The Disappearing Dollar

Monday, November 27, 2006

There was lots of talk over the weekend about the U.S. Dollar after its performance on the foreign exchange markets last week. Another Chinese central banker commented that they are tiring of accumulating dollar denominated assets in their $1 trillion of reserves, but they're not sure what else to buy.

They'll probably figure something out - maybe soon.

If there is a plunge protection team somewhere out there for the currency markets (well, in addition to the Bank of Japan) let's hope they don't still have a turkey hangover - they may need their wits about them this week.

All this brings back memories of what people were saying a couple years ago. After recalling the last time the world feared a dollar death spiral, the following cover from The Economist was retrieved - almost exactly two years ago: After a little closer inspection of the contents of this issue, it begins to feel like a sort of dollar time warp - as if everything related to the standing of the U.S. Dollar as the world's reserve currency was put on hold for two years while Alan Greenspan did his "baby step" routine for another year, the U.S. housing market boomed, and all seemed right for the world's only superpower (aside from the obvious problems encountered while spreading democracy).

After a little closer inspection of the contents of this issue, it begins to feel like a sort of dollar time warp - as if everything related to the standing of the U.S. Dollar as the world's reserve currency was put on hold for two years while Alan Greenspan did his "baby step" routine for another year, the U.S. housing market boomed, and all seemed right for the world's only superpower (aside from the obvious problems encountered while spreading democracy).

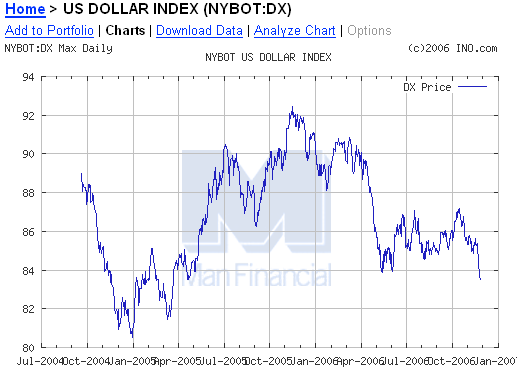

The dollar last plunged to the 80 mark on the U.S. Dollar Index back during the last days of December in 2004. With the move down last Friday, it looks ready to retest that level. Here's the cover story($) originally published in the December 2nd, 2004 print edition:

Here's the cover story($) originally published in the December 2nd, 2004 print edition:How long can it remain the world's most important reserve currency?

That all sounds familiar. The prediction "the dollar now seems likely to fall further" wasn't particularly timely, but they never did say "when". It is likely that "when" is about "now".

THE dollar has been the leading international currency for as long as most people can remember. But its dominant role can no longer be taken for granted. If America keeps on spending and borrowing at its present pace, the dollar will eventually lose its mighty status in international finance. And that would hurt: the privilege of being able to print the world's reserve currency, a privilege which is now at risk, allows America to borrow cheaply, and thus to spend much more than it earns, on far better terms than are available to others. Imagine you could write cheques that were accepted as payment but never cashed. That is what it amounts to. If you had been granted that ability, you might take care to hang on to it. America is taking no such care, and may come to regret it.

The cost of neglect

The dollar is not what it used to be. Over the past three years it has fallen by 35% against the euro and by 24% against the yen. But its latest slide is merely a symptom of a worse malaise: the global financial system is under great strain. America has habits that are inappropriate, to say the least, for the guardian of the world's main reserve currency: rampant government borrowing, furious consumer spending and a current-account deficit big enough to have bankrupted any other country some time ago. This makes a dollar devaluation inevitable, not least because it becomes a seemingly attractive option for the leaders of a heavily indebted America. Policymakers now seem to be talking the dollar down. Yet this is a dangerous game. Why would anybody want to invest in a currency that will almost certainly depreciate?

A second disturbing feature of the global financial system is that it has become a giant money press as America's easy-money policy has spilled beyond its borders. Total global liquidity is growing faster in real terms than ever before. Emerging economies that try to fix their currencies against the dollar, notably in Asia, have been forced to amplify the Fed's super-loose monetary policy: when central banks buy dollars to hold down their currencies, they print local money to do so. This gush of global liquidity has not pushed up inflation. Instead it has flowed into share prices and houses around the world, inflating a series of asset-price bubbles.

