The return of the dismal duo

Sunday, August 03, 2008

Any time a story comes along asking whether it's a good time to buy real estate, I'm more than happy to have a look because, at some point, we'll be homeowners again. Not anytime soon, mind you, but at some point. Such was the case when "Should you buy a home now?" appeared in today's Los Angeles Times and author Peter Y. Hong set out to present arguments for both sides.

Such was the case when "Should you buy a home now?" appeared in today's Los Angeles Times and author Peter Y. Hong set out to present arguments for both sides.

Fair enough. I'm game - let each side make their case.

After reading the well thought out case against such a purchase featuring such sensible valuation metrics as price-to-income ratios and price-to-rent ratios, which included as a bonus the Christopher Thornberg quip, "There's no way in hell the house you buy now will be more expensive next year", attention turned to who the author could possibly summon to argue the opposing view and what they might say.

Granted, home price have taken a serious tumble in California, down 30 percent or more in many areas, but they did double or triple before reaching a peak around 2006, so maybe there's some more downside to go before the great California housing "wealth creation" machine gets into gear again.

Much to my surprise, after the nonsensical "lifestyle asset" argument offered up by Pacific Palisades financial planner Brent Kessel - seriously, he said, "Houses are lifestyle assets, not investments. Make a purchase decision based on your lifestyle, not the market" - a pair of husband and wife economists from Pomona provided their take on the situation.

Hmmm... husband and wife economists from Pomona... that sounds familiar...

Margaret Smith, now a financial planner advised "a home is almost always a smart investment, even if values do temporarily decline" and her husband Gary, still a Pomona College economist, urged potential buyers to "stop fixating on short-term price moves; think about long-term rent savings", adding that "buying a house is risky, but waiting is risky too".

Pomona economists... super-optimistic about housing even after the bursting of the housing bubble... why does that sound soooo familiar?

Oh yeah, I remember...

Reproduced in it's entirety below is a post from almost two-and-half years ago:

Debunking the Dismal Duo

Wednesday, April 05, 2006

So, the one economist says to the other, "Honey, how do you estimate the fundamental value of a Southern California house?" While it is not known what the response was, or in fact who asked the question, Pomona College economics professors Gary and Margaret Hwang Smith later purchased a $950,000 Southern California property and labored to produce a sixty page report to convince themselves and the rest of the world that they were not the greater fools about whom housing naysayers have spoken so often in recent years.

No, the Smiths are not the greater fools, they are the greatest fools - they should have known better.

But, then again, they are economists.

After getting so far into the production of a detailed report that actually contains a good deal of very interesting data about the buy/rent calculation that prospective owners/renters should consider, they just didn't know when to stop.

Lights were flashing and alarms were sounding, but they either didn't notice or were too determined to complete an analysis that supported the real estate purchase decision that they had already made.

They just didn't know when to stop poking at their financial calculators in search of net present value, investment rate of return, and discount dividend, and instead just use a little common sense.

What they ended up with was something that Richard Peach, Vice President of the Federal Reserve Bank in New York deemed "an important paper".

An important paper indeed.

A paper that provides yet another marker for the great American housing bubble that will only be appreciated for its profundity with the passage of time. It is best captured by a single sentence:Housing prices in all of these areas can be justified by plausible, if perhaps somewhat optimistic, assumptions about the future growth of rent and prices.

Ahhh ... memories of 2000, when at the height of the tech bubble there where still those who insisted on twisting and contorting bits of data to justify that which they must know in their gut is just wrong.

Data Please

A few pencils have been sharpened, the cat has been put out, the doors have been secured, and we're ready to roll. Here are the links:

