The Construction Conundrum

Friday, February 17, 2006

Well, not really a conundrum as you'll soon see. But, that sounded like such a good title, and now that it is cast in bold type directly above, with alliteration spanning not one or two, but three letters, where those three letters have wildly divergent, in some cases devilish or naughty alternative uses ... brief consideration is now given to ceasing our scribbling at this point, knowing that the best hope to amuse for this day has already been proffered.

OK, back to work.

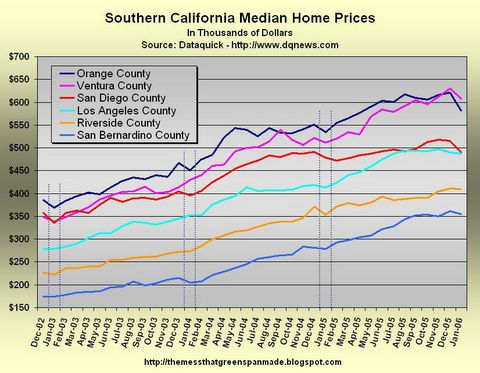

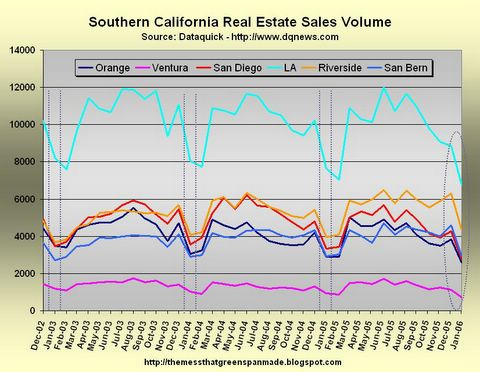

Before explaining the home construction conundrum, that really isn't a conundrum, there is some new Southern California real estate sales data to review. The monthly DataQuick report came out the other day and the now familiar sales and volume charts have been updated with the January data.

Clearly visible in the most recent data is the much talked about December to January decline for Orange and San Diego Counties. Ventura County suffered a sharp decline as well.

As mentioned a couple days ago, this is not that unusual for this time of year. The January data showed a few four to six percent declines in median price from the previous month, and elsewhere on this chart can be found numerous declines of three or four percent, most of them at the same time of year as indicated by the dotted lines.

So, everyone should just calm down about the December t0 January price action.

The year-over-year changes to median home prices below show San Diego County once again threatening the x-axis after what may prove to be a three-month long "head fake". Registering a 2.5 percent increase from last year at this time, the next few months have easier comparisons to year ago prices (see chart above), but after that it gets more difficult.

Notably, Orange County joined San Diego County with a single digit yearly appreciation, marking only the second time that two counties have simultaneously fallen below the 10 percent line in recent years. Prices in most other counties remain buoyant.

The sales volume chart below is full of intrigue this month because, with the exception of Riverside County, sales volume has dropped off to multi-year lows.

Note that the seasonal pattern here is for January and February sales to drop off significantly then rebound in March. As the March data does not get reported until two months from now, there may be a lot of people counting For Sale signs in their neighborhood trying to get a feel for how this year is going to shape up.

This may prove to be a long, anxious two months for sellers, but don't be surprised if sales rebound in a big way proving nay sayers wrong again for a while longer. The California real estate market has defied reason for so long, why stop now?

The Conundrum

So, the construction conundrum - not really a conundrum, really just business. Everyone who follows real estate today has probably heard that housing starts nationally were up over 14 percent month-to-month yesterday after a decline of eight percent for the previous month.

[Again, this is a good example of why one shouldn't read too much into the monthly data. The previous month's decline in housing starts was completely offset by the new data yielding a healthy increase for the two month period.]

But, this is not necessarily a good sign for house prices.

Remember the housing starts statistic measures new home permits, which indicates the builders' intent to build. But amidst the still rising housing starts are both rising inventory and declining sales volume.

What are the homebuilders thinking at this stage of the real estate boom?

As discussed a couple days ago, it seems that the "sticky down" part of a real estate market does not necessarily apply to homebuilders. Builders are in the business of selling homes and can't simply decide not to sell. They can decide not to build more, but how would they come to that conclusion?

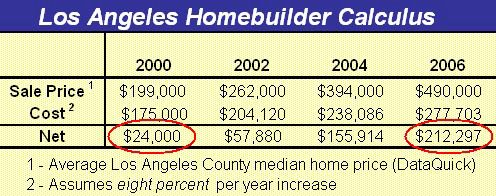

Today we take a look at some homebuilder calculus (calculations really, it just looks funny to put those two words next to each other) to get an idea how the math might look if you were in the business of building homes in the Los Angeles area.

The table below uses actual median prices along with a reasonable guess at building costs over the last six years. The 2000 cost-to-build was estimated such that the builder had a net of $24,000 per house built, then future building costs were calculated with an eight percent per year increase from that starting figure. You can click this one, but it won't enlarge

You can click this one, but it won't enlarge

The accuracy of these cost estimates is really not that important for the point that is trying to be made here - if anyone has better information, the chart can be updated, but the conclusions are not expected to change significantly.

The point of this exercise is to demonstrate a likely explanation for why builders may be all too willing to cut prices to move inventory. While it may be uncomfortable for Phase Three homeowners to see Phase Four models offered at prices lower than they paid, the builder has no such discomfort - the builder is still making good money.

And, the bad news for the Phase Three owner is that there is a lot more room to cut prices to move inventory during Phases Five and Six.