America's current-account deficit is at the heart of these global concerns. The OECD's latest Economic Outlook predicts that the deficit will rise to $825 billion by 2006 (6.4% of America's GDP) assuming unchanged exchange rates. Optimists argue that foreigners will keep financing the deficit because American assets offer high returns and a haven from risk. In fact, private investors have already turned away from dollar assets: the returns on investments in America have recently been lower than in Europe or Japan. And can a currency that has been sliding against the world's next two biggest currencies for 30 years be regarded as “safe”?

In a free market, without the massive support of Asian central banks, the dollar would be far weaker. In any case, such support has its limits, and the dollar now seems likely to fall further. How harmful will the economic consequences be? Will it really undermine the dollar's reserve-currency status?

Periods of dollar decline have often been unhappy for the world economy. The breakdown of Bretton Woods that led to a weaker dollar in the early 1970s was painful for all, contributing to rising inflation and recession. In the late 1980s, the falling dollar had few ill-effects on America's economy, but it played a big role in inflating a bubble in Japan by forcing Japanese authorities to slash interest rates.

This article($) about high oil prices also appeared in that same issue. Two years on, it seems quaint to see amounts like $20 and $30 in the same sentence as the words "barrel of oil".“HISTORICALLY, OPEC is in its best position ever.” So declared Iran's president, Mohammed Khatami, before he met Venezuela's president, Hugo Chávez, this week. Mr Chávez agreed, and vowed to “defend” today's oil price of around $50 a barrel when OPEC, the Organisation of Petroleum Exporting Countries, holds its next meeting, in Cairo on December 10th. One Iranian oil official said this week that $50-70 was “not really a high price”.

A plateau higher than $30-34 appears to have been achieved.

This is not what consumers want to hear. Oil prices have shot up from around $10 a barrel in 1998 to their current heights, with predictable consequences at the petrol pump. Yet talk of higher oil prices may sound odd just now, because lately the market has gone off the boil. The price of West Texas Intermediate has cooled from $55 in mid-October to $45-50. And there are other signs that could mean prices fall further if OPEC does not try to support them by agreeing on a cut in members' production quotas next week.

...

What is more, demand seems to be easing. China's surge in oil consumption appears to be slowing. The OECD's Economic Outlook, published this week, concluded that high oil prices have started to act as a short-term drag on the global economy—which ought in turn to weigh on oil demand. In any case, demand slows in the second quarter of the year, with the change of the seasons.

...

There are other reasons to think the oil price will stay strong. Paul Horsnell of Barclays Capital, an investment bank, claims that the rise in oil prices over the past two years “reflects structural rather than cyclical issues.” One cause is that the bloated and growing welfare states of many oil economies require ever higher oil prices to sustain them. Another is that global demand—especially in emerging giants like China—appears to be less sensitive to price increases than previously thought.

...

Maybe the Saudis will succeed in stabilising prices around a new plateau, perhaps the $30-34 range of which Mr Naimi spoke, maybe higher. The trouble is that the relative price stability, between $20 and $30, of much of the late 1980s and 1990s was due in large part to OPEC's then huge spare capacity. That is now gone, and any Saudi expansion will take time.

And what retrospective is complete without an economist's view on gold, a subject that had become increasingly popular as the metal's price first poked through the $450 level two years ago. In this story($) from that same December 2004 issue, the case is made that a falling dollar is not necessary for gold to rise.MOST economists hate gold. Not, you understand, that they would turn up their noses at a bar or two. But they find the reverence in which many hold the metal almost irrational. That it was used as money for millennia is irrelevant: it isn't any more. Modern money takes the form of paper or, more often, electronic data. To economists, gold is now just another commodity.

Of course, as last Friday's gold price movement demonstrates, a falling dollar can certainly help the price of the "irrelevant commodity".

So why is its price soaring? Over the past week, this has topped $450 a troy ounce, up by 9% since the beginning of the year and 77% since April 2001. Ah, comes the reply, gold transactions are denominated in dollars, and the rise in the price simply reflects the dollar's fall in terms of other currencies, especially the euro, against which it hit a new low this week. Expressed in euros, the gold price has moved much less.

However, there is no iron link, as it were, between the value of the dollar and the value of gold. A rising price of gold, like that of anything else, can reflect an increase in demand as well as a depreciation of its unit of account.

