Interest Rates and Credit Expansions

Thursday, August 17, 2006

As anyone who has tried to get a loan in the last year or so would probably agree, while interest rates have risen, credit is as easy as it's ever been. Banks, they say, are bending over backwards to make loans (at least that's what the real estate agents say).

Increasingly, observers point out that while money may cost more to borrow, more money is being borrowed than ever before.

Some of the more recent numbers are summarized by Henry Kaufman in this editorial ($) appearing in the Wall Street Journal a few days ago - commentary that is heavy with criticism of past and present Federal Reserve policy.In its most recent directive, the Federal Open Market Committee restated the Fed's long-standing and laudable goals: to seek "monetary and financial conditions that will foster price stability and promote sustainable growth in output." But the Fed's monetary tactics are flawed, and work against these objectives.

Mr. Kaufman goes on to point out that a measured interest rate response when combined with increasing transparency negates much of what is intended to be accomplished through rising interest rates. With apparently no limits in the amount of money and credit that can be created - either through fractional reserve banking or via newer financial products coming from Wall Street - the credit expansion not only continues, but accelerates.

Fed strategy of the last few years stands on three tactical legs. First, its responses to economic and financial developments have been measured; second, its intentions and actions have been transparent; and third, it has relied on an econometric model for projecting future developments. These approaches would be reasonable, rational and effective -- if not for the uncomfortable fact that markets have learned how to circumvent them.

Consider the steady ratcheting up of the Federal funds rate -- from 1% to 5.25% over the last several years. Has this reined in debt expansion and credit availability? Non-financial debt in the U.S. expanded at a rate of 6% in 2001, grew by 10% in 2005, and has been swelling at an even faster rate this year. At this pace, debt is growing an astounding 50% faster than GDP.

Meanwhile, outstanding credit derivative contracts increased from about $4 trillion at the end of 2003 to more than $17 trillion at the end of 2005; and the large volume of financial market activity so far this year suggests that outstanding derivative contracts are even higher now. The recent surge of these instruments is not just about reducing risk; it is fueling speculation.

What most casual observers of the Federal Reserve fail to understand is that there are two very important components to implementing monetary policy - borrowing costs and availability of funds. While the borrowing costs at the short end of the yield curve are well known to all, the availability of funds, or liquidity as many call it, is less well understood.

Many at the Fed and in corner offices on Wall Street would probably prefer this lack of understanding to persist, as it is one of the keys to the continuation of life as we know it. That is, without an ever increasing supply of money and credit, the music that is rising asset prices stops, and everyone starts looking for chairs.

Those familiar with Austrian economics refer to this as "inflate or die".

Speaking of Austrian economics, Dr. Kurt Richebächer, about whom former Fed Chairman Paul Volcker commented, "Sometimes I think the job of central bankers is to prove Kurt Richebächer wrong", offered a few thoughts recently.

Writing in the The Daily Reckoning, the good doctor elaborated on the relationship between interest rates and credit expansion, explaining how economic growth is affected.Looking at the accelerating credit expansion, we are, as a matter of fact, more than doubtful that the slowdown in the economy and the housing bubble has anything to do with the Fed’s rate hikes. What crucially matters for both is the current credit expansion, and that keeps accelerating. But the problem is that more and more credit creates less and less economic activity, as measured by GDP.

Just think of how many of your friends and neighbors would have purchased those granite countertops and plasma TVs if they had to pay for them out of savings. That's the way things used to work. Of course, when things worked that way, people spent a lot less money than they do today. The unrecognized problem in the United States is that economic growth driven by a housing bubble is extremely credit and debt intensive. It needs, firstly, heavy borrowing to drive up the house prices and, secondly, further heavy borrowing to turn the resulting capital gains into cash. Put this together with minimal or now zero real disposable income growth and you have something like a credit Moloch devouring credit and leaving less and less for economic growth.

The unrecognized problem in the United States is that economic growth driven by a housing bubble is extremely credit and debt intensive. It needs, firstly, heavy borrowing to drive up the house prices and, secondly, further heavy borrowing to turn the resulting capital gains into cash. Put this together with minimal or now zero real disposable income growth and you have something like a credit Moloch devouring credit and leaving less and less for economic growth.

