Weeeeeeh!

Tuesday, September 12, 2006

Like thrill-seeking amusement park patrons, precious metal investors have been on a wild ride in recent days courtesy of some new steep track laid by European central banks. Unlike their counterparts across the English Channel who, under the guidance of Chancellor of the Exchequer Gordon Brown, unloaded more than half of their stash of the yellow metal a few years back at rock bottom prices below $300, central bankers on the continent seem to have a far better sense of timing.

Unlike their counterparts across the English Channel who, under the guidance of Chancellor of the Exchequer Gordon Brown, unloaded more than half of their stash of the yellow metal a few years back at rock bottom prices below $300, central bankers on the continent seem to have a far better sense of timing.

Since late last week, rumors of renewed European central bank gold sales have preoccupied commodity traders and armored truck drivers the world over, the September 26th deadline for Washington Agreement sales looming just a couple weeks ahead.

Spot gold touched $584 an ounce on Monday before climbing back up to $596 in overnight trading in Hong Kong. This marked lows not seen since late June after the steep correction from multi-decade highs of over $720.

Stephen Roach of Morgan Stanley last week commented, "The mega-run for commodities has run its course", this following warnings in May that the half-decade long commodities bull market was a bubble waiting to pop.

Those familiar with Mr. Roach's "world on the mend" comments just prior to the May pummeling of global financial markets may want to consider the possibility of his most recent pronouncement, like the one in May, also being an excellent contrary indicator.

~~~~~~~~~~~~~~~~~~~~~~~~Advertisement~~~~~~~~~~~~~~~~~~~~~~~~

The lifetime rate guarantee offer of $99 per year for subscriptions to Iacono Research will expire this Saturday. Don't miss out on this last opportunity to lock in this low rate for a weekly investment newsletter from a writer soon to be appearing in Yahoo! Finance through an affiliation with SeekingAlpha.

For a no obligation two week trial, just send mail to tim-at-iaconoresearch-dot-com with the words FREE TWO WEEK TRIAL in the subject line. To begin a subscription, click here.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Other analysts view current price levels as buying opportunities. After breaking through the $500 mark last December, prices have averaged well over $600 so far this year giving little indication that when they go down, they will stay down for long.

Looking back a year ago, when purchases were made for jewelry fabrication in anticipation of the 2005 Indian wedding season, prices were in the $480 range - quite cheap when compared to 2006. Jewelry manufacturers may consider prices below $600 an ounce to be a bargain and choose to load up while they can, upward pressure in the form of physical demand causing prices to rise as quickly as they fell. But, the rumored gold sales by central banks are of the greatest interest in recent days, coming as they did shortly after the Labor Day holiday as traders returned to their desks, investors once again began looking for places to deploy funds, and Indian jewelers began preparing for the upcoming wedding season.

But, the rumored gold sales by central banks are of the greatest interest in recent days, coming as they did shortly after the Labor Day holiday as traders returned to their desks, investors once again began looking for places to deploy funds, and Indian jewelers began preparing for the upcoming wedding season.

There is little else in the world that can knock down another bout of nascent gold fever than word of central banks once again tiring of the drudgery of dusting off pile after pile of gold bars that have no practical use in contemporary monetary systems.

But there's a reason why central banks sell gold as they do.

In his memoirs, Paul Volcker, Federal Reserve Chairman back in the 1980s, lamented the inaction on the part of central banks to sell enough of their supply to contain the gold price. He said that soaring gold prices in the late 1970s and early 1980s "knocked the psychological props out from under the dollar".

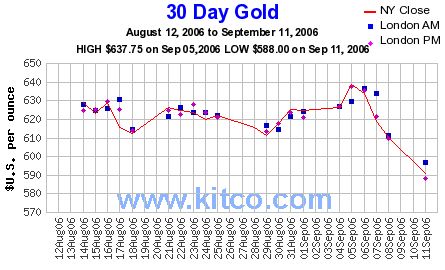

Considering recent dollar strength and the slope of the line in the chart below, it is clear just how important psychological factors can be. But, one has to wonder how long this can continue.

But, one has to wonder how long this can continue.

Selling gold to depress its price when measured in a paper currency that has been and will continue to be created in astonishing quantities in support of profligate spending by Western countries - this seems to be a long-term plan that will eventually cease to work.