In the example above, it would seem reasonable to think that the builder could cut the $490,000 price down to, say, $350,000, still making over $100,000 per copy, and happily go on doing what they were doing. That is, building even more new houses. Why stop? They're still making good money.

To the Phase Three owner, the comparable value against which their home is measured has declined almost 30 percent. Oh well - this will not be good for homeowners expecting to extend their home equity line of credit indefinitely into the future.

If you've wondered about highflying housing stocks in the last few years, this is the reason why - the sale price increases have far outstripped their material and wage cost increases, resulting in huge profits - profits that will still be large for a while longer as prices are reduced to move inventory.

Up next in the price cutting battle - the panicky speculators, many of whom don't have the luxury of taking their homes off the market and living in them. As homebuilders reduce prices, at some point, this crowd may realize they can no longer carry a money-losing investment and will be competing with the homebuilders for the dwindling number of buyers that are still considering real estate purchases.

This has the potential to get ugly.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

10 comments:

Nice analysis. This sounds a lot like the oil companies who drill, refine, and sell gasoline - their cost structure doesn't really change because the market price of oil and gasoline went up. They just rake in the profits.

It may be that the cost to build has risen more than 8% as you've indicated, but the argument seems to hold even if you bump it up to 10% or 15%. There is a lot of room for builders to cut prices and still make money.

This has the potenttial for a fascinating dynamic between the builder and the speculator. A year or two ago the speculator was begging the builder to sell him a house, and was happy to pay whatever the builder wanted. Over the last couple years this has wrked out well for both parties as prices have continued to rise. But now as the builder cuts prices, he becomes the enemy of the speculator, ruining his plans for more appreciation. There are probably no more speculators buying in the wake of price cuts, so all the speculator can do is sit and stew trying to decide whether to sell or not - that $#@&@ builder is killing me!

A while back, our buddy Barry Ritholtz explained that homebuilders don't try to "time the market" during a housing boom. In other words, they don't try to anticipate the exact moment it will peak. If they did and were wrong, it would potentially cost them a lot more in lost opportunity than it would to simply complete their current plans. If the last run of houses has to be sold for smaller profits or even at cost, then that's just the cost of doing business.

On the other hand, their executives seem to be pretty good at timing the other market. They usually know when it's a good time to unload large blocks of their company stock.

Isn't this a phenomenon of our free market system? I can't really blame the home builders or oil companies for making those profits. Imagine if you've started your own business, all the while working your tail off to keep costs low so you have as much leverage to remain competitive. For many years at a time your business makes a decent profit, but doesn't necessarily hit a home run. Then demand increases dramatically, in the case of oil emerging markets play a huge role (think China & India), they have just as much right to resources as Americans; in the case of homes, well I'm not sure the increase in demand is rational; let's just call it mania. Or if you believe the pundits, the high rate of immigration is driving that demand. Go figure. Should you artificially keep your prices low? I wouldn't, If I've worked my tail off to be competitive I would extract the profits I've earned. Similarly if I was a builder I would probably maintain prices at a level which would still attract buyers but still makes a profit. I would ask myself this question: why do speculators and/or homebuyers keep buying at these inflated prices?

So, according to those numbers, if we consider 2000 to have been a year when prices were "rational", and margins return to the 2000 levels in a "soft landing", that means current median price in LA can fall to about 315k, a drop of about 35%, and the homebuilders will still be financially sound.

Of course, when a bubbling market corrects, it overcorrects, which means we'll probably be seeing somewhat more than 35% drops in such markets. Sure, the homebuilders will keep pushing prices down, cutting margins to keep sales up. But the current owners, especially investors, will likely hit the panic button somewhere during this 35% slide, and push it further downhill.

If these numbers are correct, homebuilders who haven't overextended themselves (kept costs low, kept debt levels reasonable, kept some cash for a rainy day, stayed out of the financing side of the industry etc.) might be able to stay ahead of the stormfront, reducing new construction as their margins narrow. Sure, their stocks will tank, but they might even be able to avoid red ink. The great purchase opportunity might be when their debt hits bottom.

Of course, how many homebuilders out there are set up this responsibly? Few, I bet.

Gotta run,

My family is dropping the key to our 2 year old house on the floor and leaving. The bank now owns this house. Fortunately we found a nice fixer and used all the fixtures and cabinets from our new house into our fixer. HA we even used the granite counter top in the kitchen.

This is the thing that will deflate the bubble, and it's the most fair outcome possible. As builders increase supply, the prices will come down. Then buyers will pay what the house is worth based on living space demand, not speculation. Those who bought on speculation will be hurt but too bad. They took that chance and now have to pay the piper. The best outcome for all concerned is for housing to be cheap, mortgages to be cheap and builders still making profits because they are providing a valuable service.

I believe we are headed into an era of 1970s like inflation. People dumping dollars for other currencies will cause much of those greenbacks to make their way home. We have an oil crisis on cards. Peak oil is very real. Hard assets are where to be.

Also keep in mind that according to James Kuntsler, the Suburbia is unsustainable in a high energy environment. So we might see some dislocation of people amongst many metros.

National housing bubble may not happen. You may see some deflation in some regions especially california and North East.

http://www.theviewfromthepeak.com

..according to James Kuntsler, the Suburbia is unsustainable in a high energy environment...

Kuntsler the Hustler says lots of things. This one is one of the most egregious. He has had this particular gem stuffed back down his throat every time he tries to repeat it. It just plain old is not true and he just plain old won't stop saying it because it just sounds soooo good to his target audience.

Time to update this chart, as the current trend seems to be changing the nature of this market.

Post a Comment