...

During 2000, total financial and nonfinancial credit and debt growth amounted to $1,605.6 billion. In 2005, it had accelerated to $3,335.9 billion; and in the first quarter of 2006, it has run at an annual rate of $4,392.8 billion, and this now with zero income growth. Note that this debt explosion has happened with little change in GDP growth.

...

As to the level of asset prices in the United States, an additional comment is probably needed. Normally, the money for asset purchases comes from the savings out of current income. In the U.S. economy, with savings in negative territory, all asset purchases essentially depend on available domestic credit and capital inflows. Buying assets on credit used to be the exception. In America today, it is the rule. For good reasons, the Fed is fearful to make money truly tight; it would crush the markets.

The problem lies in the fact that economic growth is more dependent upon this sort debt-based consumption than ever before and once you make the decision to go down that path, as most of the Anglo-Saxon countries have done in the last ten years, there's no going back.

At least, there's no going back intentionally - that would be politically unacceptable.

This sort of condition has a way of resolving itself, in its own way, much to the displeasure of the millions of consumers who, after many years of easy credit and low debt service find themselves unable to continue doing what they've been doing.

Slowly like a dull pain or quickly with a loud thud, what can not stay aloft eventually falls to earth and things once again revert to the mean. Unless of course it really is different this time- that the free-lunch has indeed arrived, and it is here to stay.

Critics of Austrian thought argue that asset prices have risen much faster than debt, and the oft-heard comments about Americans being wealthier than ever before, as measured by household assets and liabilities, are soothing sounds to a population that likes things the way they are today and will worry about tomorrow later.

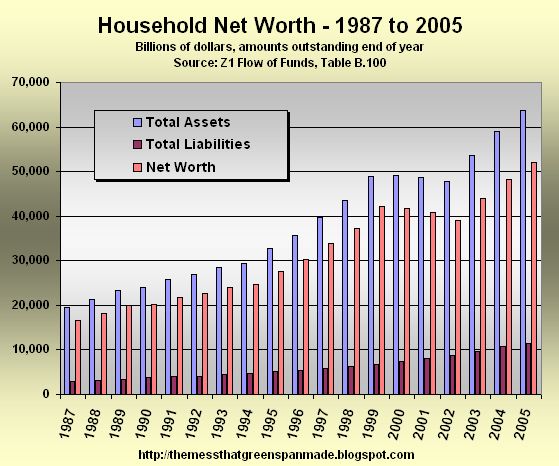

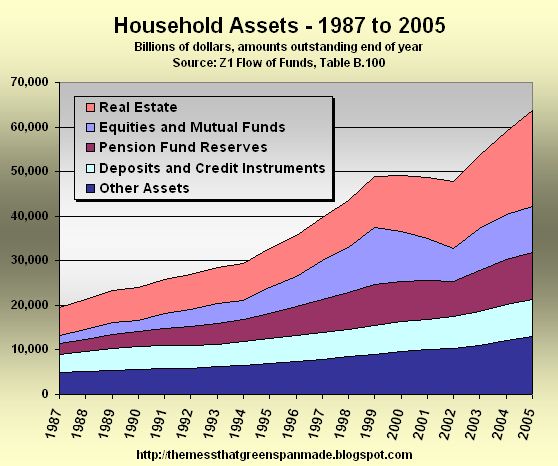

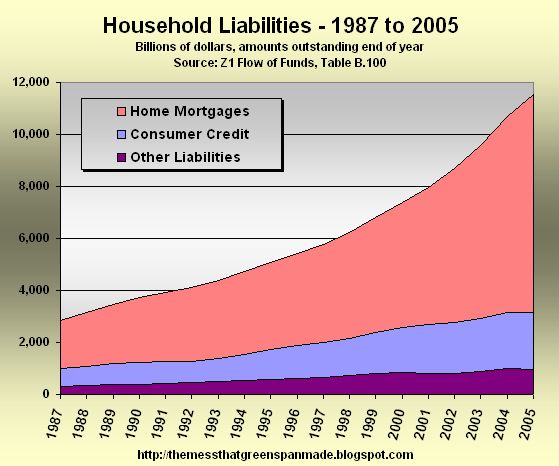

These charts from the post Three Sins, One Gift - Sin #3 - Fostering a Culture of Debt are an uncomfortable reminder that while asset prices have risen much faster than debt, and household net worth has increased like never before, there have been some bumps in the road as evidenced by declining net worth in 2000, 2001, and 2002.