At some point, there will be no gold left to sell, a goodly portion of it having found its way into the vaults of emerging economy central banks elsewhere in the world, as gold moved from Europe to the U.S. early in the last century.

Many wonder how much of the stuff still sits in central bank vaults, various lease plans and a gap of more than three decades in regular auditing of Fort Knox inventories only adding to the uncertainty.

At some point, individuals judging that a moderate gold price proves ongoing able stewardship of paper money, upon learning that the central banks have little gold left in their vaults, may abruptly change their views on paper money.

And gold.

At that point, the chart of gold prices may stop resembling a roller-coaster and appear more like a rocket.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

10 comments:

Maybe I'm just cocky having sold my Dec 590s yesterday in a piece of unbelieveable luck but I don't understand the two contradictory positions you use. Gold went up so it will go up, gold just went down so it will start up again soon. With so much of the production used in industry and consumer goods much of the currency cache has been eroded has it not? Or at least exposed prices to commodity influences? Since it looks like the Central Banks don't think they need it anymore behind their paper and an era of unprecedented consumer consumption seems to be at the least cooling will there be enough fear to even keep these prices?

[I'm just asking these contrary questions. I'm not even remotely qualified to defend them as positions.]

The flip side of what's happening with gold is what's happening with the US Dollar (I, mean, of course, long-term for both).

Wow. That's one scary chart, Aaron!

Robert,

I think it's fair to say that it went up on speculation earlier in the year, and it may go up now due to demand from India - two different sets of buyers.

I don't know about a currency caches, I know about memory caches - write-through, read-back, etc. but they're probably completely different.

Exposed to other commodity influences? Yes, see oil.

Central banks think they don't need it? Yes, we'll see how that works out, long-term.

hello from germany

at leat the berman "bundesbank" refuses to sell their gold.

the marketreaction to some numbers is to put it mildly "strange/weired"

when you look at the details of the deficit niumbers it is almost impossible to find somethin bullish for the $.

http://immobilienblasen.blogspot.com/

The market behaves totally different now compared to just five years ago. Individual trading has dropped by about 30% since 2000, but overall volume has doubled anyway. Trading by proprietary desks and hedge funds (much of it automated) seems to be the main culprit. Basically as goes the hedge fund herd, so goes the market.

What has happened to this blog? It's moved from an interesting discussion of recent economic policy to be a booster for gold. Is there some disclosures that the blog writers should be making?

Gold is interesting as a hedge for a small part of a portfolio, but this kind of gold boosterism makes me increasingly nervous (and maybe that's it's intent). Things would have to go pretty bad pretty quickly in order for gold to repeat last year's runup. We'll all habe much more to worry about than our portfolios should that happen.

I think that if you take an interest in economic policy and are concerned about its direction, you will eventually come to the conclusion that the most effective means of protest and self protection is exactly buying gold. Not everyone is there yet but they will be. More government, bigger government is not the answer. It never has been. The sooner people recognize that this system is doomed to fail them and trigger the currency crisis, the better off they will be.

uh... there's an ad at the top right of every page pointing to tim's investment website and this particular post has an ad inserted into the body...it could be that tim favors gold related investments and is trying to get people interested in having a look at his website...but thats just a wild guess and I could be waaaaay off base.

Ruidh is partly correct in his assessment - discussion here has moved more toward investments as a result of the companion website - not just gold, but commodities in general. I've been writing about gold ever since the blog began last year as it is an integral part of monetary policy - people just don't realize it yet.

And, I don't consider gold to be just a small and interesting hedge - in the years and decades ahead, it's my guess that more people will come to understand it much differently than they do now.

Post a Comment