Lots of Buying Today - Not Just iPods

Friday, November 24, 2006

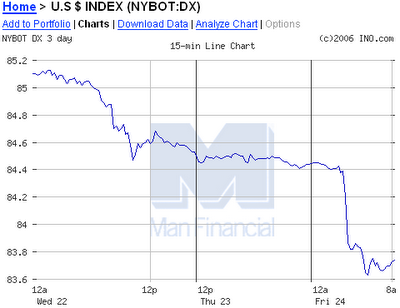

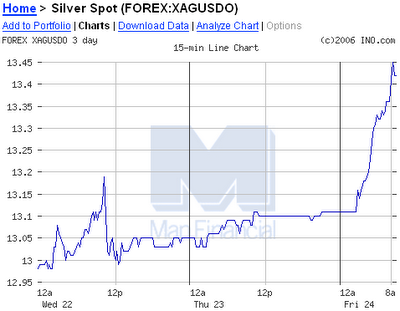

Put down those Turkey leftovers and get a load of the dollar and commodities early this Friday morning. Peter Brimelow's headline for a Wednesday story at CBS Marketwatch has so far proved prescient, as overseas trading has had a decidedly anti-dollar feel.Friday will be historic day for gold

So far, so good:

Commentary: First time CBOT contract is open when Comex is closed

By Peter Brimelow, MarketWatch

Last Update: 9:39 PM ET Nov 22, 2006

NEW YORK (MarketWatch) -- Is he or isn't he? The Gartman Letter's Dennis Gartman is seen so frequently in the media as to resemble a hot newsletter at its sizzlingest. His media distribution circuit (not including me) is similar. But the price is not: over $6,000 a year, I am told.

For gold bugs, the question is the same, but different: How come this vociferous negativist on the role of gold seems in fact to have been about the best trader of the recent gold rally? Including going long virtually at the bottom in early October below $580. And in fact has probably been the most prone to use gold over the past couple of (dramatically positive) years.

The question is particularly critical because Gartman bought more gold (a fourth "position") on the opening Wednesday morning. For a while, as gold surged by more than $6, this looked like a genius call. Eventually, gold corrected and finished up only 30 cents.

But of course the party is not over.

Friday, in fact, will be a historic day: It will be the first occasion on which the Chicago Board of Trade gold contract is open when the Comex division of Nymex is closed. The CBOT contract became a serious competitor to New York's within the last year.

The Chicago contract outflanked New York by going electronic. In commodities courses at Stanford Business School a million years ago I was taught an entrenched futures markets could not be displaced. They reckoned without the computer.

This means that Friday could actually be an interesting day for gold in America. If speculators wish, they can make a statement.

A key Gartman motivation was that the dollar looked likely to break. This in fact happened. As Richard Russell wrote Wednesday evening, "the Dollar Index plunging below its lower trendline was the most significant move of today. I'll be watching this whole picture carefully on Friday."

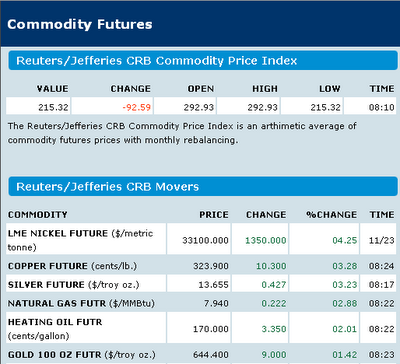

All this activity seems to have made the Bloomberg Commodity Futures page go bonkers.

All this activity seems to have made the Bloomberg Commodity Futures page go bonkers.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

2 comments:

On top of all this commodity spiking, Easton beat P'burg. Go figure. Just thought you might want to know.

Yeah it was a pretty good week all the way around.

Post a Comment