Friday Lite

Friday, October 06, 2006

The jobs report just came in - nonfarm payrolls for September rose by 51,000 after upward revisions of 62,000 for July and August. In a result akin to kissing your sister, the latest month's data, when added to the prior months' revisions, yields a total that is near the consensus estimate.

The unemployment rate fell to 4.6 percent, but does anyone believe this number provides any value other than allowing pundits to point to it instead of the more reliable establishment survey when the need suits? Average hourly earnings rose 4 percent year-over-year and workers were thrilled.

The big story continues to be the decline in retail trade and residential construction jobs. Retail trade employment was one of the first categories to peak last year, now with about 100,000 fewer jobs than at the beginning of the year. There are fewer drywall nailers and granite countertop installers as well - about 50,000 less than in January when the housing market was still booming. In September alone, over 17,000 jobs were lost in this sector, a trend likely to continue if the housing market continues to slump. As shown in the chart below, since 2001, this sector has accounted for more than a half million new jobs.

There are fewer drywall nailers and granite countertop installers as well - about 50,000 less than in January when the housing market was still booming. In September alone, over 17,000 jobs were lost in this sector, a trend likely to continue if the housing market continues to slump. As shown in the chart below, since 2001, this sector has accounted for more than a half million new jobs. Not on as large a scale, but still significant, nonresidential specialty trade employment has been booming lately. In September the increase almost completely offset the decline in its residential equivalent, however, it's hard to imagine that the line in the chart below will maintain its current slope as the economy continues to cool.

Not on as large a scale, but still significant, nonresidential specialty trade employment has been booming lately. In September the increase almost completely offset the decline in its residential equivalent, however, it's hard to imagine that the line in the chart below will maintain its current slope as the economy continues to cool. Overall the case for a soft landing improves with each new bit of economic data and the Fed pause in August appears to have been the right choice. Now if we could just get the stock market and the bond market to agree on the outlook for the economy next year.

Overall the case for a soft landing improves with each new bit of economic data and the Fed pause in August appears to have been the right choice. Now if we could just get the stock market and the bond market to agree on the outlook for the economy next year.

Oh well, it's Friday.

A Rough Crowd In New York

A big thanks to Barry Ritholtz at The Big Picture for spotlighting this little blog over at his much higher trafficked site. This is what it looked like there on Tuesday when talk of conspiracy theories momentarily occupied the thoughts of his readers. A few of his regular readers were taken aback, some apparently shocked at what they first saw in his "Blog Spotlight" series. It was an interesting set of comments on a controversial topic that Daniel Gross later picked up on in a piece at Slate - The Oil Conspiracy.

A few of his regular readers were taken aback, some apparently shocked at what they first saw in his "Blog Spotlight" series. It was an interesting set of comments on a controversial topic that Daniel Gross later picked up on in a piece at Slate - The Oil Conspiracy.

Interestingly, the story Gasoline Prices Could Fall More($) appeared in yesterday's Wall Street Journal (hat tip to Aaron), where they dryly noted:A chief influence on the selloff, analysts say, has been a decision by Goldman Sachs Group Inc. to reduce the weighting of gasoline futures in its Goldman Sachs Commodity Index, the market's largest commodities index.

It looks like the debate on cause and effect is over.

Oil and Natural Gas Everywhere

How quickly things change. Two months ago, oil was near $80 a barrel and natural gas was around $8 - consumers were complaining about the price at the pump and their summer air conditioning costs. Now OPEC is talking about production cuts to support oil prices closer to $60 and they're paying customers to take natural gas off their hands - apparently the pipelines are backing up.A glut of natural gas supplies in Britain has seen prices collapse and left traders having to pay for it to be taken off their hands.

It looks like we're in the clear on the whole energy crisis - what were people worried about anyway? The only crisis now seems to be what to do with all the excess inventory.

Wholesale gas prices for immediate delivery turned negative on Tuesday as supplies surged in from the new Langeled pipeline from Norway.

Britain's gas storage capacity is 96% full so firms need to offload supplies.

The Heat is Off

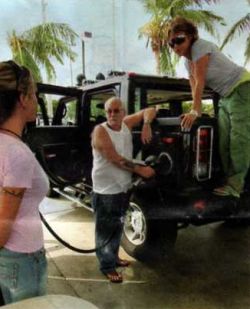

The picture accompanying this story($) about falling oil prices appears only in the print edition of The Economist, thus the reason for mentioning it here. We Americans must seem like a strange lot from across the pond.

