices would go up forever. Now that this has proven to be untrue, things are getting a bit complicated. It's not clear what kind of pressure he's talking about here or if there is any sort of support to this claim, but at least he's clarified what he meant by the words "almost all" - 90 percent it seems.

We'll see how that works out - he probably would have been better off leaving his options open for defining that phrase later. Figuring that house prices doubled in recent years, keeping 90 percent of the gain is a drop of only five percent from current levels.

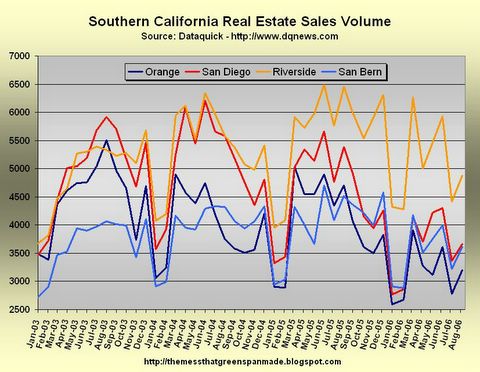

The change in sales volume is now looking scary even when viewed in absolute terms. As shown in the chart below, the summer volume is way down for both San Diego and Orange County, not just compared to last year, but when compared to each of the last three years. Riverside and San Bernardino still look OK, while Los Angeles and Ventura are too big and small, respectively, to appear on the same chart.

When measured from year-ago levels, sales volume declines of about 25 percent or so are now the norm. Sales in San Diego, Orange, and Ventura County have been declining at this rate for most of the year, while the remaining counties have only recently entered this area on the chart below.

What's the likelihood of a soft landing at this point? What are the odds of prices falling no more than five percent as Marshall Prentice has assured the 20 million residents of warm, sunny Southern California?

Dunno.

There's a large and growing awareness about real estate prices and their potential for a reversion to the mean now that the giddiness of recent years has worn off and clearer heads are more common.

Of course for many potential homebuyers still, the combination of a) lenders bending over backwards, and b) a monthly payment that bent-over lenders says is within their means - this will still seal the deal. As for the purchase price, why be concerned about the price of the home when the bank says you're good-to-go?

Homebuyers today are probably being told that they're getting a bargain because the prices they're paying are tens of thousands of dollars below appraised values or comparable sales from last year.

What's the likelihood of next year's homebuyers being told the same thing?

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

3 comments:

I use Tim's excellent links as a gateway page - anybody heard anything about Ben Jones' Housing Bubble Blog? It has been down since yesterday morning.

Housing supply/demand have crossed over. A bubble cannot exhaust to a plateau. If 'Ben-Gay' doesn't gas up the choppers soon and get us to Mises' crack-up boom, the yoy price comps are going to look like the yoy sales volume comps. And, this bubble is finally too big to bail out. Good hunting and make sure you have a way to shelter all the money you are going to make from the Feds.

Aside: came across a nice read by Rockwell here.

http://www.mises.org/story/2328

Dunno?!

Sure you know, you're just trying not to scare the sheep!

p.s.: HBB is down for another server upgrade.

Post a Comment