Is Peak Oil Already Here?

Tuesday, January 09, 2007

That seems to be the simplest explanation behind the most recent re-weighting of the Goldman Sachs Commodity Index as reported by the New York Post. The story reports a reduction in the amount of some energy commodities that the index will carry in 2007, this purportedly being linked to the recent plunge in the price of oil.

There may be more on this subject here in the days ahead and Barry Ritholtz is on top of things so far with many related links, but here's a quick look at the latest developments in the continuing story of Goldman Sachs and energy markets, a subject first discussed here back in September (see Friends in High Places?).

Yesterday, the New York Post reported the following:It might be a better idea to thank Goldman Sachs, not the weather, for the recent plunge in oil prices.

This is part of the annual re-weighting of the index, whereas the change in August involved a switch from one blend of unleaded gasoline to another. Just looking at the information in the story from the Post, this sounds pretty sinister - a cut of "as much as 50 percent in some of the sub-indexes".

While recent balmy temperatures have certainly played a role in last week's dip in oil prices, a lesser known, but equally powerful, move by Goldman at the start of the year might bear some responsibility as well. Goldman cut the energy portion by as much as 50 percent in some of the sub-indexes that comprise the widely followed Goldman Sachs Commodity Index, tamping down moves to buy them by large investment funds who mimic Goldman's index.

The changes took effect this month and apply for all of 2007, a Goldman spokesman said.

Crude oil futures plunged 9 percent Wednesday and Thursday to $55 a barrel, before settling Friday at $56.31. The two-day decline was the sharpest since December 2004.

The Goldman Sachs website describes how the commodity index is constructed and how changes to the weightings are determined. The average quantity of world production over the last five years determines the weight of each commodity in the index.

If the weighting of oil is plunging, then production must be plunging too - here's some recent world production data from the International Energy Agency:

Looks like steady growth in production as of just a few months ago, unless production fell back dramatically in the last two months of the year.

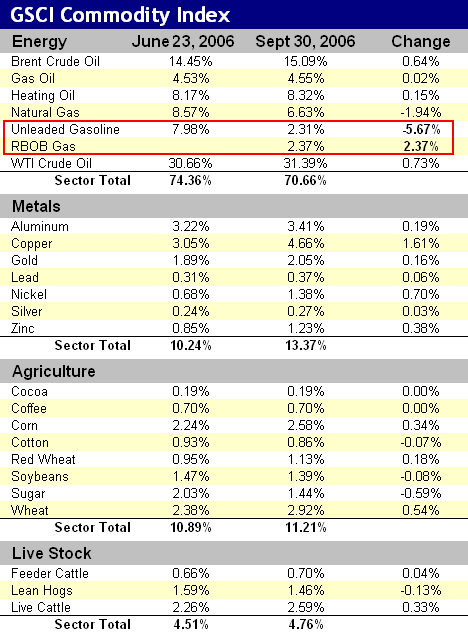

Maybe a look at the new weightings from the Goldman Sachs website will confirm a year-end plunge in production. Here's the summary from September of last year - it doesn't look like much has changed since then aside from unleaded gasoline being removed.

Here's the summary from September of last year - it doesn't look like much has changed since then aside from unleaded gasoline being removed. Natural gas was

Natural gas was was cut increased by 20 percent, RBOB gasoline fell 11 percent, and heating oil fell nine percent. The claim of a 50 percent reduction must have been the combined categories of unleaded and RBOB gasoline that was effectively halved in the most recent update to the weightings.

The story from the Post implies more than one subcategory with huge reductions, but the "as much as 50 percent in some of the sub-indexes" appears to refer to the combined gasoline sub-indexes only.

It looks like we'll have to wait awhile for peak oil to show up at Goldman Sachs.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

11 comments:

IMO, just looking at the production numbers does not tell you whether Peak Oil already happened. The demand for oil is clearly down and the producers would be stupid if they were increasing the production in this environment.

I didn't mean to trivialize the subject of peak oil by oversimpliflying it in this post - this was just an attempt at a little humor that will likely prove to be unsuccessful.

The post does include an accounting of what changed in the index - it doesn't sound that nefarious compared to what happened in August.

Any chance Goldman is working in concert with Bush to drive down the price of oil to reduce Iran's income for a few months before we attack? Didn't Reagan use the price of oil to hurt the USSR economically?

No, I think Goldman is working in concert with Gore and space aliens to save Earth's ecosystems from global warming.

Venezuela, Russia, Iran.. why is all of our oil over in their countries?

We need to get the price down so they'll beg us to buy it from them.

I think that one flew over the top of some readers heads.

It's more than just a little suspicious, thanks for the deail.

I'm really confused by that NYPost article. If production didn't change, and the reported weightings haven't changed, what the heck is the article even about?

Have the changes perhaps not been enacted yet?

I'll probably have an update on the NY Post story and the GSCI Index later today. It doesn't look like there is anything to the story, which makes it harder for guys like John Crudele to be taken seriously.

Luckily for Crudele former bureaucrats like Stephanopolous are corroborating what he's saying.

I suggest you read TheOilDrum.com. TOD Forum members Westexas and Darwinian are building a compelling statistical record on Peakoil that everyone needs to study & consider. Using the Hubbert Linearization Method and the Export Land Model as the basis for evaluating data. TODer Khebab and others have also posted impressive charts & graphs that point to increasing concern with further ramping of FFs. TOD is a ruthlessly peer-reviewed investigative website with members worldwide from many different careers & disciplines. If your time is severely constrained: check EnergyBulletin.net daily--they monitor TOD and other key webwritings, then repost snippets.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Al Gore and the aliens? Finally, I get it! Poor Al is about as stiff as the robot in the 50's film "The Day the Earth Stood Still". The robot's name was Gort, now there's a connection. Al is about as stiff as Gort. Perhaps they are cousins? Instead of being made from metal, like most robots, our Al seems to be fashioned from wood.

Where is Al today, a friend recently asked. I replied, I heard he has a new job. Where is he, he asked? Go down to the corner of 5th and Main. I think you'll find him outside the cigar store. He's taken the place of the wooden Indian just outside the door.

Now to the serious...

It seems Peak Oil may finally show its face soon. When the public learns of the implications of permanent oil shortages, you can bet there will be severe financial and social consequences even the most astute economist and social scientists cannot even imagine. Our whole worldwide system of banking, industry and commerce depends on the ability to grow.

Once growth cannot be acheived, via inexpensive petroleum, the game is over.

Sadly, it seems that the die is cast because our society has come to depend on a diminishing natural resource. There is one redeeming feature if the stuff hits the fan, the federal government will eventually become irrelevant. Over time, everything will become localized and people will be forced, by circumstances, to reply upon each other much like in the 1800's. Great civilizations always have an Achilies Heel. Peak Oil seems to be ours.

Post a Comment