A cruel joke

Friday, October 02, 2009

[This item originally appeared here on October 10, 2006. Looking back at this sort of news three years hence, it all just seems kind of sad, David Lereah and all.]

Amid news that home prices are now falling across the nation, in some places rather precipitously, comes word that a few government regulatory agencies have arrived on the scene, ready to help the process along.

What does this mean for the future retirees of America who have become comfortable with the notion of spending more than they earn, sure that the rising value of their real estate will provide for them, not only in the present, but in the future as well - in their golden years?

It looks like we're going to find out.

According to this story in yesterday's LA Times, mortgage lending standards are being tightened and lenders are being advised to ensure that borrowers can actually repay their loans.

A Novel Approach

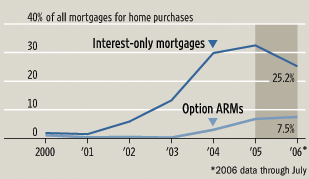

The standards come in the form of "guidance" from the Office of the Comptroller of the Currency (OCC), the Office of Thrift Supervision, the Federal Reserve, and other regulators. This is the same regulation that has been flopping around in seemingly endless review and comment cycles since late last year. Federally chartered lenders are now strongly urged to evaluate borrowers' ability to repay their loans based on more than just the low payments enabled by interest-only, option-ARMS, and low introductory interest rates.

Federally chartered lenders are now strongly urged to evaluate borrowers' ability to repay their loans based on more than just the low payments enabled by interest-only, option-ARMS, and low introductory interest rates.

A minor detail here is that interest-only loans and option-ARMS don't normally result in the loan being repaid - perhaps this is one of the reasons that the nation's housing market is currently in such peril.

Further, stated income loans, also known as "liar loans", are only to be used when the borrower's situation warrants, rather than as a means to get the deal done when income is not available as a mortgage repayment source (see Casey Serin).

It seems that all of these nontraditional mortgage products have been misused in recent years.Kathy Dick, deputy U.S. comptroller for credit and market risk, said interest-only loans and option ARMs originally were for a minority of savvy, well-off people whose income was variable — the self-employed and those who worked on commission or were paid intermittently.

No, that doesn't sound prudent. What took you so long?

"Now they're used to get someone into a home without a real analysis of their ability to pay," Dick said. "Lenders are qualifying people for homes they can't afford. We felt that wasn't consistent with prudent lending principles."

It remains to be seen how effective this "guidance" will be. Regulators promise remedial action for those who don't comply, however, these types of loans have accounted for more than half of all first-time mortgages and refinancings in recent months. It's hard to imagine how homes can be sold at current prices given the new tougher qualifying standards.

Now for the Bad News

That's where the bad news comes in and it may get a lot worse than just "bad" when it's all said and done. Some have been expecting this sort of thing for a while now."Just as the loosening of credit standards made the housing bubble go higher and last longer, the tightening of standards is going to make it deflate further and faster," said Michael Calhoun, president of the Center for Responsible Lending, a research and advocacy group that fights predatory lenders. As borrowers find they qualify only for smaller loans, Calhoun predicted, sellers will have to cut their prices.

That Michael Calhoun sounds like a smart fellow. Maybe the federal regulators should hire him, or a least call him once in a while. Maybe they should have called him a couple years ago.

"There's some pain coming," he said, noting that California "is at ground zero on this."

An acceleration in the decline in home prices may put a crimp in the current spending and future retirement plans of many homeowners, particularly the 20 million or so in California. Realistically, most Californians can do without a Hummer today, but many are counting on that home equity later on in life.

That's what David Lereah at the National Association of Realtors seems to think.

In this Chicago Tribune story from last week, when asked to comment on a study by Moody's economy.com that house prices in some areas are set to "crash", Mr. Lereah remarked, "I don't think I would use the word 'crash'. When you use a word like that, it's almost a self-fulfilling prophecy in the housing market. These are people's homes. Their retirement is depending on it."

Oops! Maybe some thought should be given to a Plan B.

Hopefully, there will be enough time for workers in their prime earning years to save for their retirement if their homes let them down. That's the way it used to work - this home equity wealth always seemed a little too good to be true. Maybe it will vanish as quickly as it appeared, and we'll all be better off for it.

Maybe this new guidance is a sort of tough love that was never administered during the Greenspan era.

An Intervention

It's as if federal regulators are about to conduct an intervention for America's negative savings rate. It's long overdue and it won't be pleasant, but someone's got to do it. Maybe then people will start to once again think of housing as a place to live, rather than a place to get rich.

The real question is what took them so long?

Wasn't it obvious a year or two, even three years ago, that regulation was needed? Low interest rates are one thing, but when cheap money is combined with lax lending standards, you're asking for trouble. Problems arose with Freddie Mac as early as 2002 and with Fannie Mae in 2003. Once the default risk was shifted from government sponsored enterprises to Wall Street, government regulators hit the snooze button. Whenever you go from zero to almost 50 percent of anything (see chart), someone should be paying attention.

Once the default risk was shifted from government sponsored enterprises to Wall Street, government regulators hit the snooze button. Whenever you go from zero to almost 50 percent of anything (see chart), someone should be paying attention.

In the last few years people have actually come to believe that their home will provide for them, not only in the present (as evidenced by the last few year's $1 trillion in home equity withdrawal), but after they stop working as well.

Mr. Lereah certainly seems to think this way, and as a result millions of homeowners do too.

As it is, coming late to the game after home prices have soared for years, regulating the risky loans that have supported astronomical home prices when millions of homeowners are now counting on these prices to remain astronomical far into the future, well, that just seems like a cruel joke.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

1 comments:

«regulating the risky loans that have supported astronomical home prices when millions of homeowners are now counting on these prices to remain astronomical far into the future, well, that just seems like a cruel joke.»

But solving the retirement problem by transferringpurchasing power from poor non-asset owners to rich asset owners has been national policy, and wildly popular too.

The idea was to grant a comfortable, long retirement to well-off baby boomers not directly by raising taxes to transfer income to them transparently, but by indirect means, engineering a huge rise in the prices of assets they owned, with the same effect: a huge transfer of purchasing power from asset-poor people to asset-rich people, and the more assets, the huger the gain.

Then of course it turned out that it was all a pump-and-dump scheme run for the benefit of big business and very wealthy owners who were looking to liquidate their USA properties to invest in places with a better future, but baby boomers enthusiastically voted to give themselves the illusion of being able to screw as much as they could out of immigrants and the young.

Post a Comment