Americans were born to drive. That is, born to drive big vehicles. The world is still consuming almost as much oil as it can pump, so any reduction in supply could send prices skywards again. Both the relative calm of this year's hurricane season and the diminishing threat of an interruption to Iran's oil exports seem to have contributed to the recent fall. But should clouds gather over the Atlantic, or tempers rise in the Middle East, the price could jump again.

The world is still consuming almost as much oil as it can pump, so any reduction in supply could send prices skywards again. Both the relative calm of this year's hurricane season and the diminishing threat of an interruption to Iran's oil exports seem to have contributed to the recent fall. But should clouds gather over the Atlantic, or tempers rise in the Middle East, the price could jump again.

...

Above all, cheaper oil would ease concerns about inflation, and so reduce the need for central bankers to increase interest rates. American inflation slowed in August, thanks in part to smaller increases in the cost of energy and transport. That's good news, except that it might simply prompt Americans to drive more.

The 33 Year Old Millionaire Guy

It's not clear what happened to this blog, My First Million at 33, but obviously something is amiss. Some time was spent poking around over there the other day, but now things don't seem to be operable. You know it's bad when you see something like this:WordPress database error: [Table './wordpress/wp_posts' is marked as crashed and last (automatic?) repair failed]

In addition to an intriguing personal story and a host of common sense ideas about how to save and invest, his current investment portfolio, available online, was found to be about 60 percent precious metals and about half again as much in energy. As soon as the site is back up, correspondence will be sent his way, as he seems to be a particularly bright fellow (despite what you might think if the only information you get about commodity markets is via the mainstream financial media).

SELECT DISTINCT * FROM wp_posts WHERE 1=1 AND post_date_gmt <= '2006-10-06 01:24:59' AND (post_status = "publish") AND post_status != "attachment" GROUP BY wp_posts.ID ORDER BY post_date DESC LIMIT 0, 14

Guess the Year-End Prices for Oil and Gold, Win Big

After all the ups and downs of late, maybe some fun can be had with the volatile prices of oil and gold. For those who dare, a contest is being offered - guess the year-end closing price for each of these important commodities and whoever is closest wins a free one-year subscription to Iacono Research.

Here are couple charts to help you out with your prognostication.

The combined percentage differences between the guessed value and the closing price on December 29th will be used to determine a winner. Entries may be made either by sending mail or posting them in the comments section of this or any subsequent post. All entries must be received no later than one week from today (a reminder will be provided next week).

The combined percentage differences between the guessed value and the closing price on December 29th will be used to determine a winner. Entries may be made either by sending mail or posting them in the comments section of this or any subsequent post. All entries must be received no later than one week from today (a reminder will be provided next week).

Special recognition will given for the best snarky comment, given recent price trends.

No Word Yet From the Colbert Report

At noon yesterday, when the fraudulent nature of Guest Blogger Stephen Colbert on Housing was revealed, an email was submitted to the Colbert Nation website informing them of what had transpired and asking if Stephen was interested in doing a real guest post. The query generated an automated reply beginning with this:Thanks for emailing ColbertNation.com. Here's the information you sent:

which was followed by the text that had been submitted. Despite the initial thought that there were messages popping up and alerts being posted on computers throughout the offices of Colbert Nation, more likely, the query is buried with the other thousands of similar-looking messages awaiting the attention of an overwhelmed staff of this popular show.

Kendra Todd on Housing

Lost in yesterday's excitement was this story from Kendra Todd, one of the winners of Donald Trump's Apprentice series from a couple years ago. She was quoted toward the end of yesterday's post, but more attention is warranted here.You can't go anywhere without hearing people talk about "the real estate bubble." Such talk drives me to distraction, and I'll tell you why. It's because there is no real estate bubble. Bubbles are for bathtubs.

No, that process might take a number of years (see Southern California 1990-1996 or Texas in the 1980s). Why do all the bubble debunkers think that bursting, like the Nasdaq, is the required outcome of a financial bubble? It is not. It is usually the case, but is not a requirement. The essential part of the definition of a bubble is that prices move to unsustainable levels based on speculation, rather than underlying fundamentals. Despite a thousand articles in Sunday newspaper real estate sections, the bubble is a myth. The real estate markets in many areas are going through a normal correction cycle.

