The Weird Months are Over

Thursday, March 16, 2006

Just a few charts today with the updated Dataquick real estate sales data for Southern California for the month of February. As noted last month here and here, it's best not to make too much of the goings on around this time of year due to significantly decreased sales volume resulting from the holidays in November and December.

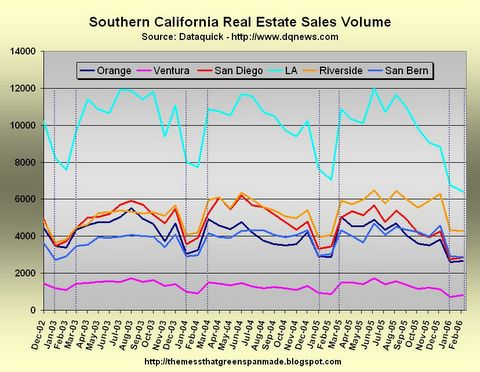

The seasonal pattern can be clearly seen in the chart of sales volume below, and during the next few months, as sales volume picks up, better conclusions about the health of this market can more easily be made.

It looks like the normal rise in sales from February to March is anywhere from 20 to 50 percent, so that should be a good indication of things to come.

Click to enlarge

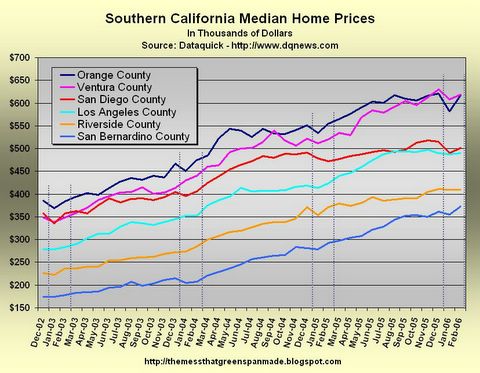

A couple counties ticked up, a couple were flat- Orange and Ventura Counties are within a thousand dollars of each other with a median price just under $620,000, which somehow, seems normal ... routine.

After years of hefty gains in housing prices, it kind of seems that median home prices at around ten times median income is normal, but it's not.

Click to enlarge

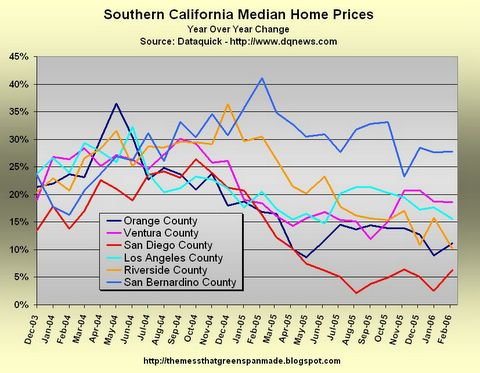

Each time it looks like the scale needs to be changed on the year-over-year price change chart, San Diego pulls up and averts the crossing of the x-axis for another month.

How long will it keep doing this? We'll see.

Riverside County is within a whisper of single digit appreciation - that area is worth watching closely, as the slope of the year-over-year price change is the steepest of the lot in recent months .

Click to Enlarge

All in all, these last two months have just been a warm up for the months ahead. It will be an interesting spring and summer.

6 comments:

How reliable is Data Quick? The reason why I am asking is that for us here in Marin County, CA one realtor's data (listing of all properties sold for Feb) indicate that the median price is down YoY by -5% or so. But Data Quick says the YoY median price is up 10%. Both are looking at total sales so I don't know what to make of this discrepancy.

Marinite

Marin Real Estate Bubble

Anyone try zillow.com yet?

Kohn speaks!

http://www.federalreserve.gov/BoardDocs/speeches/2006/20060316/default.htm

wow. these guys really do think:

- they're smart enough to predict the future and steer the world's economy in the direction of their choosing

- that monetary policy is the true engine of capitalism

what happened to the free market and the invisible hand?

Marinite,

That sounds like something worth looking into - I've heard others question the DataQuick data, but I think the sales data is publicly available if you know where to go, so it shouldn't be too hard to figure out where the difference lies.

The DataQuick results for Feb for Marin County are hugely different than what some of our realtors report. I use one real estate agency's data due to its completeness. Their data indicates that median sales price for SFRs YOY for Feb are up 2.3% (total sales median prices down -5% for the second month in a row) whereas DataQuick says it is up over 16%. That is a HUGE discrepancy. It matters because our local rag of a news paper (the Marin IJ) uses the DataQuick results (at least recently...they basically choose which data to use I think based on which is the most flattering for local RE). I lack the skills to investigate into this but I bet there is some shenanigans going on here. There has to be.

Post a Comment