Changing the Scale

Wednesday, November 15, 2006

Dataquick reported that Southern California real estate sales for the month of October were the slowest in ten years. As anyone who bought or sold real estate in 1996 will tell you, that year about marked the bottom of the last cycle after home prices had peaked in 1990-1991.

What are the odds that the similar sales volume marks a similar bottom today?

It depends who you talk to.

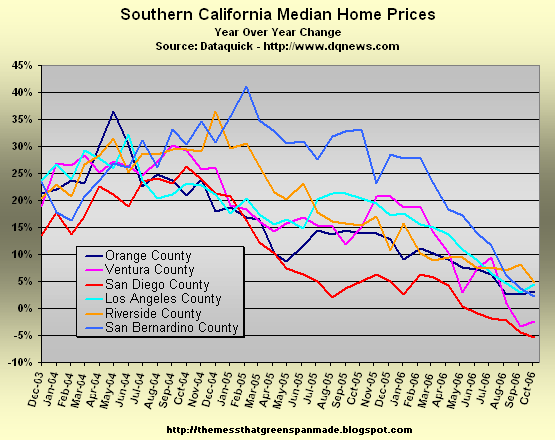

Overall median prices for Southern California are still rising at about two percent a year, but one look at the leveling off process in the chart below and it's clear the days of heady appreciation are over.

Prices in Ventura County have been volatile but, nonetheless, fifteen months ago the median price was higher than it was last month. In San Diego, more than two years of price history can be traversed with higher median prices still seen. The other counties seem almost suspended in air in the chart above as time marches on.

Some quibble about the meaning or the importance of median prices, saying that median prices paint a misleading picture or obscure underlying trends. But, median prices are the most widely used of all home price measures and, regardless of their shortcomings, tell a story worth listening to.

The scale on the year-over-year price chart below had to be adjusted again with the most recent data. After meandering between plus one and plus five percent annual appreciation for much of the last year, then passing through zero in May, the red line representing San Diego County has now broken below the minus five percent level, necessitating the change in scale.

There are a couple of tough months for comparison coming up for San Diego - as seen in the first chart above, November and December of 2005 were the price peaks.

Ventura County is in negative year-over-year territory for the second month in a row. It too will have a series of tough comparisons coming up as prices peaked there (here, actually) in December of 2005, then went on to make new highs in the new year. This data series if volatile, in part due to it being the lowest in sales volume of all the counties, but prices are down more than eight percent from recent peaks.

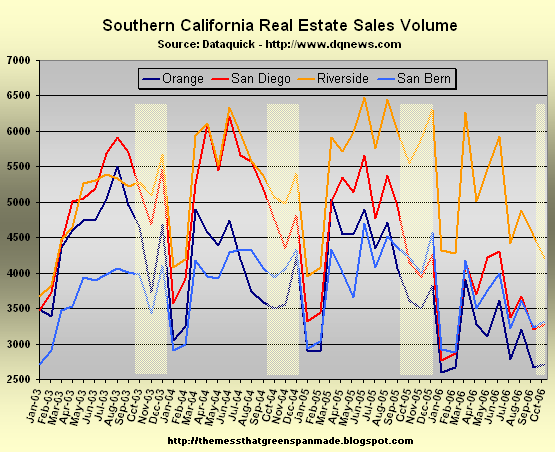

The data for sales volume continues to provide intrigue.

As shown in the shaded areas in the chart below, the last three months of the year precede the two slowest months for sales in January and February. After a November dip and a December spike, as new homeowners rush to get into their new digs for the holidays, sales volume plunges in the new year.

For the four counties shown below, sales volume totals for October are now at or below the level normally seen in January and February. If the magnitude of the December-January plunge this year is anything like it has been in past years, it could be a cold winter for home sellers in this part of the country despite the normally balmy weather.

DataQuick President Marshall "almost all, if not all, of those gains are here to stay" Prentice once again had a few thoughts regarding the most recent statistics:It's harder to buy a home if you think it might go down in value than it is if you're convinced it's going up. Buyers are taking their time, trying to wait out the uncertainty in a market that is rebalancing itself. Additionally, many potential buyers are in the move-up category, and they have their own home they need to sell.

Maybe it wouldn't be so difficult to make buying decisions in the current real estate climate if prices hadn't gotten so high. Despite the emphasis on low monthly payments in recent years, when buying a house began to feel a lot like buying a car, some people are beginning to pay attention to the price they are paying.

And as for buyers waiting out uncertainty "in a market that is rebalancing itself" this completely misses a major point regarding the proper functioning of markets - would-be buyers who are not buying are an integral part of the market.

The number of buyers is integral to setting prices - markets don't "rebalance" themselves.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

1 comments:

And speaking of buying a car...

Post a Comment