Friday Lite

Friday, November 17, 2006

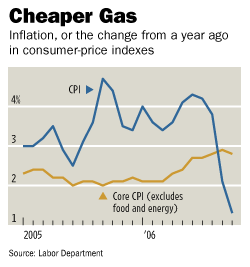

Yesterday's report on consumer prices showed that the unrelenting fight the Federal Reserve has waged against inflation is finally paying off in some very tangible ways. Oh yeah, energy prices that plunged 20 percent or more have helped too.

Overall consumer prices fell a half percent in October now showing a year-over-year change of a harmless +1.3 percent. Core inflation, excluding food and energy, rose just 0.1 percent for the month, now standing at 2.7 percent from year ago levels. Some had doubted the inflation fighting mettle of the Bernanke Fed, but once the rug had been pulled out from under commodity futures back in August, there was little hope that the price indexes would show anything other than feeble ones and twos by this time of year, a few negative numbers thrown in for good measure.

Some had doubted the inflation fighting mettle of the Bernanke Fed, but once the rug had been pulled out from under commodity futures back in August, there was little hope that the price indexes would show anything other than feeble ones and twos by this time of year, a few negative numbers thrown in for good measure.

Everyone can now breath a sigh of relief.

Everyone, that is, except for those recently attending their employer's open enrollment info-sessions where they learned of the new 2007 health care costs.

It's a good thing that gasoline prices have gone down - that'll leave a little left over for those heftier co-pays. Insurance premiums went up about ten percent this year - down from increases in the low teens in recent years, so by government accounting standards, that would be the equivalent of a two or three percent cut in health care cost (increases).

This subject was looked at here in great detail a year ago. Medical expenses were found to be under-reported in the government's gauge of consumer prices - surprise! A quick look through last year's posts on the subject shows they are still germane:

It's still not clear how a family earning the median income of around $47,000 can afford the health care bill for a family of four.

It's also not clear how the U.S. consumer could ever cope if cheap Asian imports became less cheap after currencies adjusted to "market rates" (see Purchasing Power Parity).

Oh well, it's Friday.

Milton Friedman, Nobel Prize Winning Economist Dies

The passing of Milton Friedman comes at a critical time for economists, given recent changes to the reporting of monetary aggregates and differing schools of thought regarding the role of money in formulating monetary policy.

A report from Bloomberg puts the matter succinctly.With his trademark pronouncement that inflation was "always and everywhere a monetary phenomenon'' Friedman was among the Fed's most vocal critics as inflation accelerated through the 1960s and 1970s. He said the central bank failed to control the supply of money, should be stripped of its autonomy and forced to focus on keeping money supply growth steady at about 3 percent.

There is more than a little irony in the selection of an American Eagle gold coin on his Wikiquotes page representing free markets and liberty. According to Wikipedia, Friedman was a libertarian philosophically, but a Republican for the sake of "expediency", supporting various libertarian policies that would be out-of-step with the Republican party today.

According to Wikipedia, Friedman was a libertarian philosophically, but a Republican for the sake of "expediency", supporting various libertarian policies that would be out-of-step with the Republican party today.

White Elephants and Killer Bees

There are plenty of people who still hang on every word that the former Fed chairman utters. This interview with Alan Greenspan from earlier in the week reveals the former Fed Chief is brimming with confidence.Economic white elephant—housing

He also dismissed comments by Dallas Fed President Richard Fisher about short-term interest rates being held too low a few years back, contributing to speculation in the housing market - the former Fed chair credited global financial conditions for the housing boom.

We swiftly moved to the one economic white elephant—housing. Although it's "too soon to say" if we're close to the bottom of the housing bust, Greenspan doesn't predict a rapid decline. I did get the sense that he was back-pedaling a bit from his well-quoted view recently that housing may have hit bottom. In fact, I reminded him that his "irrational exuberance" comment in 1996 came over three years prior to the market's ultimate top in 2000. In his well-crafted reply, he suggested, "This is not the bottom, but the worst is behind us." My skepticism about a muted impact of housing on the broad economy is well-documented, so I wasn't fully in agreement when he went on to say that housing market activity is likely no longer to be a drag on overall economic growth as unsold inventories clear out and stabilize against sales levels.

I followed up by asking about the rash of non-traditional mortgages that characterized this housing boom/bust. He replied that those "flaky" exotic mortgages, which allowed consumers to purchase homes more expensive than they could afford, will be financially devastating for those families holding them, but will have little impact on the macro economy. Again, I hope he's right, but I have my doubts.

Pollinating bees

But, exotic isn't all bad in the mind of the Maestro, as he's often been called. Greenspan called exotic derivatives, and their hedge fund architects, "pollinating bees" and "extraordinarily important" to a complex global economy, since their high rates of return help stabilize the entire economic system and offset our meager savings rate.