There may be bigger bumps ahead.

The problem during the early part of the decade was that stocks had risen to levels that could no longer be sustained, and some other asset was required to take its place, otherwise the music stops. That led to the real estate boom that, as shown in the chart below, stepped in to neatly to take up the slack and the music continued.

The debt, of course never goes away, and while only a fraction of the value of assets, it proceeds in only one direction - up.

So, the next time you hear about rising interest rates, consider that while there may be a lesson or two to be taught to overly exuberant real estate investors who have taken on a bit more than they should have in recent years, the world as we know it is predicated on rising asset prices fueled by credit growth.

You don't get the former without the latter anymore.

It will be interesting to see how this all works out.

9 comments:

All this focus on fed funds rates is, of course, a ruse. The Fed needs to appear vigilant for the currency to be accepted. In reality, the goal is to abuse it badly. It's a straight up con on the grandest scale. The only legitimate evidence that the currency will be defended is a program of deep spending cuts and big tax hikes.

All this focus on fed funds rates is, of course, a ruse. The Fed needs to appear vigilant for the currency to be accepted. In reality, the goal is to abuse it badly. It's a straight up con on the grandest scale. The only legitimate evidence that the currency will be defended is a program of deep spending cuts and big tax hikes.

What use is the Fed tightening when the money supply is still rising? But rising how much - who really knows?

Credit expansion comes from global liquidity. Investors are buying MBS and CMOs, and that keeps credit easy for housing. But who funds credit card company reserves? Will this credit dry up as FCBs reduce their liquidity? Is the US also trying to reduce liquidity? Credit expansion says no.... Is there any way to find out?

We are going to find out if credit growth outside of housing can sustain us. The CRB tested the 200 ma again today for the second time in two months. That tells me that inflation cannot be passed through to consumers and that is a concern. We are 10 years into a credit orgy.

During the tech boom, business got fooled into overspending. During the housing boom, household got fooled into overspending. The only fools left to overspend now are governments. This is next but it will crater the currency. What a fabulous opportunity, since you all know where to put your money now.

Excellent comments and included articles on liquidity (I'm surprised the WSJ is willing to touch this issue). There is no real "tightening"; interest rates are still historically low, and they don't even control much now anyway. If the Fed stuck the reserve requirement at 5% and actually enforced it the economy would collapse (and this estimate may even be generous).

The banks are expressly trying to increase credit right now (yes, even consumer credit)--because it has not given out yet (therefore, it will never give out!)--and they have profit growth to keep up, you see.

They've been saying it themselves; they aren't afraid of subprime lending at all. Bring it on, in fact!

I know personally that they are going the route of creating more debt to keep the game going. I get junk mail almost every day begging me to take out loans (for anything! Just take them!) Credit cards too, of course.

Talk of guidance for mortgage lending is an obscene side show:

Option ARMs still favored by lenders amid scrutiny

There's far too much trust in the derivative "insurance" products that supposedly make MBSes high return, risk free investments for pension funds and foreign investors.

It will keep working until it stops working, then someone will need to be bailed out.

What a freak show.

hello from germany

great as always.

i like the comment from the post above

"freak show" you nailed it!!!!!

i have a post in relation to the "doublespeek of the fed /greenspan put" that touches the disconnect (m3, repos etc)

http://immobilienblasen.blogspot.com/2006/08/fed-doublespeek-greenspan-put.html

Anon: It will keep working until it stops working, then someone will need to be bailed out.

Unfortunately, it will be us, the taxpayers, who will be the ones bailing.

Sigh.

Post a Comment