The Homebuilders Must Sell

Wednesday, February 15, 2006

Normally, it would be best to not make too much of the goings on in the Southern California real estate market around this time of year, but this year may turn out to be anything but normal.

Of course, given the last half decade of super low interest rates, ultra easy mortgage lending, and soaring real estate prices, does anyone know what normal is anymore?

Recent reports show an alarming drop off in new home median sales prices for the month of January, and reports from around the rest of the country seem to corroborate this trend. The monthly report from DataQuick should be out in the next day or two, but the local newspapers have already begun relaying this information to millions of homeowners, some of whom may be feeling a bit anxious right about now.

It's not clear whether potential buyers are feeling anxious, they shouldn't be.

The reports are for both Orange County and San Diego County and they have innocuous sounding headlines:

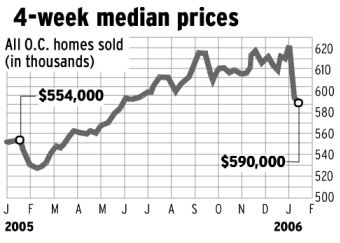

The first report from Orange County contains home sales data by zip code for the four weeks ending on January 24 and compares both sales volume and median prices to the levels of a year ago. The chart shows a significant drop off in median prices from December to January, but still a modest increase of 6.5 percent from year ago levels. Not too much should be made of this in and of itself. The scale of the chart makes the drop off appear more significant than it really is when placed in a historical context as will be seen in just a few minutes.

Not too much should be made of this in and of itself. The scale of the chart makes the drop off appear more significant than it really is when placed in a historical context as will be seen in just a few minutes.

Over the past few years, even with prices rising as they have been, a decline in price from December to January is actually more common than an increase - the low sales volume and different mix of buyers and sellers around this time of year consistently cause price movements counter to the primary trend.

The important development in Orange County in recent months has been the composition of sales - what's selling and what's not. This graphic shows the trend that seems to be developing in Southern California as well as across the country - new homes are selling at a faster pace relative to existing homes, with builder price reductions playing a large role in this change.

This graphic shows the trend that seems to be developing in Southern California as well as across the country - new homes are selling at a faster pace relative to existing homes, with builder price reductions playing a large role in this change.

It couldn't be much clearer after looking at these numbers. While overall, the median price in Orange County increased by 6.5 percent from year ago levels, prices for new homes have fallen by 26 percent.

Unfortunately for those who bought new homes in 2005, homebuilders are in the business of selling homes. That's what they do.

They don't have the luxury of setting a price, waiting to see what happens, and then maybe taking it off the market if they don't get the offer they were looking for.

As the inventory begins to pile up, and the traffic through the model homes slows, they must offer incentives or reduce prices to the point where buyers will be compelled to purchase what they are selling.

Further South ...

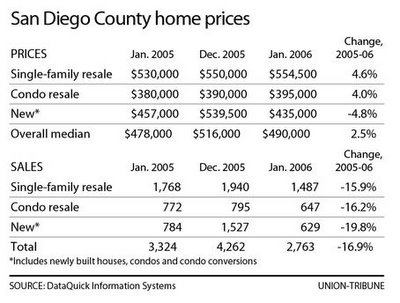

The data from San Diego tells the same story. A reduction of $104,000 in the median price of new homes from December to January along with a year-over-year drop of 5 percent shows a willingness for builders to cut prices to sell homes rather than letting them pile up.

Part of the decline is due to a larger than normal component of condo-conversions along with single family homes, but nonetheless, the drop is significant. When combined with single family resales and condo resales, the median price eked out a 2.5 percent gain from the year ago period, and the decline from December to January was just 5 percent, about normal for this time of year.

When combined with single family resales and condo resales, the median price eked out a 2.5 percent gain from the year ago period, and the decline from December to January was just 5 percent, about normal for this time of year.

Looking at this data over a longer period of time, the seasonal pattern becomes clear - December, January, and February have some strange price action. In the chart below, the January 2006 data is plotted for Orange and San Diego Counties only, but this data does seem to break significantly from what has happened in recent years - the magnitude of the drop is much sharper, even if measured on a percent change basis.

Also of interest here for San Diego real estate is the pattern that the median price has carved out over the last year or so (see the solid yellow and blue dashed lines in the chart). At the January median price of $490,000, while up 2.5 percent from twelve months ago, there is actually a slight decrease in median price when going back 13, 14, or 15 months.

In no other area of this chart, which includes all Southern California sales data for the years 2003 through 2005, can you look back for a year or more and see a decline in median prices.

Should these developments alarm you, rest assured that the White House is predicting a soft landing.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

Great analysis and data compilation.

It looks like the home builders are doing the same thing GM did with its employee discount offer last summer.

If we don't fall into a recession, I look to see the drop in new home prices to taper off, just as the prices of new cars over the last year.

For the first graph, where you point out that the y-axis leads to the appearance of a bigger drop than actually exists... well, that is the type of plot so commonly shown when it comes to GOOD news, but without the commentary and actual detailed analysis. Excellent post.

PS. My first comment, I'm one of those who stuck around after being led to your site by the Hummer thing.

Keith at the HousingPanic place is a might panicked:

http://housingpanic.blogspot.com/2006/02/flash-new-home-prices-took-sharpest.html

Great blog Tim, keep up the good work. You may want to switch over to Financial/Economic analysis full time!

Those new home price reductions do not reflect incentives. This works both ways. Previous sales were fluffed up with $15,000 granite upgrades (that cost less than $1500). Currently in addition to the "base model" actual price reductions the buyers are getting the upgrades "for free."

Good work and don't forget to add in the missng data from the most recent month when it becomes avaiable. I think Fri 17th.

This is going exactly as predicted by economics 101, supply and demand.

Non-new home owners have the luxury of offering their house conditionally, i.e., "Let's put it up for sale and see if anyone is stupid enough to pay us 3 times what we paid for it". Homeowners also have some irrational and amateur ideas about what their house is worth, TO THEM. So the non-new house sales have some intertial factors factors built in that slow down the normal supply-demand curve. People will not accept that their house has lost value and will hold off selling until the value has dropped even more.

Not so the new homes. Those are being built solely as product to be consumed. Builders have no emotional attachements to those houses and simply want the profit so their behavior will be almost exactly what is predicted by supply/demand economics.

This is what will pop the bubble. When someone sees a new house in a nearby neighborhood selling for 60% of what he paid for his house, the motivation to bail and leave the bank holding the bag will be strong.

Post a Comment