This is where gold bulls come in. The fall in the dollar is important, but mainly because as a store of value the dollar stinks. With a few longish rallies, the greenback has been on a downward trend since it came off the gold standard in 1971. Now it is suffering one of its sharper declines. At the margin, extra demand has come from those who think dollars—indeed any money backed by nothing more than promises to keep inflation low—a decidedly risky investment, mainly because America, with the world's reserve currency, has been able to create and borrow so many of them. The least painful way of repaying those dollars is to make them worth less.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

13 comments:

the dollar is going down ---- it's about time

Exactly. The dollar isn't the reserve currency, oil is. And the dollar is only worth how much oil it can buy. If OPEC decides to accept other currencies as payment, we're pretty much toast.

"the dollar is going down" - how many times have we heard this now?

this topic is a joke. when anyone talks about foriegn currency with total disregard to interest rates, they have absolutely no clue what they are talking about.

While not my best prose, interest rates are certainly central to the story:

"everything related to the standing of the U.S. Dollar as the world's reserve currency was put on hold for two years while Alan Greenspan did his "baby step" routine for another year"

For a more detailed description, consult Pimco:

Higher short-term rates in the U.S. relative to other countries have been one of the primary supports for the dollar during the last two years. The dollar was trending downward from the end of 2001 until June 2004, a period in which the Fed was cutting interest rates and the U.S. was running very accommodative monetary policy.

What happened in June 2004 to stall the dollar’s downtrend? In June 2004, the Fed began to hike interest rates. By the end of that year, U.S. short-term rates were above those in Europe and well above those in Japan. The rise in U.S. rates created demand for the dollar among foreign investors implementing “carry” trades. “Carry” is simply the interest rate difference between two currencies and thus the amount that an investor can earn by remaining in the position, assuming exchange rates and interest rates do not change.

Low volatility in the global markets made carry strategies a very attractive source of returns for many foreign investors and the dollar was a significant beneficiary of those trades. Carry trades will continue to support the dollar if—and only if—investors continue to establish new carry trades. But the Fed’s pause in August makes new carry trades increasingly unlikely. The Fed’s decision to pause likely marked the end of its rate hike cycle and the beginning of a path toward rate cuts. With the Bank of Japan and European Central Bank still in tightening mode, short-term interest rates should converge and reduce or eliminate the carry benefits of holding dollar assets.

What's with the tone of the comments lately?

We are fully prepared!

-Charles Ponzi

Hooverville Falls, VT

All Volunteer

Plunge Protection Team

hello tim from germany,

great post and a great cover!

(thank god you saved ist)

fundamentals matter (in the end)

http://immobilienblasen.blogspot.com/2006/11/us-index-do-fundamentals-matter-in-end.html

you can´t fool the markets forever. but i have to admit that the timing is very very difficult.(in the short term)

Post-election Chinese dollar diversification rumblings are just that, for now. They will diversify to the extent the we promote trade protectionism.

Interest rates do not drive FX valuations. If you believe that, you have the cause and effect reversed. Shorter term effects and noise aside, rates are a risk premium and reflect the relative degree of confidence in a currency's government bonds to hold value. As confidence wanes in the USD, the Fed will be forced to raise rates. But this is undesirable because it will cause significant distress in an overleveraged and highly unbalanced economy. The Fed will always employ rhetoric to greatest extent possible first.

Remember above all, it is nothing more than a confidence game on the grandest scale. The Fed is not about managing the economy. It is first and foremost all about managing you.

For the risk averse, it is dead simple. Just periodically accumulate gold and silver bullion after significant corrections. You can't lose. Really.

jobless rate,jobless rate it is expecting wildly, see what will happen!

Great post, I've been thinking about that cover for all the weak. We are less than five years to the end.

If OPEC decides to accept other currencies as payment, we're pretty much toast.

Makes no difference what currency is used to buy anything, as long as it is convertible. What matters is whether other countries are willing to hold US$ debt, not transactional cash balances.

Help! I'm the dollar. I'm falling and I cant' get up!

The USD is going down, but that's hardly a surprise. And I'd agree with the previous poster: all this weird talk of OIL being quoted in USDs is way off the mark. Who really cares? What does matter is if the U.S. Federal Government can continue to attract foreign investors. And with the USD under cloud that gets trickier every day.

Post a Comment