Dumb Things Said by the Fed

Friday, August 26, 2005

The Federal Reserve's wild weekend in Jackson Hole starts today. There will be lots of parties and late night antics to be sure. Loud and unruly economists stumbling through hotel lobbies in the wee hours, up to their rooms for some pre-dawn hanky panky with no consideration for other hotel guests in adjacent rooms.

Then finally trying to get a couple hours of sleep before showing up at the morning conferences bleary eyed, still reeking from the night before - winks, nods, and hand signals to each other as they sit there fidgeting, feigning interest in what another speaker is prattling on about, all the while planning more sordid fun for the rest of the day.

Or, maybe not.

While waiting to hear what will be said by the Fed in Wyoming this weekend, we look back at some of the things they have said in recent years - some of the dumber things that have come out of the mouths of Federal Reserve board members. We don't have to look back very far.

Michael Moskow, President of the Federal Reserve Bank of Chicago

August 25, 2005"Moskow said mortgages such as interest-only loans and other specialized floating-rate products that hold down initial payments but are vulnerable to rising interest rates are generally good for the economy. That's because they've opened up home ownership to more people. That said, he emphasized that the Fed has felt it necessary to warns banks of added risks with these loans."

So, getting someone into a house that they couldn't otherwise afford by using risky loan products, with terms that the borrower probably doesn't really understand, is good for the economy? Yes, in the short-term this bids up housing prices which makes more people want to buy houses because the prices are going up - this creates construction and real estate jobs. Other people feel wealthy because housing prices are going up, and these people borrow against their homes and spend money, which adds to GDP. An excellent plan for the short-term, but what about the long-term?

Robert McTeer, President of the Federal Reserve Bank of Dallas

February 2, 2001"The way Robert McTeer sees it, there's nothing wrong with the economy that couldn't be fixed with a little more consumer spending. 'If we all join hands together and buy a new SUV, everything will be OK,' said the president of the Federal Reserve Bank of Dallas."

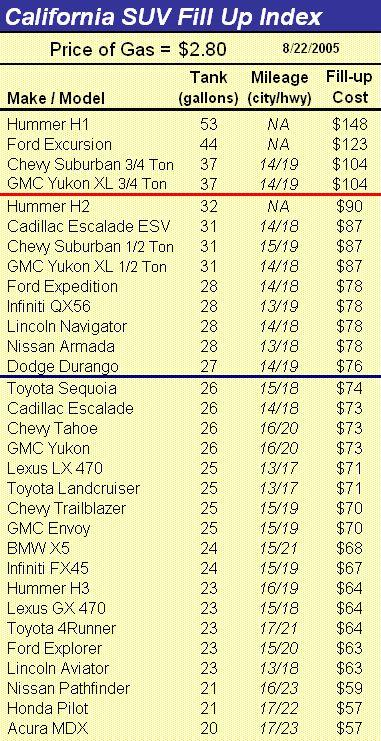

Let's see, the average price for a gallon of regular gasoline in the years since this advice was offered was $1.38 in 2001,$1.31 in 2002, $1.52 in 2003, $1.81 in 2004, and $2.10 in 2005. On Tuesday, the national average was $2.58. So, not a bad suggestion really ... for about year. After that fuel costs for your gas-guzzling SUV would have risen dramatically, having almost doubled as of just a few days ago. There's that poor long-term thinking again - pretty dumb when you look at it today.

Alan Greenspan, Chairman of the Federal Reserve

February 23, 2004"Indeed, recent research within the Federal Reserve suggests that many homeowners might have saved tens of thousands of dollars had they held adjustable-rate mortgages rather than fixed-rate mortgages during the past decade, though this would not have been the case, of course, had interest rates trended sharply upward.

Yes, when rates go down, you can save lots of money. In that case, adjustable rate mortgages are great - far superior to fixed rates. But when rates go up, then you'd rather have a fixed rate. Guess what? Short-term rates started going up just a few months after this speech and there is no indication that they will stop rising anytime soon. That's why people like fixed rates. And, that part about households that "manage their own interest rate risks"? That whole idea is pretty dumb considering the surprising number of households that don't even understand what interest is.

American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage. To the degree that households are driven by fears of payment shocks but are willing to manage their own interest rate risks, the traditional fixed-rate mortgage may be an expensive method of financing a home."

July 20, 2005 And, indeed, since the late ’70s, central bankers generally have behaved as though we were on the gold standard.

This behavior must be occurring in some parallel universe somewhere, or maybe the reference is relative. Like, compared to the central bankers in Zimbabwe, we have generally behaved as though we were on the gold standard. We don't see any gold standard like behavior from our central bankers. All we see is a money and credit explosion for the last two decades, the likes of which the world has never seen. When they write the history books, it is unlikely they will refer to monetary policy during this era as being like the gold standard. This was just dumb.

Ben S. Bernanke, White House Chief Economist (former Fed Governor)

November 21, 2002Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.

This was in reference to fighting deflation and how central banks can always create inflation if they need to. It may not sound all that dumb to most people today, however, it has the potential to be the all-time dumbest thing any central banker has ever said, if, in the coming years, the housing bubble goes bust and a new Fed Chairman looks to inflate another asset class to mitigate its fallout.

Your Recollections

We've really just scratched the surface here. Surely there are many, many more dumb things that Federal Reserve Board Members have said in recent years. Readers are encouraged to cite their favorites in the comments section.

Cell phone at the ready, legal documents in hand, and with a big smile, Chris has done well for himself - his friends and family must be proud.

Cell phone at the ready, legal documents in hand, and with a big smile, Chris has done well for himself - his friends and family must be proud.