You know the reasoning - the Berlin Wall came down, long-term interest rates fell, and everyone got rich in stocks and real estate.

The End of Low Prices

In the weeks ahead you'll hear little of the promotion that has been standard fare this week. With the six month anniversary and a price increase slated for this weekend (inflation, 'ya know), it was deemed best to err on the side of overdoing it rather than having the numerous mentions escape the notice of readers of the blog.

The Iacono Research website is still open to the public - username: IR, password: isopen.

In addition to the current subscription rate, a lifetime rate guarantee will be in effect for new subscribers joining by the end of the day on Saturday along with a 60-day risk free money-back guarantee that is part of the standard subscription agreement.

Guesses for Oil and Gold

If you made a guess at the year-end price of oil and gold you can have a look here to see how you're doing. The lucky winner gets a free subscription to ... oh, enough of that. The average guess is somewhere around $65 and $650 - current prices are still far away from those marks.

From the look of yesterday's price movement for oil, a couple of those off-the-chart (literally) guesses at the bottom left seem less improbable than they did earlier this week.

The yellow dot feels like it wants to move up, whether or not it moves to the right by the time the New Year arrives is another matter. Six more weeks to go.

Quotable?

David Gaffen, who writes MarketBeat over at the Wall Street Journal, must be commended for his sharp eye. In a story that was otherwise just full of TV transcripts, there was apparently something original worthy of mention as shown below. Seeking Alpha and Yahoo! Finance published the story as well - the original version is here. My personal favorite of the week showed up at The Big Picture in this week's edition of Bloggers' Take. In response to the question "What should the Fed be focused on? Inflation? Slowing growth? Neither?" the following was submitted:

My personal favorite of the week showed up at The Big Picture in this week's edition of Bloggers' Take. In response to the question "What should the Fed be focused on? Inflation? Slowing growth? Neither?" the following was submitted:The Fed? Do they even matter anymore? Didn't Hank Paulson at Treasury grab hold of the steering wheel a couple months back and relegate Fed Chief Ben Bernanke to the back seat with one of those Playskool steering wheels?

The imagery this invokes still elicits a chuckle here, even after two days.

What If?

For a number of years now, the housing boom in the U.K. has been ahead of the one in the U.S. by roughly nine months. After not falling in a jumbled heap on the floor during 2006, and with the central bank even feeling the need to raise interest rates due, in part, to a resurgent housing boom, this report shows that concern has reappeared.Banks in the UK have been ordered by financial regulators to assess how they would cope in the event of house prices crashing by 40 per cent.

Well, as long as it's not a forecast.

The instruction to include a housing slump scenario in their stress-testing models comes after the Financial Services Authority found that some banks were failing to include gloomy enough assumptions in their modelling.

The FSA said yesterday that an “appropriate” benchmark was to assume property prices fell by 40 per cent and that 35 per cent of mortgages in default ended with homes being re-possessed. It stressed that this was not a forecast but a “severe but plausible scenario” and one that banks should examine when deciding how robust their balance sheets were.

Let's Hope He Doesn't Have a Blog

The Australians watching this event probably made sure the reporter from the Associated Press knew that the gentleman catching the grapes in his mouth was not a local.

If Steve seems a bit odd, what must it be like to be on his "publicity team"? An American man caught 116 tossed grapes in his mouth in three minutes in what he hopes will become a new Guinness World Record, his publicity team said Thursday.

An American man caught 116 tossed grapes in his mouth in three minutes in what he hopes will become a new Guinness World Record, his publicity team said Thursday.

Steve "the Grape Guy" Spalding, 44, of Dallas, Texas also set a personal record for endurance grape catching, using his mouth to catch 1,203 grapes thrown from a distance of 15 feet over half an hour, according to publicist Deanna Brown.

No Guinness World Records officials were present at Spalding's grape-gobbling attempt, carried out Thursday in Australia overlooking Sydney's iconic Opera House.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

3 comments:

Speaking of the British bubble, there was a graph on Calculated Risk the other day that seemed to indicate the current bubble is right in line with past boom/bust cycles when expressed in terms of price to income ratio.

By contrast, I keep hearing that our bubble is completely unprecedented. That would seem to be a fundamental difference between our bubble and theirs, making their "leading" less predictive. Unless the methodology for that graph is so tortured that a US graph would look the same.

Do you know if anybody has done a direct comparison along these lines?

Your comment about rising healthcare costs and open enrollment rang true for me - my annual costs more than quadrupled. Granted, my company still has low premiums relative to other public companies; however, what amounts to about a $500 pay cut doesn't make me happy.

Hey man, dont' worry about the advertising, yours is mild compared a lot of the crap we have to put up with on some sites. Yours is like a 2 on scale of 1 to 10 on my annoy-o-meter. None would be better, but I think your readers understand.

Post a Comment