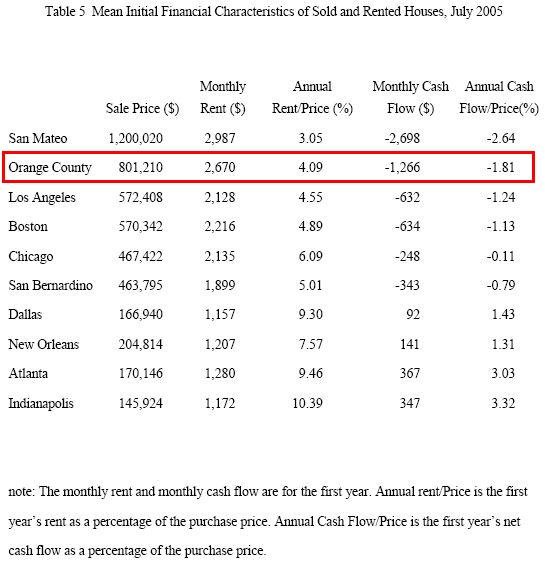

Skipping directly to Table 5 in the back of the report we find first year figures for a number of sold and rented home pairs in different parts of the country. The Smith's task was to find near-identical homes in the same neighborhood, one just sold and one rented, that could be used to calculate the investment rate of return for the home that was just sold were it to be rented at the same rate.

By calculating the rate of return, they figured they could determine if the sale price was too high, too low or just right.

The example that we'll use to test the Smith's handiwork comes from Orange County, California, the world-wide headquarters of sub-prime lending, where according to the last report from DataQuick, a median priced home fetches about $600,000.

The subject home sale from 2005 was for $801,210 and the rental equivalent brought in $2,670 per month. As indicated in the table, after all the calculations were done, the monthly cash flow starts out as minus $1,266 per month - nonetheless, the Smith's concluded that, at $801,201, the price was just about right.

We'll assume everything up to this point is hunky-dory and work from here. The idea here is that even though you're starting with a negative cash flow, things will go up over time, and as long as you come out with a six percent return on your investment, then the purchase price was right at the time of the sale.

In this case, 20 percent of the purchase price is about $160,000, and six percent of that is just under $10,000 a year. Figuring that the $1,266 per month in Table 5 works out to over $15,000 in the hole for an entire year, the first year looks to be a real loser.

But Things Change

The Smiths figured that rent and maintenance go up three percent a year (expenses start at an annual rate of one percent of the purchase price), and taxes go up two or three percent per year depending upon where you live. Most importantly however, the value of the home increases at a rate of three percent, which doesn't seem like much at first, but you'll soon see how important this seemingly innocuous three percent rise really is.

These were the only changes identified in the report - rent, maintenance, taxes, and the value of the home which is sold at the end of the ten year period.

As shown in the top portion of the table below, given the starting monthly deficit along with the changes to rent, maintenance, and taxes, after ten years, this rental is still losing almost $1,000 a month. It is only with the tiny three percent per year appreciation that this deal makes any sense - that three percent increase on a $800,000 property results in a gain of over a quarter of a million dollars.

That's how the Smiths figured the $800K was the right value - because in ten years, they figured the house would be worth over a million dollars.

Note that there are many simplifying assumptions made in the table above. The disparity of losing almost $130,000 on the rental side of the deal while gaining over $280,000 on the appreciation won't be affected in a material way by properly accounting for taxes, the time value of money, or other details.

Also note that the rental net value is calculated based on the starting monthly cash flow, then figuring the changes to that cash flow based on changes to rent, maintenance, and taxes.

The point here is that the expected appreciation of this property is the dominant factor in the calculation that results in a fair valuation - something that is not mentioned in the study itself. One has to dig into the details of the report to learn this.

It's Just Three Percent

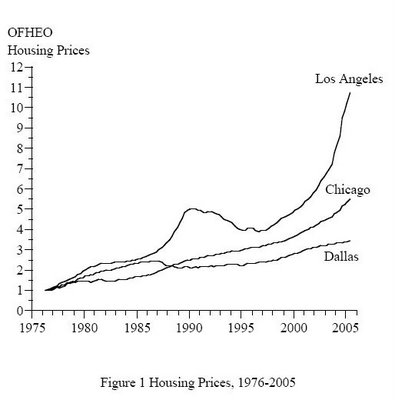

So, is three percent a reasonable annual increase to expect of Southern California real estate? It all depends on the timing. Veteran real estate investors would probably look at the chart below, which was included in the report, and think that maybe the timing isn't so good right now.