Despite a thousand articles in Sunday newspaper real estate sections, the bubble is a myth. The real estate markets in many areas are going through a normal correction cycle.

...

A bubble is a market in which the value of the key asset is inflated based on speculation and psychology. Because of this, true bubble markets can burst overnight when something happens to shatter the perception of value ... Talking about a bubble implies a sudden burst, and real estate does not work that way. You don't go to sleep one night with your house worth half a million dollars and wake up to find it's lost half its value.

Ben Stein on Housing

Also in Yahoo! the other day was Ben Stein who was also talking about housing. Ben's old enough to remember that home prices can go down, something that it appears every generation has to learn anew.In March of 1990, after two years of looking for a house during a hysterical real estate boom, I bought a modest home in Malibu for exactly $600,000.

So if history repeats, Ben's Malibu home purchased last year for $1.8 million may be worth $5.4 million in 2020. The bad news is that it may go as low as $1 million in the coming years. History doesn't usually repeat, as Mark Twain once famously said, but it does rhyme. The owners had paid about half that five years earlier, but I really loved the house and thought that in a highly desirable area like Malibu the downside would be limited.

The owners had paid about half that five years earlier, but I really loved the house and thought that in a highly desirable area like Malibu the downside would be limited.

The real estate crash to end all real estate crashes began the next month. Within three years, I couldn't have given that house away. If I'd been able to sell it, I might have gotten $350,000 for it.

The price languished in the same miserable range for a few years, then revived, and then took off for the moon. By early 2005, I might have been able to sell it for $1.8 million -- a tidy profit.

A Long Way to go to Reach 1.24 Trillion

This story of a Japanese mental health counselor who recited pi to 100,000 decimal places from memory over a 16 hour period is just fascinating. How the heck do you to that?Haraguchi, a psychiatric counselor and business consultant in nearby Mobara city, took a break of about 5 minutes every one to two hours, going to the rest room and eating rice balls during the attempt, said Naoki Fujii, spokesman of Haraguchi's office.

He's got a long way to go.

Fujii said all of Haraguchi's activities during the attempt, including his bathroom breaks, were videotaped for evidence that will later be sent for verification by the Guinness Book of Records.

...

In 2002, University of Tokyo mathematicians, aided by a supercomputer, set the world record for figuring out pi to 1.24 trillion decimal places.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

15 comments:

I like round numbers - $60 and $600

$31.41 $592.65

germany hopes for 70 and 700

have a nice weekend

The Kendra Todd thingy is an advertisement, as evidenced by the link http://promo.realestate.yahoo.com/

l'emm must have missed yesterday's Colber issue

So all you schadenfreuders out there, you can wipe that smile off your face because the housing bubble isn't a bubble at all - and if it ain't a bubble, it ain't gonna pop. I know this because I just read Kendra Todd's article at Yahoo! Real Estate where she said that the bubble is a myth and that, "real estate markets in many areas are going through a normal correction cycle."

[It was an ad - look at the URL - it says promo]

I'll take $625 and $55

i have something that is a must over the weekend.

this is the best i have ever seen.

a comiplation from the tapes with lereah, shiller bernanke, etc

over 70 minutes of superb bubblehistoy video´s alle the famous quotes “not a bubble, a baloon” call to arms at lows etc.

spread this one around. this is a must see!!!!!!!!

http://www.paperdinero.com/BNN.aspx?id=20

48 and 530

$700 and $65

jiminy cricket

$500 and $52

justin

$750 and $85.

$66 and $666

jmf,

I'm about ten minutes into the video compilation, and it is a classic - Paper Dinero - highly recommended.

Repost of anon 10/06-11:10 (long URLs make Explorer work funny)

BLS, opps btw we just found about 800K jobs we missed sorry. BLS is useless

Link

Repost of chubbray 10/07-6:12 AM (same reason as above)

Faber does it again. Always great. Enjoy.

Link

Will their little paper beaver damn survive the seasonal deluge 'til end of year? Got me. $680/oz, $72/bbl ???

you should say the Dow will fall to 6800 like Barry Ritholtz predicted , then when the news comes out better than expected , the earnings are better than expected , the economic figures are better than expected , and the Market rallies , say that every one else is wrong

Post a Comment