Trade and Transportation Jobs

Monday, August 08, 2005

The more you look, the worse it appears.

The more you look, the more clear it becomes that job creation over the last four years has been based to a high degree on the housing boom and the wealth effect created by skyrocketing home prices. As a result, when housing cools, the labor market is likely to have some serious difficulty.

That's about the only conclusion that can be drawn from looking at job creation within the Trade, Transportation, and Utilities sector over the last four years. Last Friday we looked at Construction, Financial Activities, Professional/Business Services, and Leisure/Hospitality and noticed an abundance of housing/wealth effect relationships, today we look at Trade and Transportation.

Pollyanna

But, before we get to that, let's get the official comment on the recent job statistics from the Treasury Department. While we're at it, let's also take a look at their assessment of the big picture, from none other than the President's number one pitchman/carnival barker, or as The Economist calls him, the President's "taveling salesman", Treasury Secretary John Snow.

He apparently sees nothing wrong:"Combined with several recent reports indicating steady non-inflationary increases in economic activity, this shows that the fundamentals of our economy are strong and that we are continuing on a positive path of growth and prosperity."

Here's the graphic - a little cut and paste work to get the smiling face and the above quote on the same screen, which, in retrospect, was well worth the effort:

Click to enlarge

You see, the fundamentals are strong - nothing to worry about - we are the world's economic superpower. It's hard to believe that anyone takes this guy seriously.

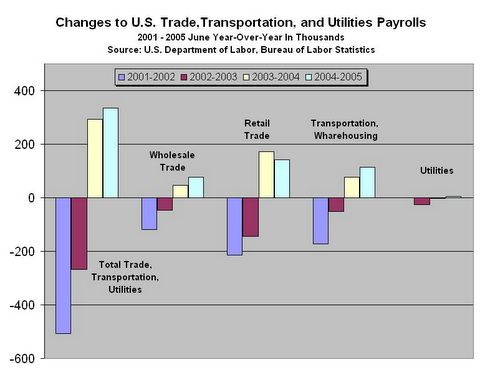

Trade, Transportation, and Utilities

So, on to Trade, Transportation and Utilities - the last four years. First, as shown below, there's not much happening by way of job creation within the Utilities category. That leaves three categories, and since the Wholesale Trade category consists almost exclusively of changes in payrolls for the wholesale middlemen (electronic markets and agents and brokers), and is unremarkable in quantity, that leaves two categories, Retail Trade and Transportation/Warehousing.

These two categories have accounted for about a half million new jobs in the last two years.

Click to enlarge

Looking at retail trade, it is clear that there are two categories where job creation has outperformed other categories. Jobs at The Home Depot and Lowes seem to be plentiful, as are jobs at stores selling clothing and clothing accessories, almost all of which are imported, inexpensive, and getting more inexpensive.

Apparel is one of the categories in the Consumer Price Index that has been falling over the last few years, as we saw here. This helps balance the rising medical and energy costs to produce the "benign inflation" we keep hearing about, resulting in what Secretary Snow calls, "non-inflationary increases in economic activity".

Click to enlarge

The Other Retail category consists of jobs in these areas:

No one category in this group is remarkable, some have declined a little, some have gained a little. It is interesting to note that gains in retail jobs for Building Material and Garden Supply are about equal to the combined total of all the categories in the Other Retail group in the graphic. That's a lot of ceiling fans and shovels they're moving over at the home improvement stores.

How is the increase in clothing store jobs explained? Perhaps since clothing prices have declined so much in recent years, more people are able to afford more apparel than ever before, requiring more salespeople to handle the increased flow of apparel products? Maybe.

Keep on Truckin'

The Transportation category graphic below is equally descriptive of the job creation that we've experienced over the last few years. This category is dominated by two areas - trucking and warehousing. Presumably, a large part of the trucking is done from West Coast ports to giant warehouses scattered around the country. Then the pallets get unloaded and moved around within the warehouse for a while, only to then be trucked out to the retail stores, where the goods can be purchased by the "resilient" American consumer.

Trucking and warehousing - a job creation success story.

Click to enlarge

So where does that leave us?

Recent trade and transportation job creation in the U.S. can be summed up as dock workers moving shipping containers from boats onto trucks, which then transport the imported goods to giant warehouses, where they are eventually loaded onto different trucks to transport the imported goods out to home improvement and clothing retail stores, so Americans can purchase them using borrowed money.

Perhaps this is a bit of an oversimplification, but it is not that far from the truth.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

You still haven't explained what is "wrong" with this picture. You started out strong and then kinda trailed off at the end there ...

What's wrong?

The Home Depot and Lowes jobs are based on a housing boom which looks like it's about to stop booming.

The clothing retail jobs, and many of the trucking and warehousing jobs are based on Americans going deeper into debt to buy cheap imported Asian goods.

An unbalanced job creation picture for trade and transportation to match our other imbalances, I suppose.

Americans are going deeper into debt buying cheap Asian goods? You've got to be kidding me.

As for Home Depot jobs being dependent on the housing boom. Look, prices may be inflated in some local markets. So what? Even if prices level off or decline in those markets, why would that significantly affect the national market for new houses? The rising home prices include existing homes, which is mostly irrelevant to Home Depot. In fact, prices for existing homes have been rising while prices for new homes have been falling (sales of new homes are still going up though!). I don't see how Home Depot will be losing a significant amount of business, enough to justify layoffs.

Let's say that Home Depot and Lowes, etc. DO lose a lot of business. From these graphs, the Building Material/Garden Supply category accounts for 50k out of 500k+ jobs created in '04-'05. That's about 10%. OK, out of this 10%, how much was due to increased demand for new home construction (as opposed to people planting trees, flowers, etc.)? Let's be generous and say half of that. That's 5% of all new jobs were due to new home construction. And how much of that number is due to the fact that there's too much construction (as you claim)? I dunno, let's say half again for good measure. That's 2.5% of new jobs created over the past two years which are at risk if the bubble collapses and we go back to "normal" rates of construction. 2.5%, about 12,000 jobs, is the upper bound of the "crisis".

So who gives a sh!t?

This is just another small piece of the big picture - the extraordinary influence of the housing boom on recent job creation. It shows up in many other areas as indicated in the prior post and in this one which includes a link to a study by Asha Bangalore of the Northern Trust Company indicating that:

"Employment in housing and related industries (sum of employment in the establishment survey under various categories related to housing industry) accounted for about 43.0% of the increase in private sector payrolls since the economic recovery began in November 2001."

I'd love to see the actual data behind that 43% claim. Unfortunately it's not in the report you cited. What the heck is "various categories related to housing industry?" Look, I just don't buy this automatic causal relationship between rising home prices and hiring for "housing-related" jobs. Home prices are not increasing because people are planting more shrubbery and putting in extra ceiling fans in their homes. At most, construction jobs for building new homes would be affected, to the extent that some construction wouldn't be profitable in a cooling market. But I've already discussed that - even though new home prices are going down, sales are going up. This is why I'd like to see the breakdown of this 43% figure - to see how much of an overshoot we're talking about.

The causal link is not that hard to defend. In an overheated, speculative housing market, in order to "flip" a house, you can imagine quite a bit of remodeling and landscape going on in between the buying and selling.

Post a Comment