After rising at near 20 percent a year for the last five years, what would make anyone think that home prices will now rise at an average of three percent for the next decade? Without the appreciation, this investment is a big loser, and if prices reverse, as they did in the 1990s, then things could really get ugly. This is the fundamental flaw in this valuation methodology, which, by the way, overestimated the value of a Diamand Bar, California home by 24 percent when applied by a New York Times reporter in the second link above.

This is the fundamental flaw in this valuation methodology, which, by the way, overestimated the value of a Diamand Bar, California home by 24 percent when applied by a New York Times reporter in the second link above.

Like many economists, the Smiths fail to realize that we are living in a bubble economy where nearly all the things they learned in school no longer apply. They are likely teaching a whole new generation of future economists all the things that no longer apply.

Economists!

P.S. (The Smiths moonlight as certified financial planners - their website is www.smithfinancialplace.com should you wish to have them help you with your own buy/rent decision or other personal investments.)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

3 comments:

Well, in answer to the question of whether now is the time to buy a house, that would depend on the reason for your buying a house. If it's not to live in it, then no time, not now, not ever, is the right time to buy.

A house is not an asset. An asset generates income. A liability generates expenses. A house, unless it's a rental property that produces more revenues than expenses, does not generate income. Rather, it's a capital savings (equity) account with expenses. Over time, the expenses incurred--taxes, utilities, maintenance, insurance, etc.--may or may not exceed the savings or equity accrued. A lot depends on the location and the fluctuations of the market.

Prices go up and prices go down. Realistically, that doesn't matter, not when it comes to buying a house. It doesn't matter because the reason why one buys a house is not to buy low and sell high (that is, to play the market). The reason why one buys a house is to live in it.

An older, well-maintained house in an established neighborhood with good schools is one of the safest places to park your money. But that's only if you intend to live in and maintain it for 20 or 30 years.

There will always be someone on the market for that kind of house, which of course is why these are the more expensive houses. It's not so much that they appreciate as it is they don't depreciate. Your principal is always safe in one of these houses.

The question isn't whether now is the time to buy a house or live in your van under a bridge.

The question is whether you should BUY a house today or RENT a house until prices move further.

It's a financial question. It's not an emotional question about how you FEEL about a house.

That's the exact mistake the Smith duo made in rationalizing their decision to buy at the peak in CA.

Your principal obviously is NOT always safe in a house. That's the whole point right now! It's called a housing CRISIS because people are losing their financial shirts due to DEPRECIATION.

If you have $500,000 cash available to "park" in something, you might decide to park it in a house.

If you did that recently, you lost 30% and you've watched your "investment" go down to $350,000 in value. If you sold now, you'd lose about $150,000.

In order for the house to come back UP to $500,000 from the new value of $350,000, it has to go UP by 43%. (It's always farther coming back up than going down.)

So, even if house prices have hit bottom (fat chance!) and will climb at a more normal 5% per year rate, it will take about 7-8 years for your house to BREAK EVEN.

This is ignoring all costs of ownership - which are substantial.

Compare that with renting and PARKING your money in a CD paying 4%. While your house was going down 30% and you're waiting 7 years to get back to even, your CD has been earning 4% a year or about 30% over that same time. And, there's no out of pocket costs to owning the CD.

Or, you might park it in gold or some other commodity. While the return isn't guaranteed, you'd have the potential for some real appreciation.

But, that's the whole point of this question. WHERE do you put your money? Timing is EVERYTHING!!

There are many emotional reasons to buy a house. But, this web site is more about the rational aspects of the American economy. The housing crisis is a HUGE part of that and we can thank Greenspan for the current mess.

The Smith duo is a PERFECT example of how supposedly intelligent people do dumb things because we are all emotional beings. It's hard to be logical when self interest is involved. That's why you can't trust anyone's advice if they have an interest in your decision. (Think REALTOR)

The Smiths are just another of the endless examples of people who can't manage their own lives but are all too eager to tell you how to live. We see this in spades with public officials.

Hopefully, others can learn from the many examples of stupidity (such as the Smiths) exposed here on this web site from people who, logically, should know better. Greenspan is, of course, the best example of this concept.

Dear friend,

Wonderful .

Accept my sincere thanks and appreciation

John ,

http://www.dirking.net

Jobs – companies – real estate – engineers – petroleum company

Post a Comment